Best savings accounts this week as loyal savers urged to check interest rates and consider switching

Moneyfacts has ranked the best savings accounts according to interest rates this week

|GETTY

Savers are being urged to see if they are being rewarded for their loyalty and consider switching to more competitive savings accounts

Don't Miss

Most Read

Millions of Britons are being urged to review their bank accounts, in case they are missing out on inflation-beating returns.

With the latest CPI figure showing UK inflation increased by 3.2 per cent in the year to March 2024, there are a range of accounts offering competitive interest rates.

There are still a number of one-year fixed deals paying more than five per cent interest, but there are now just three two-year products doing the same, new analysis shows.

These are the two-year bonds accounts offered by Hampshire Trust Bank (HTB), RCI Bank UK, and Close Brothers Savings.

James Hyde, spokesperson at Moneyfactscompare.co.uk, told GB News: “HTB’s chart-topping two-year fix offers 5.06 per cent interest on a minimum investment of just £1, which may be appealing to those with a smaller savings pot.

“Those who would like access to their cash will again see minimal movement in the easy access top rate tables, although Close Brother Savings recently withdrew their easy access account and Cynergy Bank cut the rate on theirs by 0.05 per cent.

“The only fixed ISA product currently paying over five per cent is Virgin Money’s One Year Fixed Rate Cash ISA paying 5.05 per cent, although it is necessary to have or open certain linked products to qualify for the account.

“As always, it’s vital that savers continue to review and switch their account if they are not being rewarded for their loyalty.”

Fixed rate savings accounts

Best one-year fixed savings accounts:

- SmartSave 5.18 per cent AER/gross

- Allica Bank 5.17 per cent AER/gross

- Birmingham Bank 5.16 per cent AER/gross

- Close Brothers Savings 5.16 per cent AER/gross

- Atom Bank 5.15 per cent AER/gross

- QIB (UK) 5.15 per cent AER/gross

- Zenith Bank (UK) LTD 5.15 per cent AER/gross

- Hampshire Trust Bank 5.10 per cent AER/gross

- Beehive Money 5.10 per cent AER/gross

- Hodge Bank 5.10 per cent AER/gross

Best two-year fixed savings accounts:

- Hampshire Trust Bank 5.06 per cent AER/gross

- RCI Bank UK 5.05 per cent AER/gross

- Close Brothers Savings 5.05 per cent AER/gross

- SmartSave 4.96 per cent AER/gross

- Atom Bank 4.95 per cent AER/gross

- Beehive Money 4.95 per cent AER/gross

- Union Bank of India (UK) Ltd (minimum investment £1,000) 4.95 per cent AER/gross

- Union Bank of India (UK) Ltd (minimum investment £5,000) 4.95 per cent AER/gross

- Hodge Bank 4.90 per cent AER/gross

- Zenith Bank (UK) Ltd 4.90 per cent AER/gross

Easy access savings accounts

Best easy access savings accounts without bonus:

- cahoot 5.20 per cent AER/gross

- Ulster Bank 5.20 per cent AER/gross

- Monument Bank 5.01 per cent AER/4.90 per cent gross

- Paragon Bank 5.00 per cent AER/4.89 per cent gross

- Kent Reliance 4.96 per cent AER/gross

- Oxbury Bank 4.94 per cent AER/4.83 per cent gross

- Charter Savings Bank 4.93 per cent AER/gross

- Wealthify 4.91 per cent AER/4.80 per cent gross

- Secure Trust Bank 4.90 per cent AER/4.79 per cent gross

- Hampshire Trust Bank 4.90 per cent AER/gross

Best easy access savings accounts with bonus:

- Principality Building Society 5.00 per cent AER/gross

- Cynergy Bank 4.95 per cent AER/gross

- Tesco Bank 4.81 per cent AER/gross

- Principality Building Society 4.80 per cent AER/gross

- Marcus by Goldman Sachs 4.75 per cent AER/4.65 per cent gross

- SAGA 4.75 per cent AER/4.65 per cent gross

- Post Office Money 4.75 per cent AER/gross

- Sainsbury's Bank 4.40 per cent AER/gross

- Post Office Money 4.10 per cent AER/gross

- TSB 2.92 per cent AER/2.89 per cent gross

Regular savings accounts

- The Co-operative Bank 7.00 per cent AER/gross

- Nationwide Building Society 6.50 per cent AER/gross

- NatWest 6.17 per cent AER/6.00 per cent gross

- Royal Bank of Scotland 6.17 per cent AER/6.00 per cent gross

- Principality Building Society 6.00 per cent AER/gross

- West Brom Building Society 6.00 per cent AER/gross

- TSB 6.00 per cent AER/gross

- Saffron Building Society 5.75 per cent AER/gross

- Principality Building Society 5.50 per cent AER/gross

- Halifax 5.50 per cent AER/gross

Skipton Building Society is also still offering members a seven per cent AER/gross interest rate for 12 months via its Member Regular Saver Issue 3.

LATEST DEVELOPMENTS:

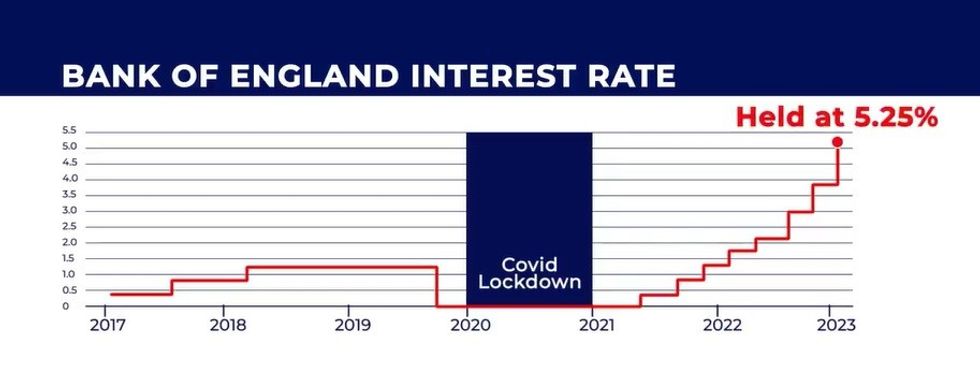

The Bank of England base rate is currently being held at 5.25 per cent

|GB NEWS

Cash ISAs

Best one year fixed rate cash ISAs:

- Virgin Money 5.05 per cent AER/gross

- Punjab National Bank (International) Limited 4.80 per cent AER/gross

- Shawbrook Bank 4.72 per cent AER/gross

- OakNorth Bank 4.71 per cent AER/4.61 per cent gross

- Cynergy Bank 4.70 per cent AER/gross

- Secure Trust Bank 4.70 per cent AER/gross

- Close Brothers Savings 4.70 per cent AER/gross

- Charter Savings Bank 4.66 per cent AER/gross

- Newcastle Building Society 4.65 per cent AER/gross

- Virgin Money 4.65 per cent AER/gross

Best variable rate cash ISAs

- Plum 5.17 per cent AER/5.06 per cent gross

- Moneybox 5.16 per cent AER/gross

- Chip 5.10 per cent AER/4.99 per cent gross

- West Brom Building Society 5.10 per cent AER/gross

- Zopa 5.08 per cent AER/4.96 per cent gross

- Marsden Building Society 5.05 per cent AER/gross

- Furness Building Society 5.01 per cent AER/gross

- Newcastle Building Society 5.00 per cent AER/gross

- Earl Shilton Building Society 5.00 per cent AER/gross

- Teachers Building Society 5.00 per cent AER/gross

Interest rates were compiled by Moneyfactscompare.co.uk at 09:07 on Monday, April 29.