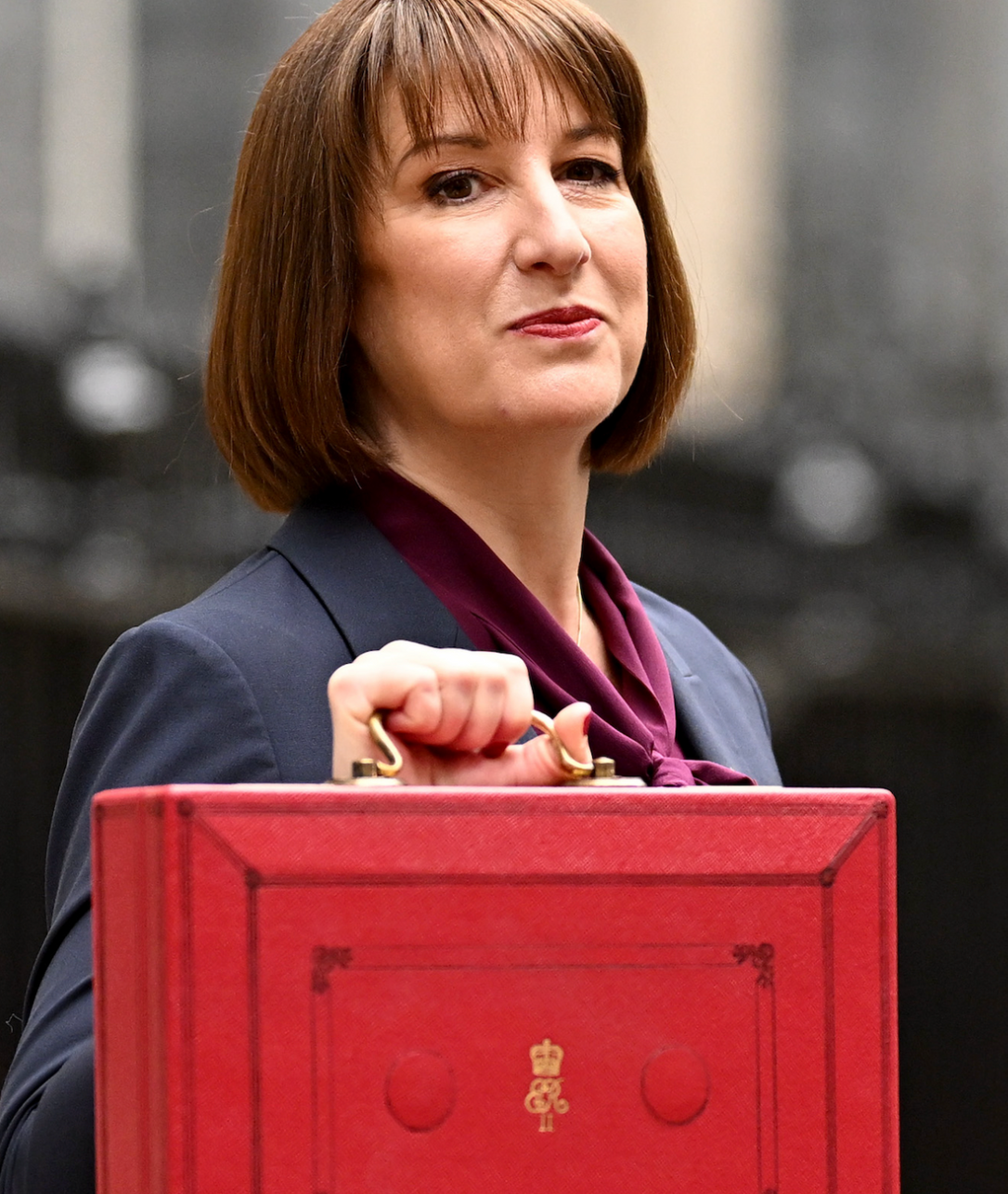

Rachel Reeves 'considers scrapping stamp duty for new property tax'

Andrew Griffith blasts Rachel Reeves for another tax grab |

GB NEWS

The proposed tax would be paid by homeowners when selling properties exceeding £500,000 in value

Don't Miss

Most Read

Rachel Reeves is exploring a new property tax that would apply to homes valued above £500,000, potentially replacing stamp duty on owner-occupied properties.

Senior Treasury ministers have instructed civil servants to analyse how such a "proportional" property tax might function and assess its potential effects ahead of Mrs Reeves's autumn budget.

The chancellor is searching for various revenue-raising options while maintaining Labour's pledge to maintain the triple lock.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The party were criticised for raising national insurance on employers, which many viewed as an indirect tax on working people, breaking their manifesto promise.

Rachel Reeves is examining introducing a new property tax

|PA

Initial plans, reported by the Guardian, focus on establishing a national property levy, with considerations for a subsequent local tax that could eventually supersede council tax to support struggling local authority budgets.

The proposed tax would be paid by homeowners when selling properties exceeding £500,000 in value, with rates determined centrally and revenue collected through HMRC.

This approach would impact approximately 20 per cent of property transactions, significantly fewer than the current stamp duty system, which affects roughly 60 per cent of sales.

Second homes would remain subject to existing stamp duty arrangements under the proposals being examined.

LATEST DEVELOPMENTS:

The average UK property price stood at £272,664 in July, according to Nationwide

| GETTY/PAThe average UK property price stood at £272,664 in July, according to Nationwide, meaning most homeowners would avoid the new levy.

Implementation of a national property levy could occur within the current parliamentary term, while replacing council tax would require considerably more time and likely depend on Labour securing re-election.

No definitive decisions have been reached regarding the proposals, according to sources familiar with the discussions.

The transition away from stamp duty would necessitate careful phasing, with multiple approaches under consideration for managing the changeover period.

The proposed changes have been revealed ahead of Rachel Reeves's autumn budget

| Getty ImagesLast financial year, stamp duty on primary residences generated £11.6billion for the Treasury, though this figure varies substantially based on housing market activity.

Officials claim the new system would eventually match stamp duty revenues while providing greater consistency.

The proposals draw partly from research by centre-right thinktank Onward, authored by Tim Leunig, a former government adviser instrumental in developing the furlough scheme.

Leunig argued: "These proposals would make it easier and cheaper to move house, for a better job, or to be near family, as well as being fairer. It should not be the case that a terrace house in Burnley pays more than a mansion in Kensington and it wouldn't be under these proposals."

Deputy Prime Minister Angela Rayner has advocated for increased wealth-based taxation.

More From GB News