Best savings accounts of the week: Savers urged to ‘carefully consider’ interest rates of up to 5.28%

Savings interest rates continue to be relatively high and experts have been highlighting some competitive accounts from challenger banks

Don't Miss

Most Read

Latest

Savers are being encouraged to “carefully consider” the top accounts on the market which are offering competitive interest rates of up to 5.28 per cent.

Experts from Moneyfactscompare have compiled a list of the best savings accounts on sale for the week beginning March 4, 2024.

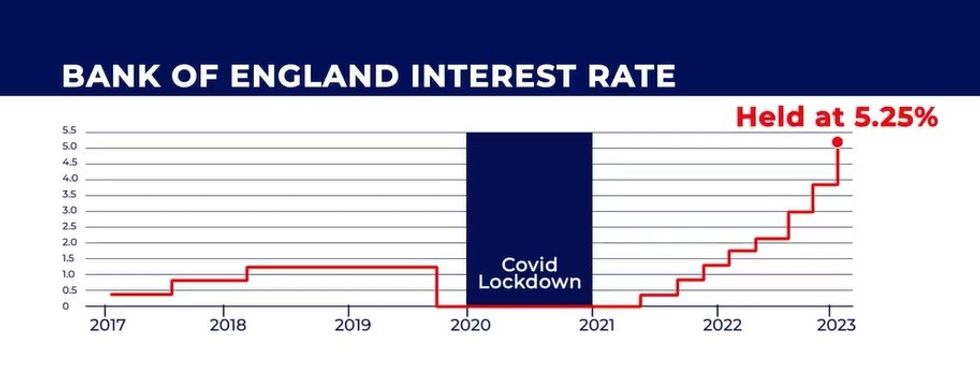

Savings interest rates have remained high over the past year following the Bank of England’s decision to raise the base rate to 5.25 per cent.

With the central bank expected to cut rates later this year, Britons are looking to lock down the best deals before its too late.

Here is a full list of the best savings accounts, alongside their corresponding interest rates, currently on offer, according to Moneyfacts:

- SmartSave – One Year Fixed Rate Saver: pays an interest rate of 5.28 per cent

- Moneybox – Moneybox Cash ISA: pays an interest rate of 5.11 per cent

- Castle Trust Bank – Fixed Rate e-Cash ISA: pays an interest rate of 5.05 per cent

- Close Brothers Savings – Two Year Fixed Rate Cash ISA: pays an interest rate of 4.70 per cent

- Hampshire Trust Bank – 5 Year Bond (Issue 36): pays an interest rate of 4.54 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers are looking for the best high interest rate deal

|GETTY

SmartSave’s offering has a minimum opening amount of £10,000 with a maximum investment sum of £85,000.

Account holders need to be at least 18 years old and can manage their finances their online through the bank’s website.

Caitlyn Eastell, a spokesperson for Moneyfactscompare, said: “It is important to note that early access is not permitted, so careful planning may be required.

“On a more positive note, savers may be glad to see that they can make further additions for 14 days from account opening.”

Notably, MoneyBox’s Cash ISA includes a 0.96 per cent interest rate bonus for the first 12 months of the account’s opening.

The minimum opening amount is £500 with a lower rate being paid on the account if more than three withdrawals are made per year.

For savers looking to take advantage of their full ISA allowance of £20,000, Moneyfacts highlighted the account from Castle Trust Bank.

Ms Eastell added: “Investors must have a minimum of £1,000 to open the account and it accepts transfers in from both Cash and Stocks and Shares ISAs.

“This deal permits early access on account closure, subject to a 90-day loss of interest penalty which should be noted.”

While Close Brothers Savings’ ISA was mentioned by Moneyfacts, the finance experts reminded the public this product is ideal for savers depending on their situation.

“Savers who do not mind locking away their cash for the longer-term may find this an appealing option if they wish to receive a guaranteed return,” Ms Eastell added:

“However, savers will need to carefully consider if they wish to get earlier access to their funds because this will be subject to account closure and 150 days’ loss of interest.”

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent | GB NEWS

The Bank of England has held the base rate at 5.25 per cent | GB NEWSBased on figures from Moneyfacts, the average one-year fixed savings rate today is 4.58 per cent which is down from 4.60 per cent as of yesterday.

Furthermore, the average one-year fixed cash ISA has fallen from 4.50 per cent to 4.49 per cent over the same period, while the average easy access ISA is at 3.35 per cent from 3.36 per cent.

However, the average easy access savings rate today is 3.17 per cent which is unchanged from the previous working day.

The Bank of England's Monetary Policy Committee (MPC) will next make an announcement regarding the base rate on March 21, 2024.