State pension overhaul from Rachel Reeves as thousands to lose access to full payments in Budget shock

Chancellor Rachel Reeves announces £2,000 salary sacrifice pension cap

|GB NEWS

The Chancellor has announced changes to state pension eligibility for people 'living abroad'

Don't Miss

Most Read

Chancellor Rachel Reeves has confirmed an overhaul to the state pension regime with thousands of retirees living abroad will be expected to pay more to access full payment entitlement.

In her Budget statement, the Chancellor unveiled plans to abolish voluntary class 2 National Insurance contributions for people living abroad.

Thanks to this contribution scheme, Britons who are self-employed are able pay for National Insurance credits in order to qualify for their full, new state pension entitlement.

As well as this, Ms Reeves announced an increase in the number of years someone has to have lived in the UK to claim a pension.

The Chancellor has unveiled an overhaul to state pension rules for people 'living abroad'

|GETY

However, people only in receipt of the basic or new state pension will only have to pay small amounts of income tax if their earnings cross the tax-free threshold.

Analysts have warned that state pensioners were increasingly at risk of paying tax on their payments alone due to the impact of fiscal drag, which occurs when thresholds are frozen during a time when incomes are rising.

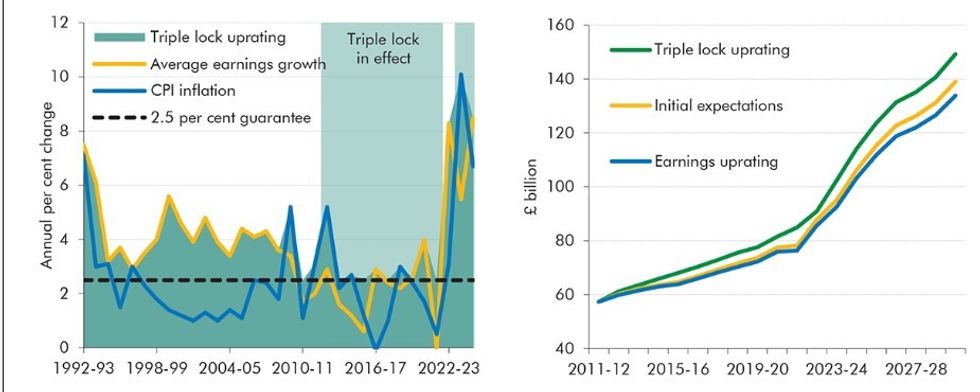

Due to the triple lock, which guarantees an annual payment rate hike of at least 2.5 per cent, pension payments have been a year or two away from crossing the £12,570 threshold.

Speaking to the House of Commons, the Chancellor said; "Today I will maintain all income Tax and equivalent National Insurance thresholds at their current level for three further years from 2030, while ensuring that people only in receipt of the basic or new state pension do not have to pay small amounts of tax through Simple Assessment from April 2027.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR "And taxpayers’ money should not be spent on pensions for people abroad… …who only lived here for a couple of years and may never have paid a penny of tax. The Conservatives let thousands of people living abroad buy their way into the state pension for £3.50 a week… …debasing the purpose of our pension system"

As well as this, the Chancellor recommitted to the state pension triple lock with payment rates set to soar next April by 4.5 per cent.

Around 4.1 million people on the full, new state pension will benefit with more than £550 a year more while the 8.8 million people on the basic pension equivalent will receive £440 a year more.

Yesterday, the Chancellor said: "Whether it's our commitment to the triple lock or to rebuilding our NHS to cut waiting lists, we're supporting pensioners to give them the security in retirement they deserve."

Despite the Department for Work and Pensions (DWP) reopening the case of compensation for women born in the 1950s impacted by historic changes to the state pension age, the Chancellor did not confirm any payout for those affected.

The Women Against State Pension Inequality (Waspi) campaign shared their disappointment with Ms Reeves after she finished her statement to MPS.

Angela Madden, chair of the WASPI Campaign said: "Another year. Another Budget. And another let down for WASPI women. The Government has had to admit defeat on a key part of the legal challenge against them, conceding their decision not to compensate 1950s-born women was incorrect.

"They cannot continue to stick their heads in the sand on this in perpetuity. Today must be the last fiscal event at which justice for the appalling treatment of WASPI women is left - again - on the backburner."

LATEST DEVELOPMENTS

Steven Cameron, pensions director at Aegon, added: "State pensioners will be relieved to hear this week that the state pension triple lock is being honoured in full, leading to a 4.8 per cent ncrease which is above inflation.

"However, the sting in the tail is that by 2027/28, the full new state pension will exceed the personal allowance which has today been frozen until 2031, leading to even those relying solely on the full new state pension for retirement income facing a tax liability. This liability will grow in future years and if the triple lock led to the same increases from now till 2031, it could grow to over £500.

"The Chancellor has offered some assurances by saying pensioners won’t have the admin burden of completing simple assessment tax returns. However, importantly, this is not the same as waiving the tax. The Government is to look into alternative approaches to dealing with the tax charges. It’s important that this made as easy and stress-free as possible for pensioners.

"While state pensioners may not face tax bills through the letterbox, many of those solely reliant on the state pension will in future pay tax on some of this – a case of the Government giving with one hand and taking with the other."