Don't Miss

Most Read

Trending on GB News

GB News Business and Economics Editor Liam Halligan has revealed his predictions for bank interest rates in 2024. He explained that inflation has "come down a lot" but is still double the target set by the Bank of England.

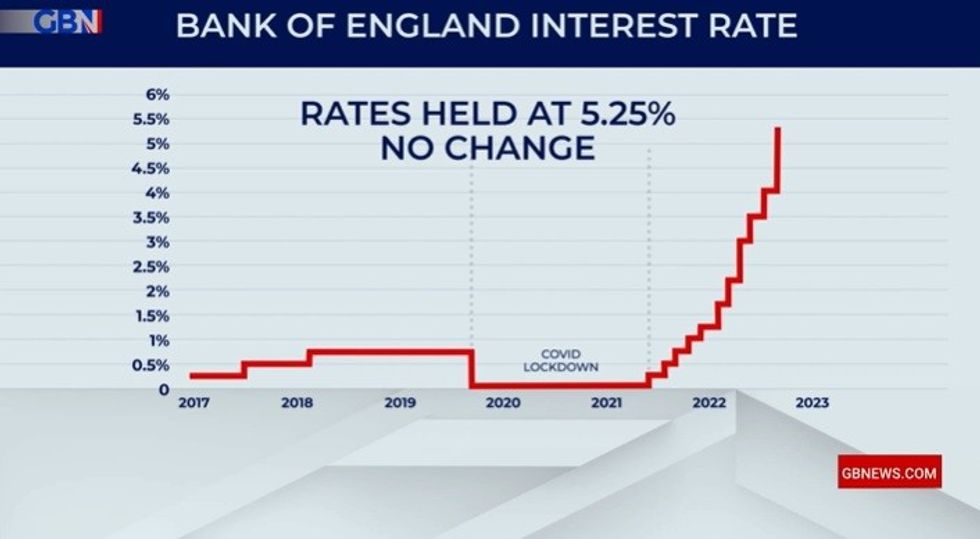

It comes as the Bank of England revealed its verdict on interest rates today and announced it will keep interest rates on hold at 5.25 per cent for the fourth time in a row.

Earlier today, the Bank of England's Monetary Policy Committee (MPC) confirmed that the UK’s base rate would not be cut from its 15-year-high.

Speaking about his predictions for the year ahead, Halligan said: "I do think interest rates are going to come down in the months to come. We have had 14 rises.

Liam Halligan shared his 2024 predictions

GB News

"During the Covid lockdown, interest rates went all the way down to nought point one per cent.

"We then had a staircase of rate rises. 14 successive rate rises to 5.25 per cent which is where they have been since the summer.

"Inflation has come down a lot. It's come down from 11 per cent at the back end of 2022 to four per cent now, but that's still double the Bank of England's two per cent target."

He added: "It could go up when the number for January comes out later this month because the Ofgem energy price cap has gone up. But history doesn't happen in a straight line.

The Bank of England base rate has increased 14 consecutive times but was held for the first time in nearly two years last month GB NEWS

The Bank of England base rate has increased 14 consecutive times but was held for the first time in nearly two years last month GB NEWS"The general trend of inflation is down. That's why I do think we're going to get successive interest rate cuts from 5.25 per cent starting in April or May, after the budget.

"That's why the Tories are playing the long game. If Rishi Sunak can hold on to power and hold on to his government, then he's going to go as long as he can before the general election because he thinks interest rate cuts will generate a feel-good factor."

He then went on to talk about the recent tax cuts to National Insurance.

He explained: "Jeremy Hunt, the Chancellor is managing expectations like crazy. He knows his backbenchers are gunning for tax cuts with the tax burden at a 70-year high. We saw a tax cut this month with National Insurance.

He also discussed tax cuts

GB News

"They want another interest rate tax cut in this budget on March the 6th, and then maybe another tax cut in an Autumn statement before a general election. That's their strategy.

"In December, the UK government borrowed about four or £5 billion. That's way lower than December 2022. What did the OBR [Office for Budget Responsibility] say the UK government was going to borrow in December? Not four or five billion. They said 11.6 billion.

"That's how gloomy they were and yet Jeremy Hunt will now be in some kind of dance with the Office for Budget Responsibility.

"He will be asking are you going to let me cut taxes or if I do cut taxes are you going to start briefing the press and saying it is irresponsible so the market go nuts."

"I think they're too powerful, The OBR, and I say that as a highly qualified economist. I think they're two cognitively similar."