Rachel Reeves sparks major investor anxiety as UK borrowing costs soar to 27-year-high

Labour's history of economic woes and recessions |

GB NEWS

UK gilt yields continue to be high as investors signal growing concern over the economy's trajectory

Don't Miss

Most Read

Latest

Government borrowing costs have surged over the past two weeks, an investors grow increasingly anxious over Chancellor Rachel Reeves's attempts at bolstering the UK economy.

Last Friday (August 15), the 30-year gilt soared to 5.57 per cent before slipping back to 5.54 per cent once markets opened yesterday morning (August 18).

This is a higher level than levels seen in April, when gilt yields reached a 27-year high in the wake of President Donald Trump's "Liberation Day" tariffs.

As well as this, 10-year gilt yield rose to as much as 4.7 per cent from 4.51 per cent; however this is a lower level than what was seen in April and June.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Chancellor Rachel Reeves is under more pressure after gilt yields soar

|GETTY / MARKETWATCH

Growing anxiety over borrowing costs are indicative over concerns whether major economies, including the UK, will pay able to pay off their debts.

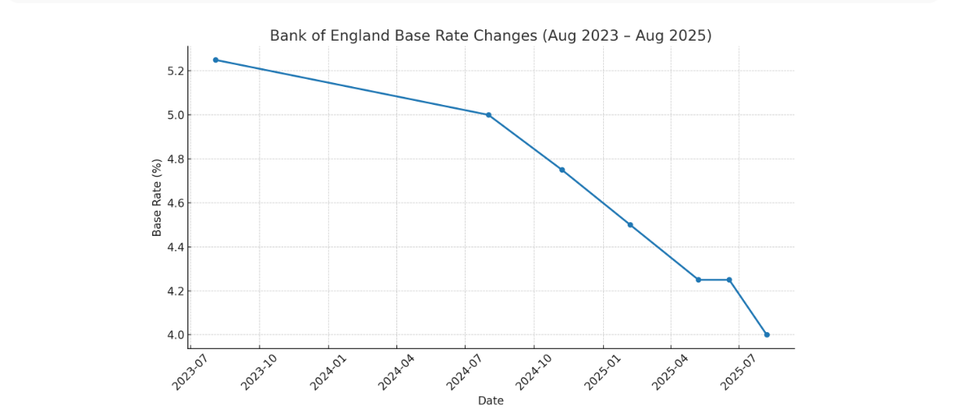

The Bank of England has raised interest rates to as high as 5.25 per cent in recent years in an attempt to rein in inflation, however the base rate has since been reduced to four per cent.

Traders are preparing for inflation to rise once again, with the central bank projecting the consumer price index (CPI) rate will peak at four per cent next month.

If this becomes reality, analysts warn interest rates could be kept higher for longer. Furthermore, the Government's spending choices have also contributed to the gilt yield's movement.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

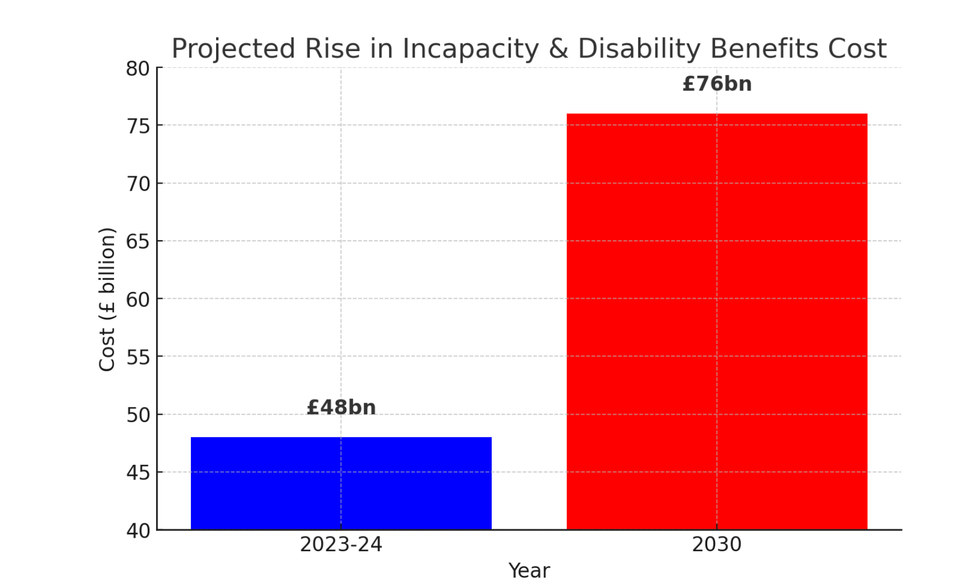

The cost of incapacity benefits is set to skyrocket over the next five years | ChatGPT

The cost of incapacity benefits is set to skyrocket over the next five years | ChatGPTMs Reeves was forced to scale back planned spending cuts on benefits expenditure after backlash from backbench Labour MPs to the Universal Credit and Personal Independence Payment Bill.

Kathleen Brooks, the research director at trading platform XTB, broke down UK gilt yields are "rising father" than equivalent yields across the pond and in Europe.

She told City AM: "The spike in European bond yields coincided with the release of the UK labour market data, which showed stubbornly high wage data and a slowdown in job losses in recent weeks and months.

"Interest rate cut expectations for the UK are being scaled back, there is now less than one rate cut getting priced in by the end of the year, and only a 40 per cent chance of a cut priced in for November."

MEMBERSHIP:

- Bournemouth is just the beginning. Vigilante groups are coming to a town near you - Renee Hoenderkamp

- Rachel Reeves' deceitful tax will leave you £82k poorer. And that's not even the worst of it - Kelvin MacKenzie

- Three SHOCK graphs expose who is REALLY crossing the Channel in small boats - and it's NOT women and children

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- POLL OF THE DAY: As the Chancellor eyes a property tax raid, do you fear further hikes in the Autumn budget? VOTE NOW

"For now, UK bonds are taking the brunt of the selling, and Gilt yields are rising faster than yields in Europe and the US. Due to the UK’s weak fiscal position, this is to be expected."

Ahead of this year's Autumn Budget, the Chancellor has declared her strict fiscal rules are "non-negotiable" which promise not to raise taxes on working people.

LATEST DEVELOPMENTS:

The Bank of England has brought interest rates down in recent years | CHAT GPT

The Bank of England has brought interest rates down in recent years | CHAT GPT Speaking to the Treasury Select Committee earlier this year, Ms Reeves said: "One in £10 of Government spending is spent servicing our debt. I am a Labour politician.

"I don’t think there’s anything progressive about spending £100billion a year, often to US hedge funds when I would rather spend that money on our health service or on defence."

The Bank of England's Monetary Policy Committee (MPC) is next scheduled to announce any future changes to UK interest rates on September 18, 2025.

While no data has been confirmed by the Treasury, the Chancellor is expected to give her Autumn Budget statement sometime in late October-early November.

More From GB News