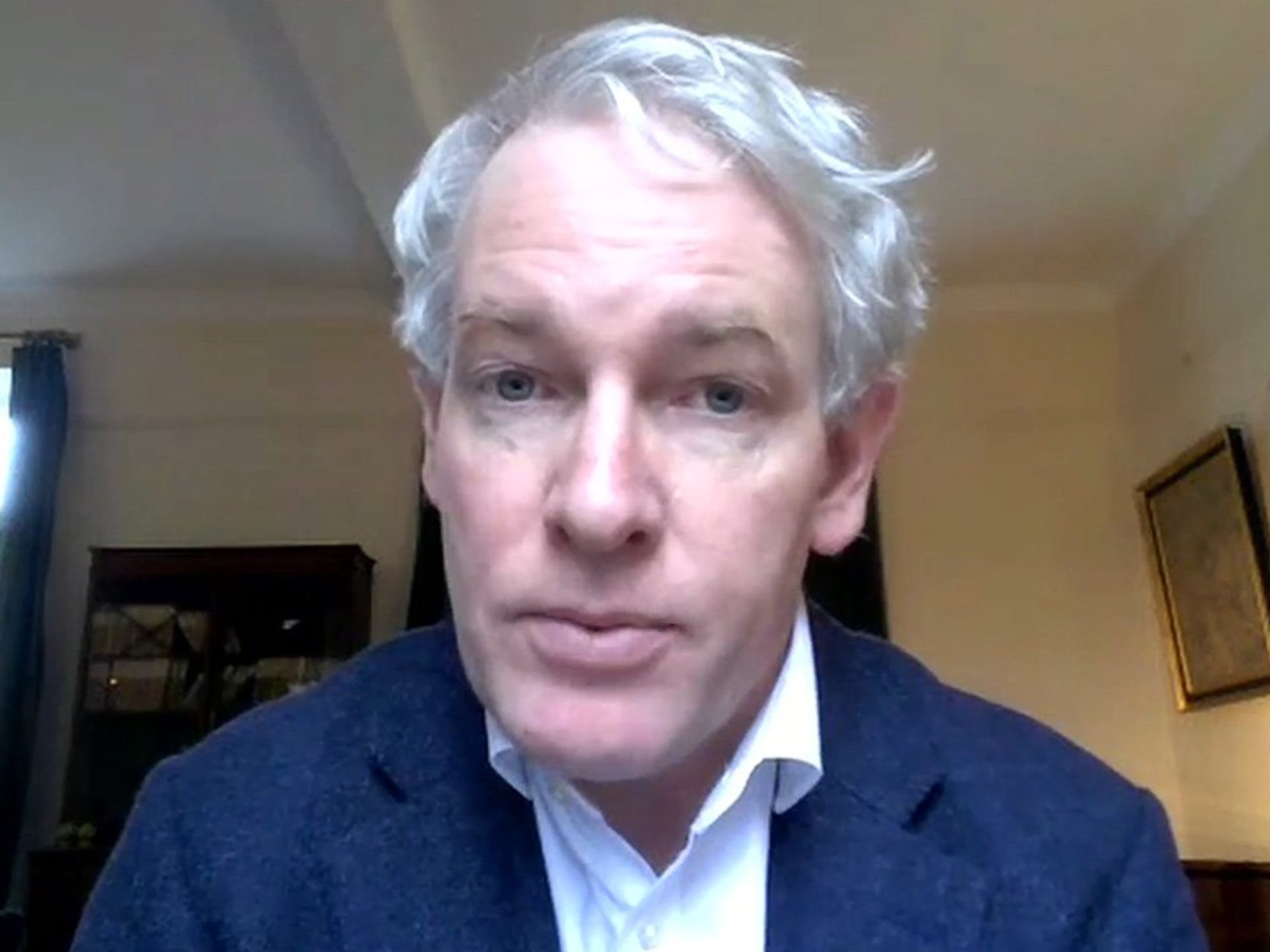

Jeremy Hunt says UK needs ‘low tax’ as he addresses six-year ‘stealth tax’ hitting teachers and nurses

Chancellor Jeremy Hunt told GB News about his “approach” to the Autumn Statement, which will be delivered on Wednesday

Don't Miss

Most Read

Chancellor Jeremy Hunt has said the UK needs taxes “to be lower than they are at the moment” as he addressed cutting the tax burden.

In an exclusive interview with GB News, Mr Hunt said he did believe there should be “low” tax for a “dynamic” economy, but refused to confirm whether he would abolish the six-year tax threshold freeze, which is dragging middle earners into the 40 per cent higher rate tax bracket – known as fiscal drag.

Speaking to the GB News presenter Camilla Tominey asked: “How about unfreezing these tax bands?

“You can’t be happy about this idea of people – some of them might be teachers, some of them might be nurses – actually being fiscally dragged into paying more tax. It’s a stealth tax and it needs to stop doesn’t it?”

Have you been affected by the tax threshold freeze? If you would like to share your story, get in touch by emailing money@gbnews.uk.

Chancellor Jeremy Hunt was asked about the ongoing 'stealth' tax during an exclusive interview with GB News

|GB NEWS

Mr Hunt said he would not talk about the measures he would be announcing in the Autumn Statement, but said: “There is a very big dividing line between us and the Labour Party on tax.

“I do believe that if we are going to be a dynamic, thriving, energetic, fizzing economy, we need low tax and we need taxes to be lower than they are at the moment."

Mr Hunt said while he wouldn’t state the measures, he would explain his “approach”.

He said: “First of all, we’re not going to do anything irresponsible – particularly by which I mean anything that fuels inflation. We had a big victory last week when we delivered the Prime Minister’s pledge to halve inflation.

"When he and I came into office it was over 11 per cent. Now it’s 4.6 per cent.”

The Chancellor said he was going to “do this responsibly”.

He went on to state that his priority on Wednesday is “growth”.

“Having made good progress on inflation, we can move to the next part of our plan, which is to unlock much higher levels of growth.”

A Conservative Party MP this week told GB News he was urging the Chancellor and Prime Minister Rishi Sunak to increase the 40 per cent higher rate tax threshold - which they have frozen at £50,271 until 2028.

LATEST DEVELOPMENTS:

WATCH NOW: Greg Smith urges Chancellor to change the threshold for higher rate tax

The measure means high earners with a £50,000 salary in 2022 are set to pay an extra £1,967 in tax by 2027, compared to if the threshold rose with inflation, according to calculations by interactive investor.

If these workers had two children, they would also lose £2,075 in Child Benefit by 2027 due to being caught in the High Income Child Benefit Charge, should their salary increase with inflation but the £50,000 tax threshold remain the same.

People on a £30,000 salary last year are set to pay £889 more in tax by 2027 due to frozen thresholds, according to the analysis.

The personal allowance has also been frozen at £12,570 until 2028, which means lower earners and pensioners face being dragged into the 20 per cent income tax net.

Alice Guy, head of pensions and savings at interactive investor, said: “Fiscal drag is silent and ruthlessly efficient way of raising the tax burden over time.

“It works by freezing tax thresholds so that we pay tax on more and more of our income as our wages rise with inflation. It’s less obvious than raising tax rates, but potentially has an even bigger impact on taxpayers over time.

“Frozen tax thresholds affect all of us, not just higher earners, because the frozen personal allowance means even lower earners gradually pay tax on more of their income.”