Savers urged to check terms and conditions as Lifetime ISA rule reform ‘overlooked’

Lifetime ISA savers purchasing a home costing more than £450,000 face the choice of being charged on their hard-earned cash or miss out on their dream home

Don't Miss

Most Read

Latest

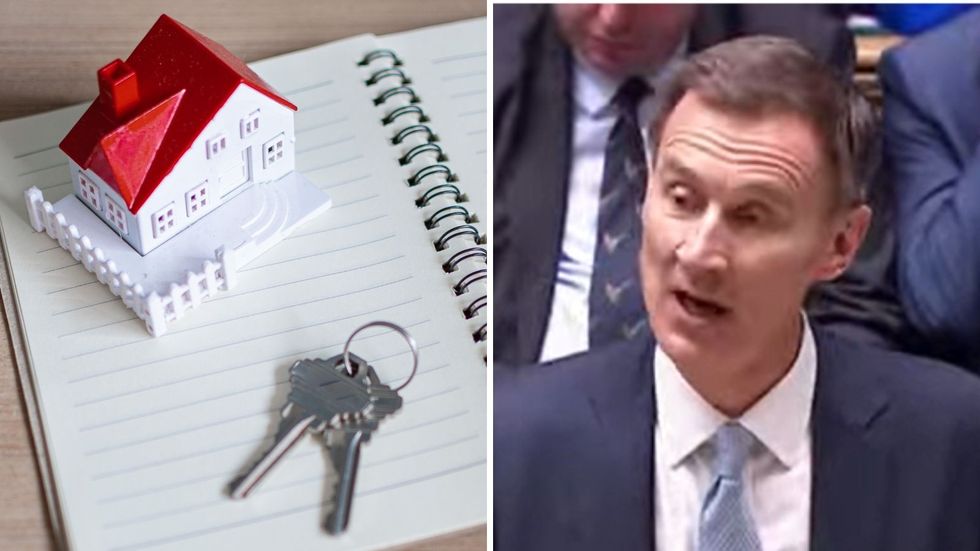

Chancellor Jeremy Hunt has been accused of "overlooking" Lifetime ISA reform, which could have helped first-time buyers who are trying to get on the housing ladder amid increasing property prices.

Financial experts have been calling for the Chancellor to increase the property price limit for a fee-free withdrawal of Lifetime ISA savings in today's Spring Budget.

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said: “There has been a missed opportunity to reduce the withdrawal charge on Lifetime ISAs, and no acknowledgement on wider calls to raise the property value threshold for first-time buyers – it was overlooked.

Chancellor Jeremy Hunt has been accused of "overlooking" Lifetime ISA reform

|GETTY | GB NEWS

"It’s disappointing that consumers who need to unexpectedly access their Lifetime ISA pot will still be susceptible to the 25 per cent withdrawal charge."

Ms Springall issued a warning for first-time buyers to check the rules before depositing their cash in a Lifetime ISA.

She said: “Any savers considering a Lifetime ISA would be wise to check the full terms and conditions before they enter any arrangement to ensure they are eligible for the 25 per cent Government bonus.

"If savers have any concerns, they may want to consider alternative savings accounts where they can move their money freely, and sadly miss out on the Government boost that LISA offers.”

Kate Smith, Head of Pensions at Aegon, said first-time buyers and those using a LISA to save for retirement would be disappointed Mr Hunt didn't take the opportunity to modernise LISA rules.

Various rules and restrictions are failing to keep up with the times," she said.

“Currently, you can’t open a LISA once you pass age 40, can only contribute a maximum of £4,000 per year, and can no longer contribute once you hit 50.

"Raising the maximum age for taking out a LISA, say to 50, would have made them available to a wider audience, while allowing contributions to continue, possibly to 55, could have enabled LISA savers to build up larger sums, particularly if using the product as a retirement savings vehicle.

"The annual contribution limit is also restrictive and has not been increased since introduced back in 2017.

“The current property purchase cap of £450,000 is causing problems for prospective first-time buyers particularly in areas of high property process.

“Omitting a modernisation agenda for LISAs from the Budget is a missed opportunity particularly for those aspiring to be first-time buyers.”

Money Saving Expert founder Martin Lewis, who has been calling for Lifetime ISA changes, told his social media followers that Mr Hunt told him he would not be announcing reform in the Budget.

Mr Lewis said: "He said the reason he's not doing is 'I wanted to do a big home ownership package but that doesn’t work until property prices are definitely rising and I still have to keep an eye on overall borrowing.'

"He also told me, 'I want to do more than remove the penalty. I want to reform LISAs.' I am of course disappointed there are no changes this time, but at least it is not off the table."

LATEST DEVELOPMENTS:

Lifetime ISA holders can put up to £4,000 into their account each tax year, and get a 25 per cent Government bonus - up to £1,000 per tax year - added to the account.

However, until now, they must meet one of the three fee-free withdrawal conditions, or face a withdrawal charge of 25 per cent.

This is known as an unauthorised withdrawal and aims to recover the government bonus, but it can mean savers face a penalty on their original savings.

For instance, initial savings of £800 would earn a £200 bonus, creating a pot of £1,000. To access the entire amount as an unauthorised withdrawal, the saver would need to pay a withdrawal charge of £250, leaving them with £750.

Under existing rules, savers must meet one of the following reasons to access their savings without paying the 25 per cent charge:

- Buying your first home

- Aged 60 or over

- Terminally ill, with less than 12 months to live.

Lifetime ISA savers who are buying their first home must also meet the following conditions:

- The property costs £450,000 or less

- You buy the property at least 12 months after you make your first payment into the Lifetime ISA

- You use a conveyancer or solicitor to act for you in the purchase - the ISA provider will pay the funds directly to them

- You’re buying with a mortgage.

Savers must be aged 18 or over and under 40 to open a Lifetime ISA.

Once opened, people can deposit money into their Lifetime ISA until they turn 50.

Chancellor Jeremy Hunt announced a new type of ISA today, known as the British ISA.

The British ISA will give people an additional £5,000 tax-free allowance to invest in UK assets, on top of the existing £20,000 ISA limit.