Economy alert: GDP growth DOWNGRADED in OBR's assessment of Rachel Reeves's Budget

Shocking moment Rachel Reeves discovers OBR Budget leak ahead of statement

|GB NEWS

The OBR has updated its assessment of the UK economy following the Chancellor's fiscal statement

Don't Miss

Most Read

Latest

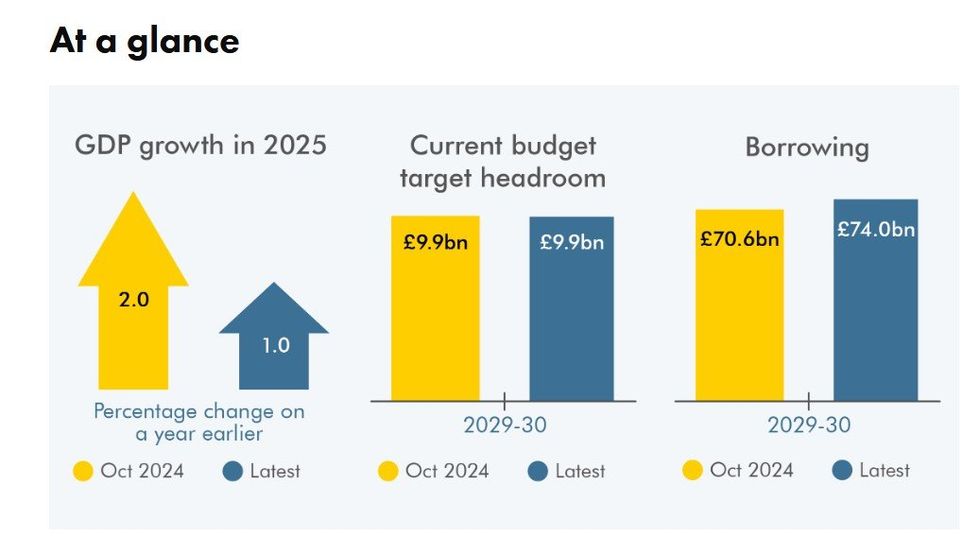

The Office for Budget Responsibility (OBR) has downgraded its growth forecasts for the UK economy in a post-Budget blow to Chancellor Rachel Reeves.

After Ms Reeves's fiscal statement this afternoon, the fiscal watchdog shared its updated forecast for gross domestic product (GDP) growth which has been central to the Labour Government's vision since returning to Number 10 Downing Street last year.

Based on the OBR's projections, Britain's GDP will ease to 1.5 per cent, 0.3 per cent less than previously forecast in March.

Furthermore, the fiscal watchdog for Government spending estimates there remains a £20billion black hole in the public finances which the Chancellor hopes to address with her announcements today.

The OBR has given its assessment of the UK economy post-Budget

|PA

Confirmation of the GDP figures came after the OBR published it assessment earlier than expected before the Budget

In a slight win for the Treasury, the Chancellor appears to have secured £22billion in extra fiscal headroom with her fiscal policies.

Based on the watchdog's report, the Chancellor's Budget will raise taxes by £26billion, with the tax take hitting 'an all-time high of 38 per cent of GDP in 2030-31.

Speaking to the House of Commons, Ms Reeves said: "borrowing will fall as a share of GDP in every year of this forecast” and the amount of headroom against the Government’s targets will double to £21.7billion, "meeting our stability rule and meeting it a year early".

In March, the OBR provided its previous forecasts for GDP growth in the UK

|OBR

She insisted forecasts were "the Tories’ legacy not Britain’s destiny” after the OBR lowered its expectations for productivity growth by 0.3 percentage points from its initial assessment in March.

In the OBR's assessment, the fiscal watchdog stated: "This means that total growth in nominal GDP over the forecast is only around one percentage point lower than in March and is more tax rich, thanks to a larger share accruing to labour income and consumption.

"This, combined with frozen personal tax thresholds, boosts pre-measures tax receipts by amounts rising to £16billion by 2029-30 relative to our March forecast.

"But premeasures spending is also higher in every year and by £22billion in 2029-30 due to higher spending by local authorities and on welfare and debt interest.

LATEST DEVELOPMENTS

"The net result is a modest medium-term deterioration in the pre-measures fiscal outlook, with borrowing £17billion higher this year but only £6billion higher in 2029-30 compared to our March forecast."

Notably, borrowing is projected to fall from 4.5 per cent of GDP in 2025-26 to 1.9 per cent of GDP in 2030-31 with debt rising as a share of GDP from 95 per cent of GDP this year and ending the decade at 96 per cent of GDP, which is two percentage points higher than projected in March.

Concerningly, this is twice the debt level of the average advanced economy. The current balance target is met in 2029-30 with a margin that fell from £10billion in the March forecast, to £4billion in the pre-measures forecast, but is then boosted to £22billion by Budget policies.

Matthew Allen, a lecturer in Economics at the University of Salford, shared: "This leaked Budget makes the Government’s direction unmistakable.

"Targeted support where politically unavoidable, broad-based tax rises where economically necessary, and a heavy reliance on fiscal drag to stabilise the public finances.

"The prescription charges which has been announced to be frozen, along with rail fares, will be welcome news for many but these tax rises will be felt by many.

"The accidental early release is embarrassing, but the policies themselves will shape UK households, businesses, and the wider economy for years to come. Despite promising to put more money into people’s pockets there is the effect of ‘giving with one hand, take with the other."

More From GB News