Budget 2025: Rachel Reeves announces cash ISA tax-free allowance cut to £12,000

GB News

Chancellor confirms major overhaul of savings rules

Don't Miss

Most Read

Savers will see major changes to how they protect their money after Chancellor Rachel Reeves confirmed in her Budget that the annual cash ISA allowance will be cut to £12,000 from April 6, 2027.

Ms Reeves told MPs the existing £20,000 per year threshold will be reduced, while £8,000 has been reserved for investment.

The stocks and shares ISA allowance remains at £20,000 per year.

This will not apply to over 65s, who will keep the £20,000 cash ISA limit and will only apply to new money being put in to ISAs.

Online hubs will be set up, designed “to help people invest” in the UK, Rachel Reeves has said as she set out reforms to the Isa system.

The Chancellor told MPs: “From April 2027, I will reform our Isa system, keeping the full £20,000 allowance while designating £8,000 of it exclusively for investment, with over-65s retaining the full cash allowance.

“And thanks to our changes to financial advice and guidance, banks will be able to guide savers to better choices for their hard-earned money.

“Over 50 per cent of the ISA market – including Hargreaves Lansdown, HSBC, Lloyds, Vanguard and Barclays – have signed up to launch new online hubs to help people invest here in Britain.”

The £12,000 limit is higher than the £10,000 ceiling examined earlier in the policy process but still marks a notable tightening of the rules.

The announcement forms part of wider Treasury plans to boost stock market participation among British investors.

For years, individuals have been able to shelter up to £20,000 each year from tax in cash-based ISA products.

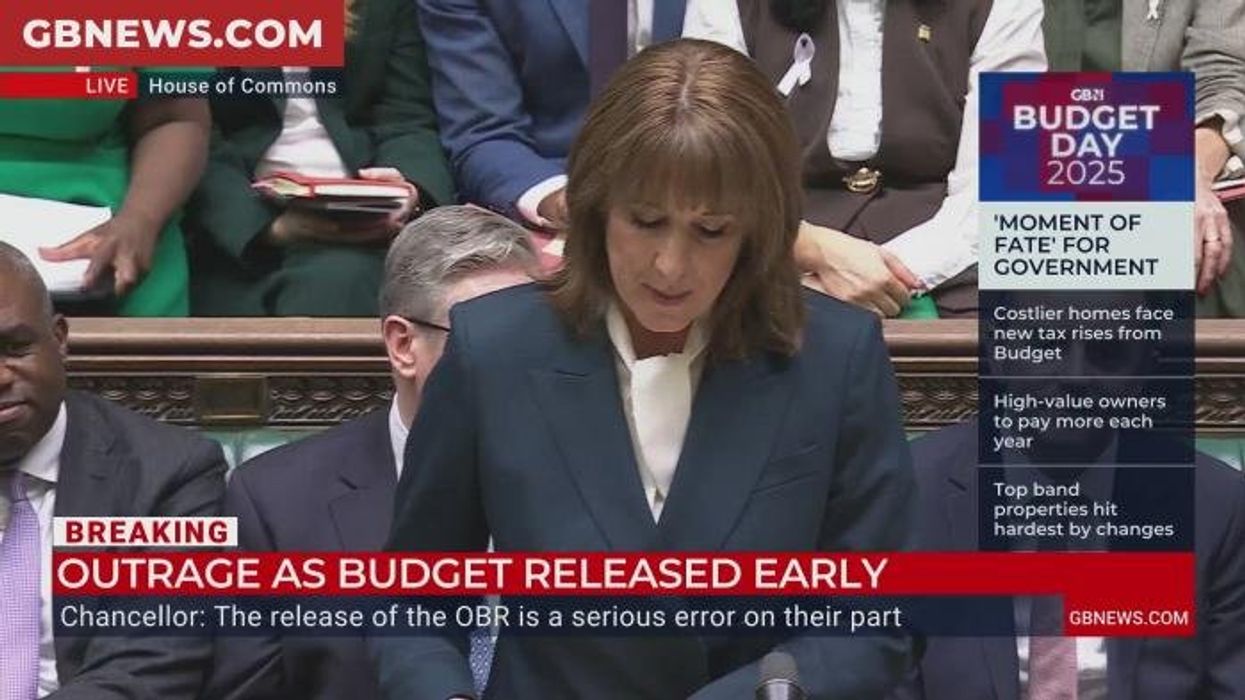

Rachel Reeves announced the savings cut during her statement

|POOL

Financial institutions have long voiced mixed opinions about the prospect of a reduced allowance.

Building societies previously warned that any cut would damage their ability to provide mortgage lending.

They said a fall in cash ISA deposits could limit their funding capacity and potentially drive up borrowing costs for homebuyers.

Investment platforms, however, have argued that the allowance remained too high and urged the Treasury to go further.

Some firms lobbied for halving the allowance or scrapping limits on cash ISAs altogether.

LATEST DEVELOPMENTS

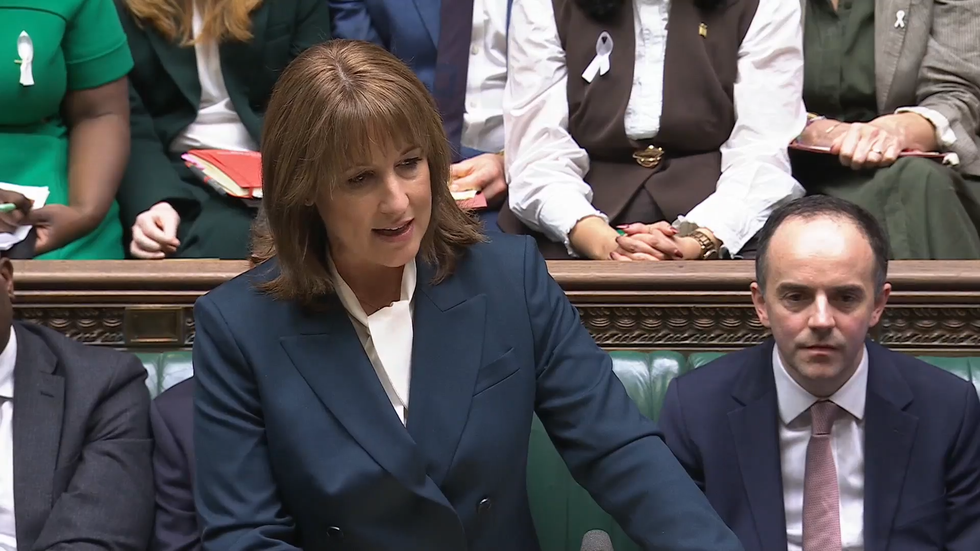

The Chancellor delivered her speech earlier today

|POOL

The measure is expected to increase revenue while encouraging greater use of tax-efficient accounts.

Harriet Guevara, Chief Savings Officer at Nottingham Building Society, said: “The decision to slash the annual Cash ISA allowance from April 2027 is a sucker punch for savers and deeply disappointing for lenders.

"We support the Government’s aim to boost an investing culture in the UK, but restricting choice is not the way to do it.

“At a time when financial confidence is already fragile, cutting the allowance sends a difficult message to households who are trying to do the right thing.

“Millions of savers rely on Cash ISAs as a low-risk way to build financial stability. Two thirds of our Cash ISA customers have used the full £20,000 allowance so far this year.

"These aren’t people with excess wealth - they’re individuals and families working hard to save for the future.

“What’s more, only 38 per cent of Cash ISA holders nationwide would consider switching to a Stocks and Shares ISA if the allowance is cut."

Martin Lewis said he would've preferred a 'carrot not stick approach'

| gbnewsMoneySavingExpert Martin Lewis said: "The stated aim was not to raise revenue but to encourage young people to invest rather than save - both for the economy but also because on average it outperforms.

"When I met Chancellor on this a few weeks ago, I pointed out that a blanket cut to the limit would be perverse, to cut cash ISA limits to older people to encourage younger to invest wouldn't work.

"So the carve out for over 65s makes total sense and I'm pleased she listened.

"What needs to happen along with this is better investment education, easier access to guidance, and better investment incentives for young people."

Royal London’s consumer finance expert, Sarah Pennells, said: “The chancellor’s confirmation that the cash ISA limit will fall to £12,000 from April 2027 won’t affect the majority of ISA savers. Our research shows that only 16% of ISA holders save or invest the maximum £20,000 annual allowance.

“The fact that the full £20,000 cash ISA allowance is being retained for those over the age of 65 will be welcome by those pensioners who rely on cash savings to boost their retirement income, but who don’t necessarily want to invest.”

She continued: “The FCA has estimated that there are 8.6 million people with £10,000 or more in cash savings that could be invested.

"Our research shows that six in 10 people with money in cash ISAs could be persuaded to invest in a stocks and shares ISA.

“However, it also shows that concern among consumers that they don’t have enough money to invest, and a lack of understanding of investing, are among the main barriers.

"Reducing the cash ISA limit will do nothing to address this.”