‘Tax has to be fair!’ Tory MP slams ‘hidden’ 60 per cent income tax ‘trap’

A Conservative Party MP is urging Jeremy Hunt to change income tax threshold rules

Don't Miss

Most Read

Chancellor Jeremy Hunt is being urged to make changing the “hidden” 60 per cent income tax “trap” his next priority.

Conservative Party MP Greg Smith said the current rules, which leave some higher earners facing their marginal tax rate going up to 60 per cent, were “punishing”.

The issue affects workers who earn between £100,000 and £125,140, as a result of the tapering of the personal allowance for higher earners.

Currently, the personal allowance – meaning the amount of taxable income a person can earn without paying tax – reduces by £1 for every £2 that adjusted net income is above £100,000.

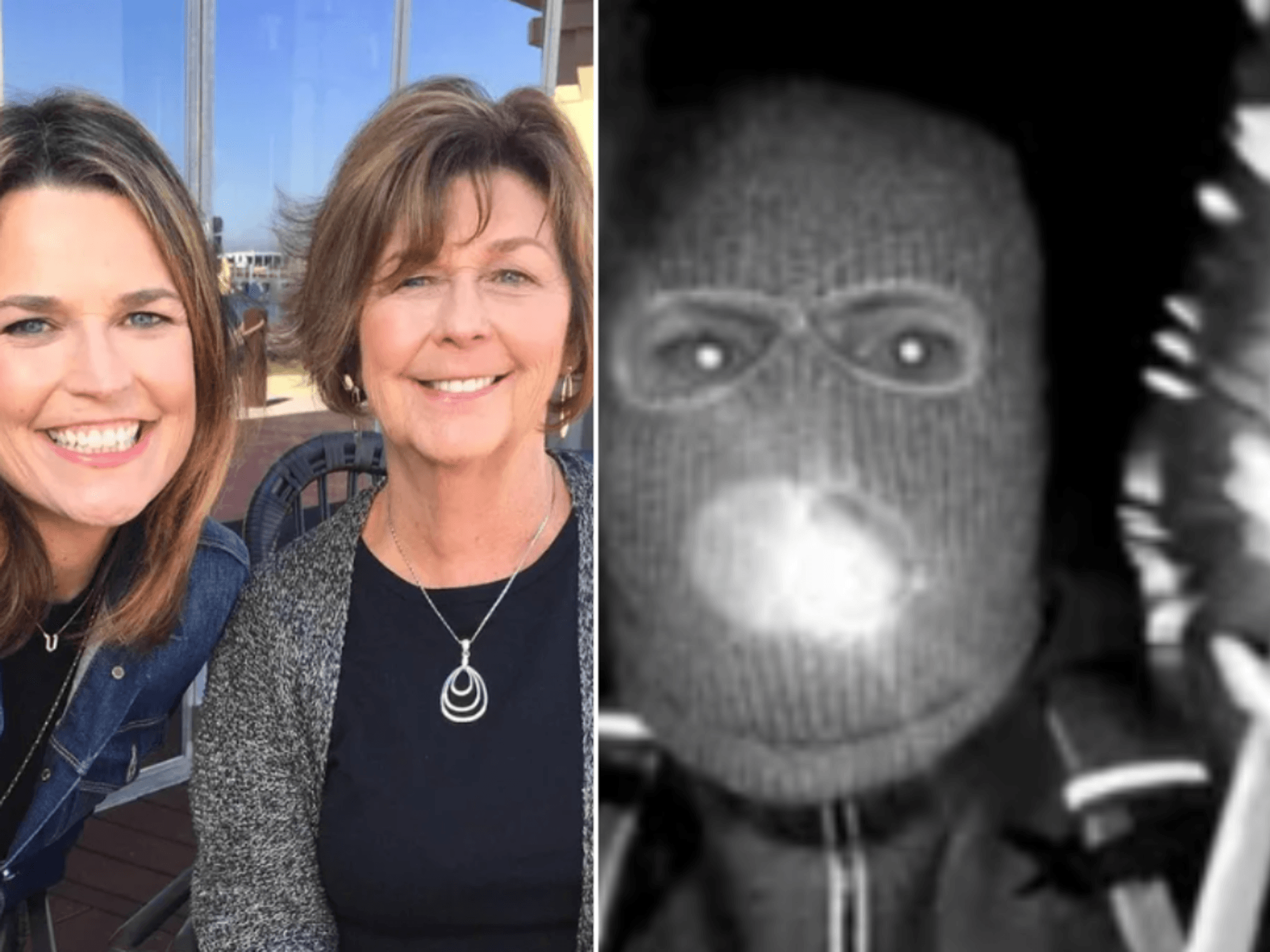

Jeremy Hunt will deliver the Autumn Statement on Wednesday

|PA

With the personal allowance frozen at £12,570 until 2028, it means the allowance will be zero if a person’s income is £125,140 or above.

In an exclusive interview with GB News, Mr Smith, MP for Buckingham, said: “There are two problems that we actually have to solve in terms of people who earn over £100,000 and then the people who earn over £125,000.

Have you been affected by the tax threshold freeze? If you want to share your story, get in touch by emailing money@gbnews.uk.

“Because there is this really punishing, almost unintended perversity of the system where if you're in that 100,000 to £125,000 income bracket, your marginal tax rate goes up to 60 per cent.

“Now who on earth in their right mind is going to go after that marginal pay rise that pushes them into that, when they're earning a really great salary of £97,000 or £98,000? No one's going to really want the £5,000 pay increase if your marginal tax rate then goes up to 60 per cent.”

He added: “It is an absurdity that anybody should be paying 60 pence in the pound of that which they earn to the Government.

Mr Smith said the matter “has got to be the next priority for the Chancellor” to fix.

The Tory MP continued: “Tax has to be fair. Everybody accepts that we need to pay something for the public services we want, for the schools and the hospitals and the roads and everything else.

“That 60P in the £1 can't be fair or right in anybody's book. We've got to flatten that out and ensure that people in that £100,000 to £125,000 income bracket are not being treated disproportionately.”

He urged Mr Hunt to flatten out the rule, so there isn’t a “cliff edge” at £100,000.

Mr Smith also urged the scrapping of the 45 per cent additional rate of tax, which applies to taxable income over £125,140.

He said of the 45 per cent rate: “Personally, I don't see why we should have it at all.”

Mr Smith said he thought if the rate were to be “flattened out”, it would encourage economic growth.

He said: “I actually think it would be a massive boost for aspiration, a massive boost for economic growth and set the economy free.”

However, Mr Smith said his “big priority” at the moment is encouraging the Chancellor to scrap his six-year freeze to the 40 per cent higher rate tax threshold – which is held at £50,271 until 2028 – and increase the threshold.

He said: “The big priority for me at the moment is the fairness around those thresholds for the 40p in the pound bracket, where people that were never intended to pay higher rate tax - police sergeants, teachers, some nurses, others - are inadvertently trapped in it.”

LATEST DEVELOPMENTS:

- Jeremy Hunt urged to scrap ‘tax increase’ policy as more parents face paying thousands to HMRC by 'stealth'

- Pensioners who have saved all their working lives are being ‘punished’ by 'absurd' stealth tax, says Tory MP

- How much ‘stealth’ tax freeze is costing you as Treasury set to rake in £52billion by 2027

WATCH NOW:

Writing for St James’ Place, Kip Katesmark said: “If there’s one word to describe the UK tax system, it’s ‘complicated’.

“It’s easy to misinterpret the rules, and end up make some expensive mistakes, if you fall into one of the hidden tax ‘sinkholes’.”

It may be possible to “sidestep the 60 per cent tax trap” by topping up pension contributions.

Melloney Underhill, Head of Marketing Insights at St James’s Place, said: “The quickest and simplest way is to pay more into your pension before tax-year end, so you reduce the earnings that fall into that bracket.

“This way you save income tax and boost your retirement fund at the same time."

An HM Treasury spokesperson said: “Our tax burden remains lower than any major European economy, despite the difficult decisions we’ve had to make to restore public finances after the dual shocks of the pandemic and Putin’s illegal invasion of Ukraine.

“But the best tax cut we can provide is lower inflation, and we have now achieved our priority of halving it this year, and will continue to build on our work to get it all the way back down to two per cent.

“We have also taken three million people out of paying tax altogether since 2010 through raising personal thresholds, and the Chancellor has said he wants to lower the tax burden further – but has been clear that sound money must come first.”