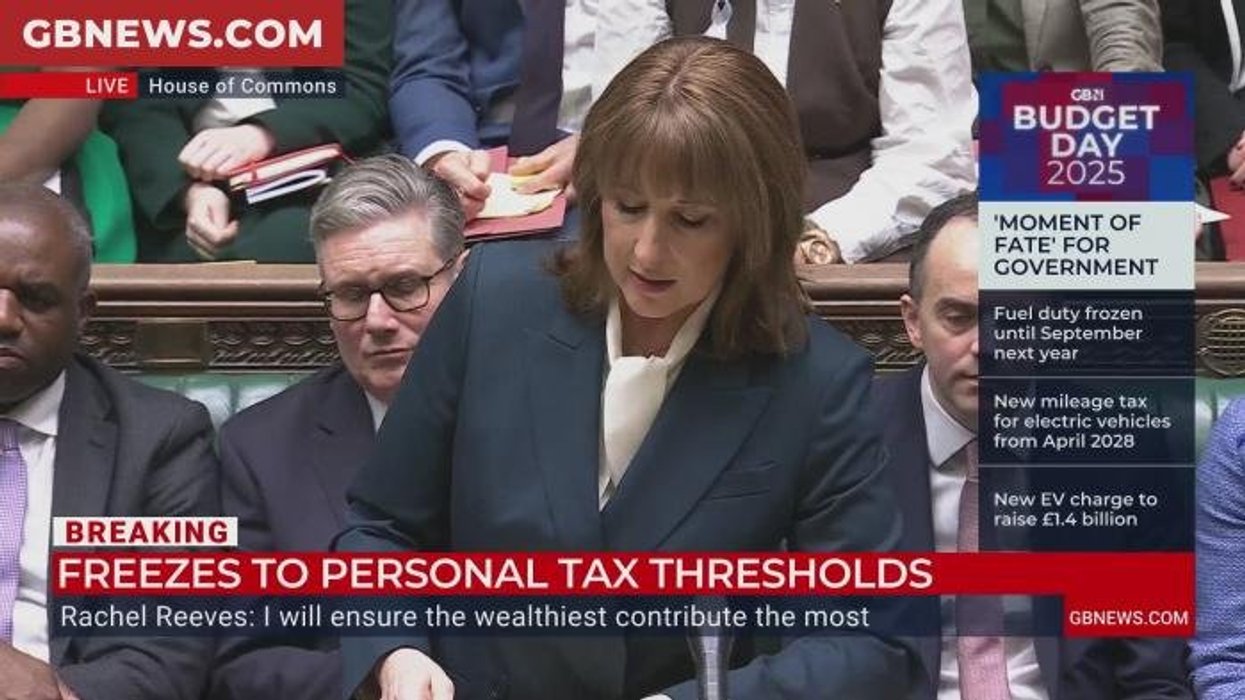

'Mansion tax' confirmed as thousands of high-value homes face council tax surcharge

Chancellor Rachel Reeves introduces a high-value council tax surcharge in England |

GETTY

The measure is forecast to generate £0.4billion in the 2029-30 financial year

Don't Miss

Most Read

Rachel Reeves has announced a high-value council tax surcharge on homes worth more than £2million.

In the Autumn Budget, she explained the measure is forecast to generate £400million by 2031.

The surcharge is expected to apply to the top end of the housing market and will sit on top of existing council tax bills.

This effectively increases charges for owners of high-value properties rather than creating a standalone tax.

The Chancellor said: "I will take further steps to deal with wealth inequality in our country.

"A Band D home in Darlington or Blackpool pays just under £4,200 in council tax. Nearly 300 more than a £10million mansion in Mayfair.

"From 2028, I am introducing the high-value council tax surcharge in England and an annual £2,500 for properties worth more than £2million, rising to £7,500 for properties worth more than £5million.

"This will be collected alongside council tax levied."

Council tax burden in northern cities is triple that of London, fresh data reveals | GETTY

Council tax burden in northern cities is triple that of London, fresh data reveals | GETTYTRENDING

Stories

Videos

Your Say

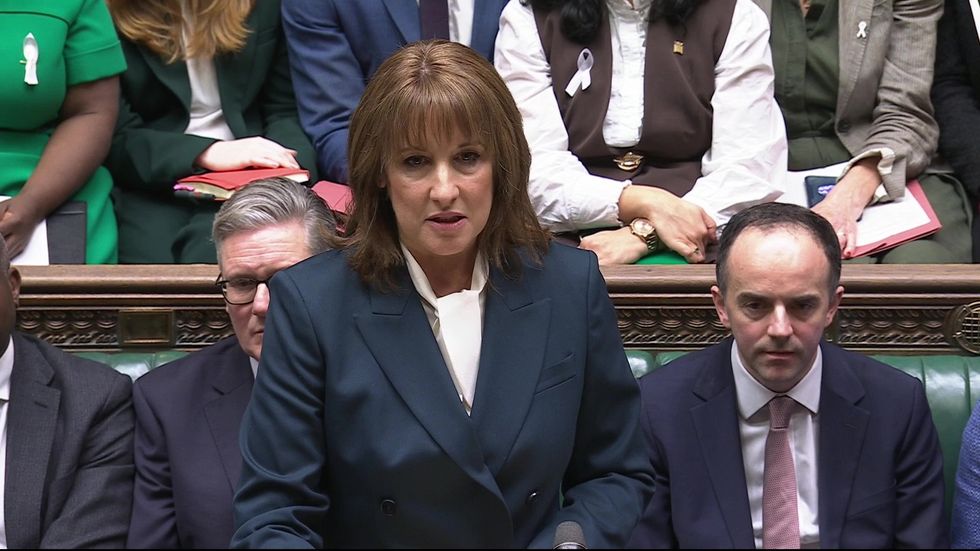

Elliot Castle, CEO of leading homebuying service We Buy Any Home, said: “This new levy on properties in the top three council tax bands - F, G and H - will impact more than 100,000 homeowners.

“Given that more than 60 per cent of homes valued at £2million or more are in London, there’s no doubt that people in the capital and South East England will feel like they’re bearing the brunt of the Treasury’s decisions today.

“We expect this could put off some buyers at the top end of the market and others will be rushing to devalue their homes in a bid to avoid this tax altogether.

“The hope is that these changes will be phased in gradually, once a full and fair reevaluation has been made of the outdated council tax bands, so the market isn’t shocked overnight.

'Mansion tax' confirmed

|PA

“We have seen a massive stagnation in the property market over the past few months in the run-up to this Budget. A strong market needs confidence and at the moment homeowners are anxious and unsure. Hopefully this clarity will mean people can make informed decisions and the property market can get moving again.”

Speculation over the changes has stifled sales in the lead-up to the announcement, with research by We Buy Any Home finding one in five homeowners have put their plans to sell on ice over fears of potential tax changes by Rachel Reeves.

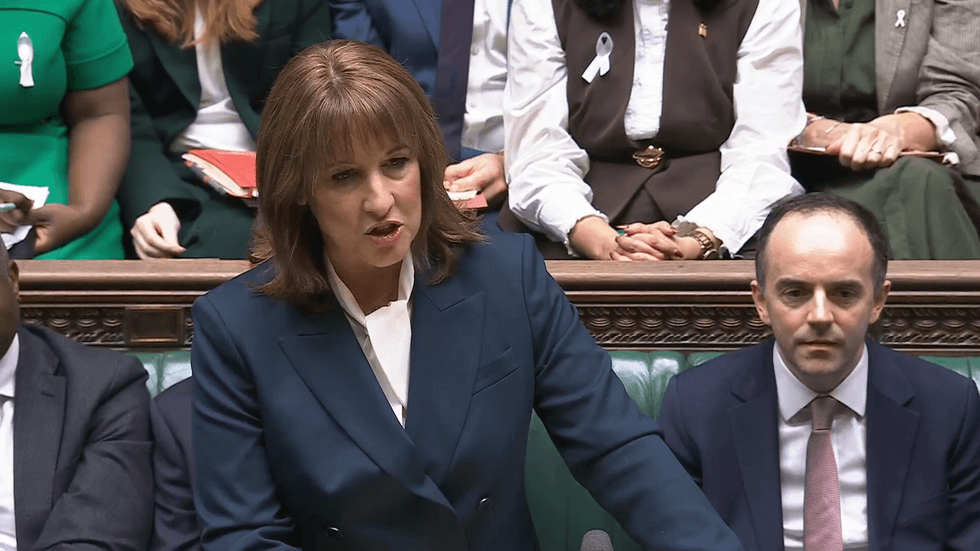

Rob Hillock, Head of Personal Financial Planning at leading independent financial services consultancy Broadstone said: “The Chancellor’s introduction of a ‘Mansion Tax’ on houses valued above £2million will likely prompt many homeowners to get an up-to-date valuation of their property wealth.

“It has the potential to create market distortions as homeowners look to reduce the value of their home to avoid additional tax or prompt some to downsize to smaller, cheaper homes.

The Mansion Tax’ on houses valued above £2million will likely prompt many homeowners to get an up-to-date valuation of their property wealth.

|PA

The tax is said to affect the top 1% of homes

| GETTY/PA"The OBR notes in its comments that the reform could see price bunching below each of the four new price bands as homeowners look to minimise their tax liability.”

Glen Thomas, partner at MHA, comments: "As a huge shake up of the taxation of homes, the long expected ‘mansion tax’ was announced this afternoon.

"There are worries that such a move may depress the residential property market and unfairly disadvantage those who were able to acquire their home many years ago. It is envisaged that those who are asset rich may struggle to pay the new annual surcharge which could be as much as £7,500 in respect of homes that are in excess of £5million or more.

"The OBR is concerned that such a measure, whilst expected to raise £0.4 Billion, will contribute to reduction in the yield from other property taxes including SDLT and CGT as a result of behavioural changes."

More From GB News