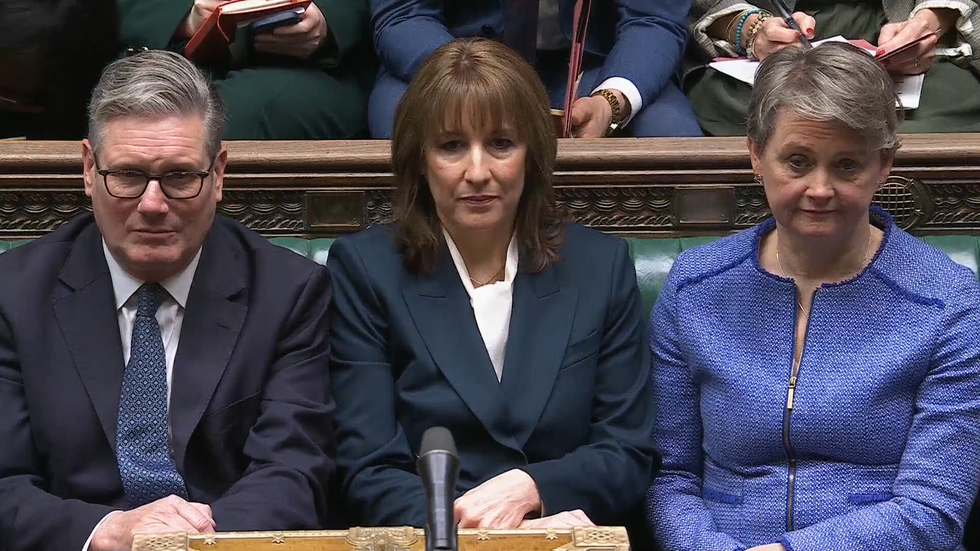

Rachel Reeves clobbers Britain with £26BILLION tax hikes in chaotic Budget after unprecedented leak - read the measures in full

Chancellor Rachel Reeves announces Labour will freeze income tax thresholds and equivalent National Insurance thresholds at their current level until 2031 |

GB News

The Chancellor announced Labour's highly anticipated Autumn Budget on Wednesday

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves has confirmed tax rises worth £26billion after a downgrade in the UK’s growth outlook.

More than 1.7 million people are set to pay more income tax due to the continued freeze on thresholds, which will push workers into higher tax bands as wages rise.

Ms Reeves admitted the policy would affect "working people" despite Labour’s previous pledge to protect them, saying she was “asking everyone to make a contribution”.

To close what she described as a £40billion gap in the public finances, the Budget includes a mix of tax and borrowing measures affecting pensioners, working professionals, benefit claimants, motorists, students and savers.

The Chancellor delivered her statement in unusual circumstances. Much of the Budget was already public after the Office for Budget Responsibility accidentally uploaded its full assessment to its website hours before Ms Reeves took to the dispatch box.

She called the leak “deeply disappointing” and a “serious error”, though the episode did little to change the financial reality facing households.

Although the fiscal picture was less severe than many had feared, there was no sense of relief for taxpayers. The extended freeze on tax thresholds, alongside rises in other taxes and charges, means millions will continue to feel financial pressure for years to come.

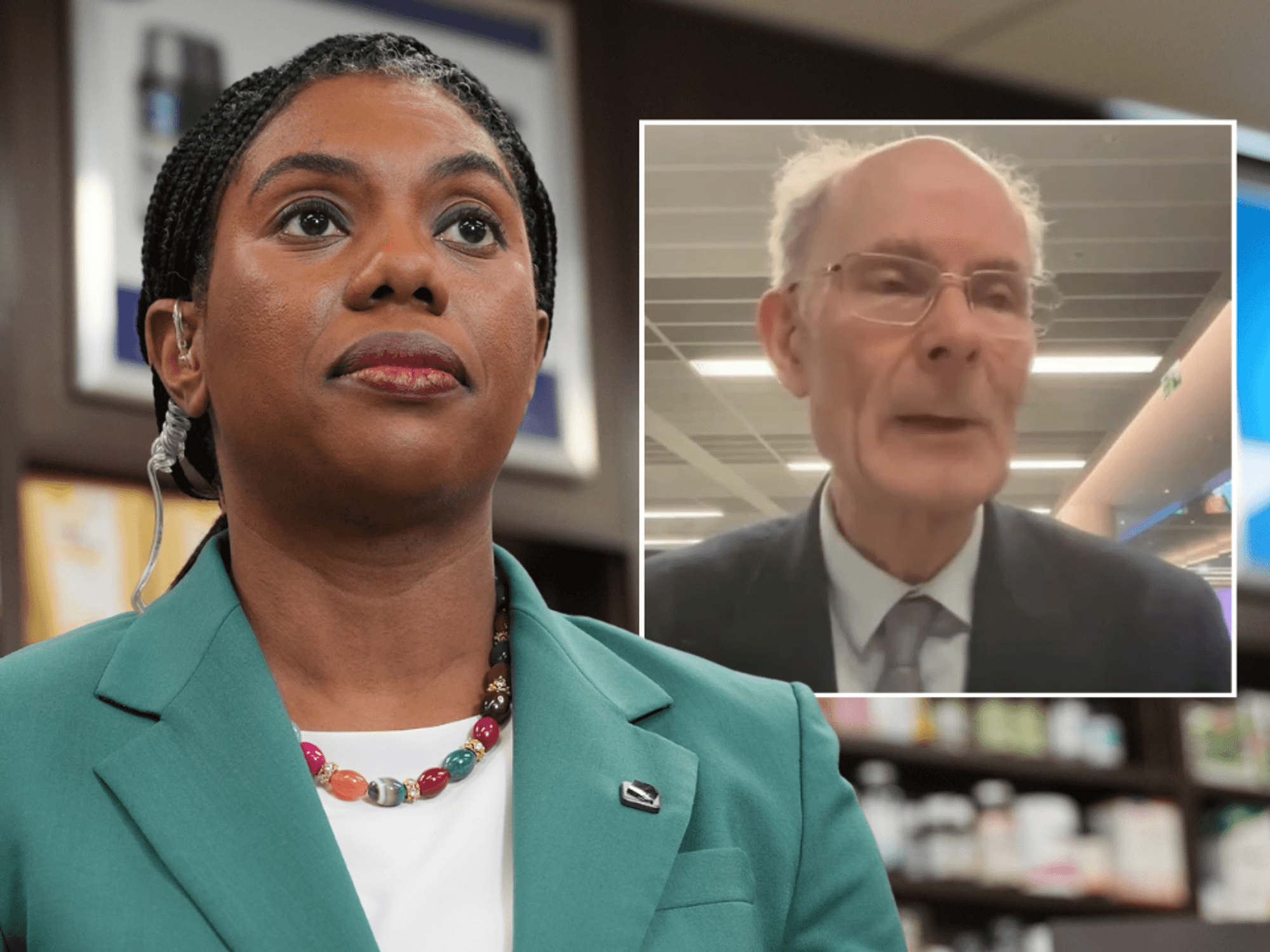

Conservative leader Kemi Badenoch compared Sir Keir Starmer’s Government to a “slow-motion car crash” and called on the Chancellor to resign.

Ms Reeves also confirmed an extension of the income tax threshold freeze to 2030/31, locking millions more workers into higher tax bands as wages rise.

The Chancellor also confirmed a boost to the state pension and changes for savers

|PA

Savings policy also saw significant changes. The annual Cash ISA allowance will be reduced from £20,000 to £12,000 from April 2027, though savers aged over 65 will be exempt from the cut.

The Treasury has framed this as a push to encourage investment, but the move risks triggering a rush into Cash ISAs before the deadline rather than improving retail investing in the long term.

The ISA system will also become more complicated rather than simpler - in contrast to the pre-election promise of streamlining.

A series of other personal finance measures were confirmed, including higher income tax charges on savings, increases to dividend tax and a limit on the tax advantages of salary-sacrifice pension contributions.

From April 2029, contributions above £2,000 through salary sacrifice will be treated like ordinary employee pension contributions for National Insurance purposes. Investors, savers and higher earners will feel the effects of these changes most sharply.

Rachel Reeves unveiled her November Budget today | GB NEWS

Rachel Reeves unveiled her November Budget today | GB NEWS Pensioners received one of the few direct boosts in the Budget, with a 4.8 per cent rise adding £574.50 a year to the new state pension and £439.40 to the basic state pension.

The Chancellor also committed to keeping the triple lock, despite fears pension costs are now spiralling out of control.

However, the OBR leak also confirmed plans for a council tax surcharge on homes worth more than £2million, expected to raise around £400million in 2029/30.

Critics have already branded the measure a “mansion tax by stealth”.

But there was some relief for families. Scrapping the two-child benefit cap and freezing rail fares were highlighted as measures to ease pressure on household budgets.

Kevin Mountford, personal finance expert and co-founder at Raisin UK, said: "Scrapping the two-child welfare limit and freezing rail fares will provide some welcome breathing room for households.

"The Great British Savings Report shows that 60 per cent of people dipped into their savings last year just to keep up with rising costs, so this support could help prevent further erosion of people’s financial safety nets."

TRENDING

Stories

Videos

Your Say

Here is the full list of measures

Tax threshold freeze

The chancellor confirmed tax thresholds will be kept frozen until at least 2030 in a move considered a stealth tax raid by many economists, according to the leaked assessment of her statement from the Office for Budget Responsibility (OBR).

This will mean that those who earn more with inflation will pay into higher tax bands through fiscal drag, effectively increasing taxes on working people

“I can keep that contribution as low as possible because I will make further reforms to our tax system today to make it fairer and to ensure the wealthiest contribute the most,” she said.

Find out more here.

Pension Changes

Rachel Reeves announced that National Insurance will be charged on salary sacrifice contributions.

She has announced that national insurance will be charged on salary-sacrificed pension contributions above an annual £2,000 threshold.

The change will take place from April 2029, raising £4.7billion, the Office for Budget Responsibility said.

In the Autumn Budget, the Chancellor said: "I am introducing a £2,000 cap on salary sacrifice into a pension, with contributions above that taxed in the same way as other employee pension contributions.

"That is a pragmatic step so that people, especially those on low incomes and middle incomes, can continue to use salary sacrifice for their pension without paying any more on tax than they do now.

Learn more here.

Chancellor announces £26billion tax raid

| PAISA slashed

The chancellor revealed plans to cut the tax-free cash ISA allowance from £20,000 to £12,000.

In practice, this will affect millions of savers who want to keep their money in a high interest savings account without risking their capital on the stock market.

In her announcement, she said: “From April 2027, I will reform our Isa system, keeping the full £20,000 allowance while designating £8,000 of it exclusively for investment, with over-65s retaining the full cash allowance.

See more here.

Mansion tax

Ms Reeves confirmed Rachel Reeves has announced a high-value council tax surcharge on homes worth more than £2million.

In the Autumn Budget, she explained the measure is forecast to generate £400million by 2031.

The Chancellor said: "I will take further steps to deal with wealth inequality in our country.

"A Band D home in Darlington or Blackpool pays just under £4,200 in council tax. Nearly 300 more than a £10million mansion in Mayfair.

"From 2028, I am introducing the high-value council tax surcharge in England and an annual £2,500 for properties worth more than £2million, rising to £7,500 for properties worth more than £5million.

"This will be collected alongside council tax levied."

Read more about the measure here.

Two child benefit cap scrapped

Chancellor Rachel Reeves has announced that the two-child benefit cap will be scrapped, marking one of the most significant welfare changes in nearly a decade.

The policy, introduced under the Conservatives in 2017, restricted Child Tax Credit and Universal Credit to the first two children in most households.

She said that: The Chancellor told the commons: "We on this side of the House do not believe that the solution to a broken welfare system is to punish the most vulnerable children."

More details here.

State pension changes

Chancellor Rachel Reeves has confirmed an overhaul to the state pension regime with thousands of retirees living abroad will be expected to pay more to access full payment entitlement.

Ms Reeves said during her speech in Westminster, that the Labour government is achieving "the biggest reduction in child poverty" over a Parliament since records began.

Full story here.

OBR economy downgrade

The Office for Budget Responsibility (OBR) has downgraded its growth forecasts for the UK economy in a post-Budget blow to Chancellor Rachel Reeves.

Speaking to the House of Commons, Ms Reeves said: "borrowing will fall as a share of GDP in every year of this forecast” and the amount of headroom against the Government’s targets will double to £21.7billion, "meeting our stability rule and meeting it a year early".

Read more here.

More From GB News