‘Good news for savers’ as Coventry Building Society increases interest rates

Coventry Building Society has increased interest rates on variable rate savings accounts

|ALAMY

Coventry Building Society has today announced various changes in response to yesterday’s Bank of England base rate rise.

Don't Miss

Most Read

Coventry Building Society is increasing the interest rates on all of its variable savings accounts.

The changes, which will take effect from August 14, mean all variable savings members can expect a new minimum rate of 3.10 per cent or more on all savings accounts.

Matthew Carter, head of savings at Coventry Building Society, said: “We’ve increased variable rates for our savers thirteen times since January 2022, and in the first six months of this year alone our members received £163million in extra interest than if we’d simply paid the market average.

“It’s good news for all of our savers, whether they are saving for their first home or entrusting us with their life savings.

Coventry Building Society said the new changes will take effect from August 14

|ALAMY

“There’s also some positive news for borrowers, despite the rate rise, with our aim being to keep a close eye on the markets and return value to borrowers wherever we can.”

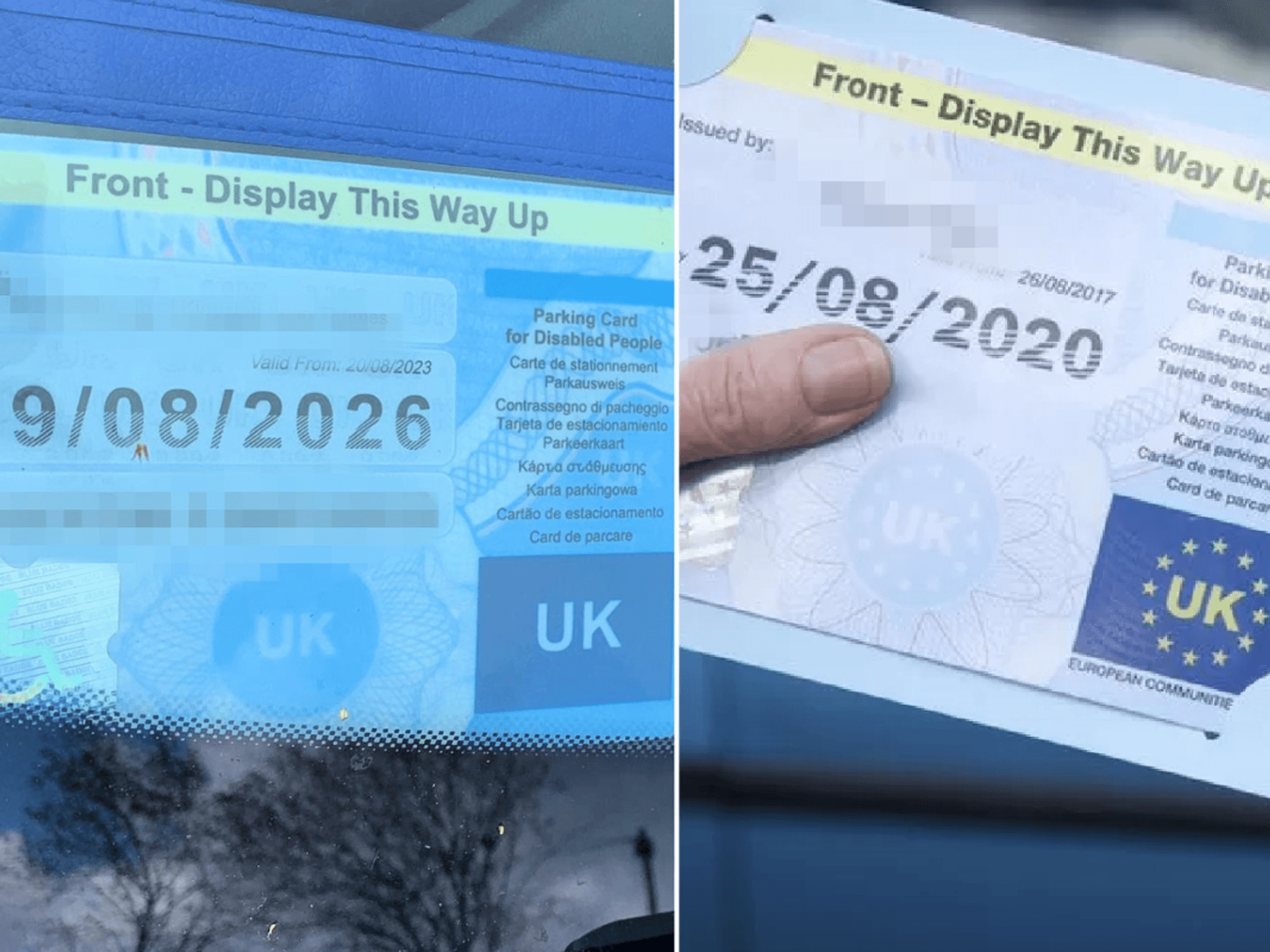

All easy access accounts, including the easy access ISA, will pay 3.10 per cent.

The Regular Saver (5) and First Home Saver (2) will both increase to pay the building society’s highest variable rates of 5.05 per cent.

All of their children’s accounts will pay a minimum of 4.15 per cent under the changes, with the Young Saver climbing to 5.25 per cent. The Junior ISA will pay 4.95 per cent.

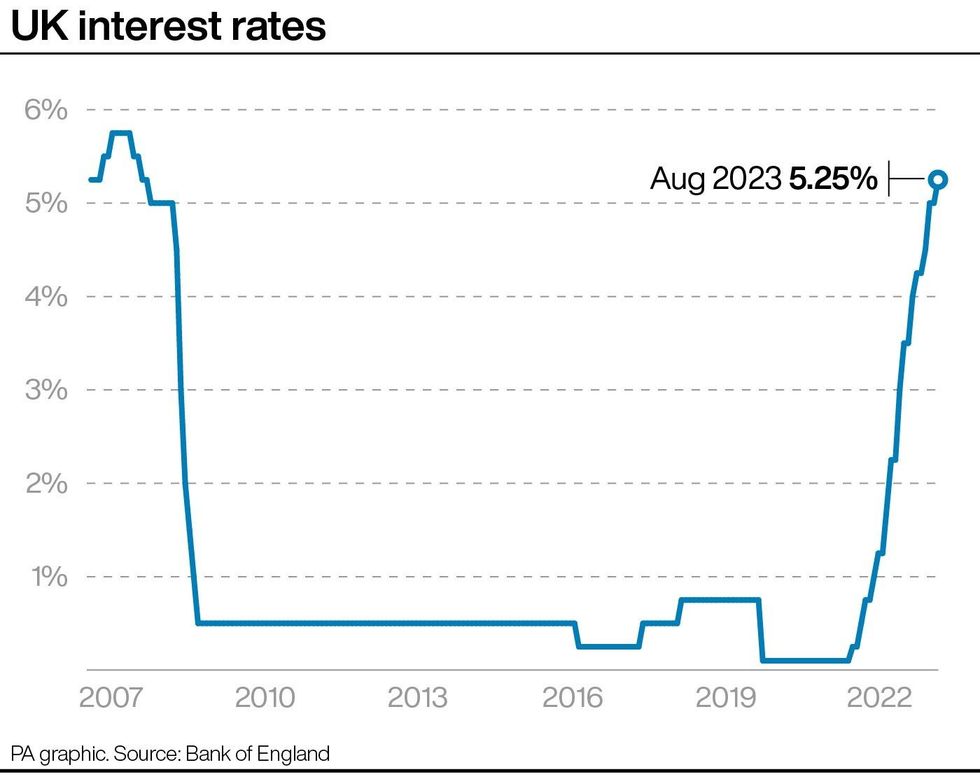

The announcement comes in response to the Bank of England raising the base rate for a 14th time in a row yesterday, to 5.25 per cent.

The Bank Rate now stands at the highest level in 15 years, since 2008.

Yorkshire Building Society has also announced changes to interest rates on its savings accounts following the decision.

The building society will add up to 0.25 per cent to all its variable rate savings accounts by Thursday, August 10.

LATEST DEVELOPMENTS:

The Bank of England base rate has reached its highest level in 15 years

|PA

Chris Irwin, director of savings at Yorkshire Building Society, said: “With the Bank rate continuing to rise, we’re sure it will be welcome news to our savers to hear we’re increasing the interest rate on our accounts yet again.

“Our decision to pass on this latest Bank rate rise maintains our commitment to delivering value to our members. Increasing rates across all of our variable rate savings - including our member loyalty savings accounts - continues to reflect our purpose of supporting our savers.”

The Regular Saver rate will rise to 5.25 per cent.

The Rainy Day Saver Issue 2 will Increase to 4.55 per cent on balances up to £5,000 and 3.9 per cent above this level.