Mortgage blow to 900,000 households as repayments to rise by £240 ahead of General Election

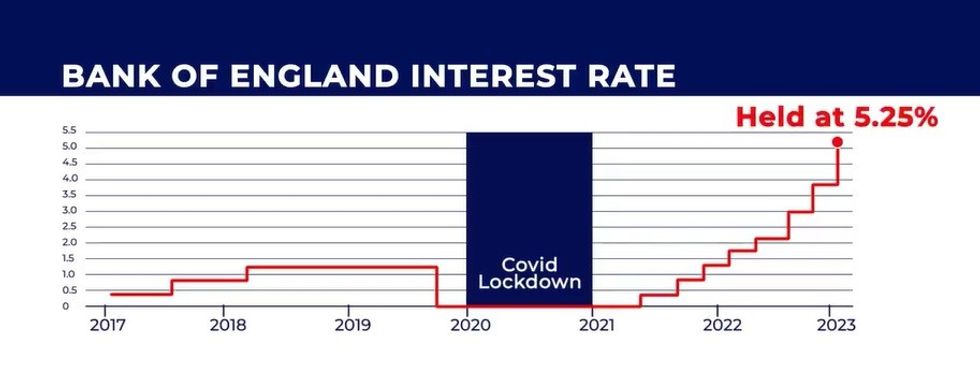

Mortgage repayments have been significantly hiked in recent years due to interest rate increases from the Bank of England

Don't Miss

Most Read

Nearly 900,000 households are expected to see their mortgage repayments rise by £240 on average ahead of the next General Election, according to new analysis.

Data from the Financial Conduct Authority (FCA) suggests that 4,200 mortgage holders will pay more between now and the expected election in November.

Research conducted by the House of Commons Library, commissioned by the Liberal Democrats, found that “Blue Wall” voters in Southern England are more likely to be hit hardest.

According to this analysis, the regions where mortgage deals are most likely to expire in the next six months include Greater London, the North West and the South West.

This analysis comes to light ahead of the Bank of England’s decision over interest rates later today.

The central bank’s Monetary Policy Committee (MPC) is expected to keep the UK’s base rate at 5.25 per cent following its meeting.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgages are expected to rise for nearly 900,000 households

|GETTY

Rates have remained at this level since August 2023 which has resulted in high street lenders raising mortgage rates in a blow to homeowners.

Traders are placing a 50 per cent chance on the first interest rate cut being implemented at the MPC’s next meeting in June.

Another reduction to the country’s base rate is expected before the end of 2024, possibly as late as December.

This would provide some much-needed relief to households which have been saddled with sky-high mortgage repayments as a result of the Bank’s decision-making.

However, this latest research suggests homeowners will not be in receipt of this support before voters head to the polls sometime this year.

While Prime Minister Rishi Sunak has not named a date for the next General Election, it will have to take place by January 2025 at the latest.

Political analysts are betting on Sunak calling the election for November as the Tories hope to postpone a likely devastating for the party defeat to Labour, if polling is to be believed.

Moneyfacts reports that the average two-year fixed-rate deal is currently 5.93 per cent and the average five-year deal is 5.5 per cent.

Despite this being lower than the peak of nearly seven per cent in July 2023, it is still significantly higher than average mortgage rates reported in early 2023.

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWS

The Bank of England has held the base rate at 5.25 per cent in recent months | GB NEWSMultiple high street lenders have raised mortgage rates in recent weeks, including HSBC and Virgin.

Sarah Olney MP, the Liberal Democrats’ Treasury spokesman, slammed Sunak over the Tories record in power.

She said: “This Conservative government crashed the economy and now they are condemning hard-working households to a mortgage nightmare.

“Rishi Sunak’s claim that the Government’s plan is working shows he is living in a parallel universe, as every day thousands of families are seeing their mortgage go up by eye-watering amounts.”