Don't Miss

Most Read

Trending on GB News

Energy bills could rise again and inflation is unlikely to fall to pre-pandemic levels , a Bank of England rate setter has claimed.

Catherine Mann, a member of the central bank’s Monetary Policy Committee (MPC), warned that it is “prudent” to assume energy prices could increase.

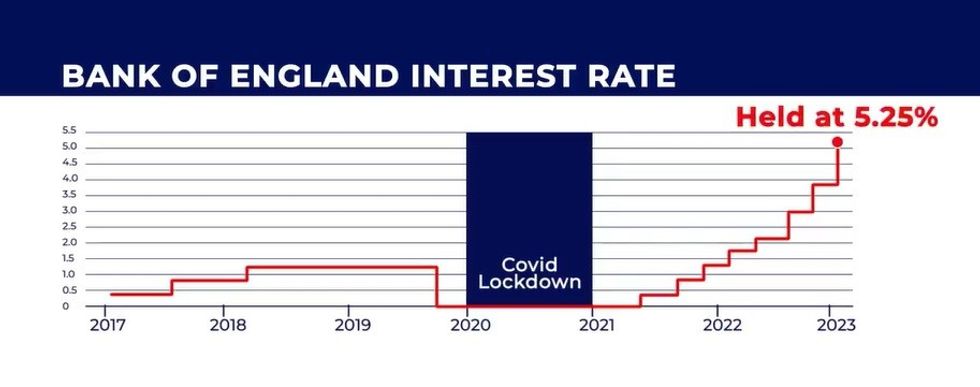

Last week, she was one of two members of the committee who voted to raise interest rates from 5.25 per cent to 5.5 per cent while the majority of those on the MPC voted to keep the base rate as is.

Mann highlighted that there is a “higher risk” of inflation being unable to drop to the Bank of England’s two per cent target as energy bills.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England has warned inflation could rise once again later in the year

GETTY

According to the MCP member, the Bank needs to be more aggressive in combating inflation further interest rate hikes being on the table.

She explained: “Monetary policy is working, so patience is warranted, and a hold could have been my appropriate vote.

“I see risks of continued inflation momentum and embedded persistence. Inflation is the most pernicious of taxes, affecting all households, and those at lower incomes most severely.

“I determined it was prudent to vote for another increase in Bank Rate. It was a finely balanced decision.”

Despite the Consumer Price Index (CPI) rate easing in recent months, inflation rose to four per cent for the 12 months to December 2023.

Last week, the Bank of England forecast that inflation would drop to the two per cent target by the middle of the year if interest rates cut as markets expect them to be.

However, the central bank warned that the CPI rate would likely rise once again in the later half of 2024.

Energy prices will be lower than they were in 2023 around the middle of the year which will put further downward pressure on inflation.

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent since August 2023 GB NEWS

The Bank of England has held the base rate at 5.25 per cent since August 2023 GB NEWSHowever, experts are warning this trend will reverse after summer which will lead to another hike in inflation.

Mann added: “Without energy contributions, inflation, in fact, never reaches the two per cent target within the next three years.

“Of course, we cannot know whether there will be further energy shocks over the next three years.

“But, given the currently low energy price futures curve (low at least in the context of recent years) and geopolitical stresses, it is prudent to consider that the risk of a higher energy price is greater than that of a lower one.”