Budget 2025: Stealth tax raid from Rachel Reeves CONFIRMED as income tax thresholds to remain frozen until 2030

Chancellor Rachel Reeves announces Labour will freeze income tax thresholds and equivalent National Insurance thresholds at their current level until 2031 |

GB NEWS

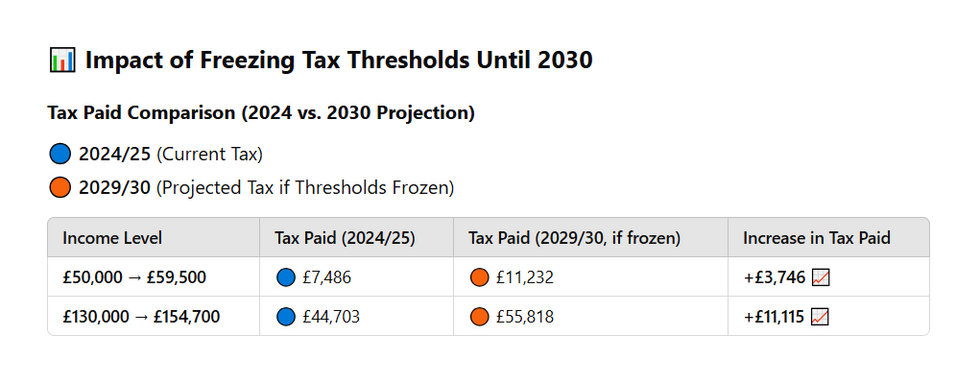

Working Britons could pay £4,000 more a year to the tax man with the threshold freeze

Don't Miss

Most Read

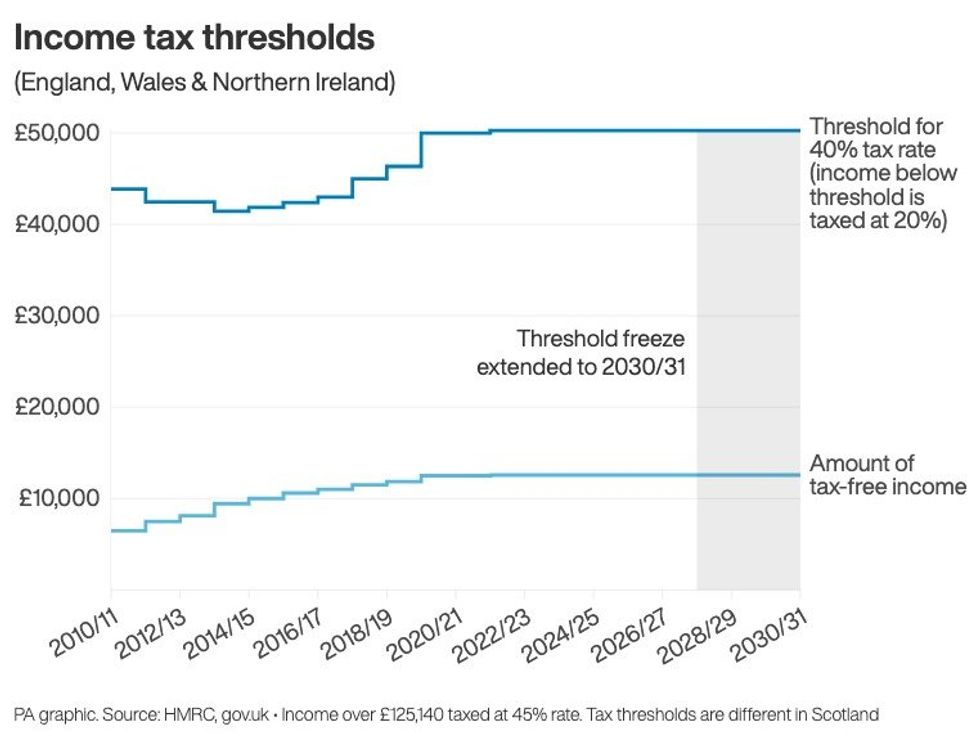

Chancellor Rachel Reeves will keep tax thresholds frozen until at least 2030 in a move considered a stealth tax raid by many economists, according to the leaked assessment of her statement from the Office for Budget Responsibility (OBR).

The existing freezes to personal tax thresholds for another three years until 2030-31 in a move which is projected to generate around £8billion in savings for the Treasury's coffers.

Introduced by former Conservative Chancellor Jeremy Hunt, income tax and National Insurance thresholds for working Britons have been at the same level since 2021.

Based on the OBR's report, said the freeze in tax thresholds would result in 780,000 more basic-rate, 920,000 more higher-rate and 4,000 more additional-rate income tax payers in 2029/30.

The Chancellor has confirmed tax thresholds will remain frozen

| PAMs Reeves acknowledged the freeze in tax thresholds would hit “working people” – the group Labour had promised to protect – but she was “asking everyone to make a contribution”.

“I can keep that contribution as low as possible because I will make further reforms to our tax system today to make it fairer and to ensure the wealthiest contribute the most,” she said.

Analysts have noted this results in millions paying more to HM Revenue and Customs (HMRC) due to the impact of fiscal drag, which occurs when incomes or inflation rise during a period of time when tax thresholds remain frozen.

As a result, workers are pulled into higher tax brackets with today's announcement likely to place a disproportionate burden on middle-class earners making around £50,000.

LATEST DEVELOPMENTS

Analysis by Rathbones claims higher earners could pay over £4,000 more tax a year without any significant boost to their purchasing power with income tax threshold freeze continuing until 2030.

The firm's analysis claimed the tax burden would be £1,766 for someone who was on £80,000, £1,438 for those who earned £50,000, and £353 for those on £35,000.

Reacting to the news, Frances Li, founder and director of Biscuit Recruitment, said: "Tax rates haven’t risen, but many people will be paying more tax than ever.

"The threshold freeze has already acted as an invisible pay cut, and now that it’s been extended to 2030, it could discourage more workers from moving jobs or seeking promotion.

What could frozen tax thresholds mean for you? | GBN

What could frozen tax thresholds mean for you? | GBN"Fiscal drag doesn’t just affect individuals — it affects the economy. When people delay promotions or stay in roles longer than planned, employers struggle to hire, sectors struggle to grow, and innovation slows.

"Skilled candidates are becoming more hesitant, and that’s creating friction across the talent pipeline."

"We’re hearing more professionals ask: What’s the point of progressing if most of it goes to tax? That hesitation is becoming common, especially among skilled workers approaching the next tax bracket."

Matthew Parden, CEO of budgeting app Marygold & Co, added: "This could quietly push many households into higher effective tax rates as wages rise.That shift makes careful monthly budgeting even more important. Understanding real take-home pay after tax and inflation helps people stay ahead of any change."

Income tax threshold freeze impact

|PA

Grant Slade, UK Economist at Morningstar, shared: "The Autumn budget’s fiscal consolidation efforts focus on further freezes to income tax threshold indexation and a range of other, smaller receipt raising measures.

"Encouragingly, Reeves’ greater tax haul - and an improved set of economic forecasts from the OBR - delivers improved fiscal headroom, estimated at £22billion relative to her self-imposed fiscal rule to balance the current budget by fiscal year 2029/30. Still, this has been achieved via a combination of tax measures that are largely backloaded.

"Consequently, the gilt market was largely unimpressed by the Chancellor’s widened fiscal wiggle room, with gilt yields remaining above levels in recent weeks when broad-based hike to income taxes were expected.

"Hikes to the headline income tax rates would have been a preferred outcome for gilt markets since they are front-loaded and signalled a more aggressive approach to debt consolidation."

More From GB News