Benefit cheats face 'crackdown' under Labour as Rachel Reeves vows to 'root out' unlawful claims

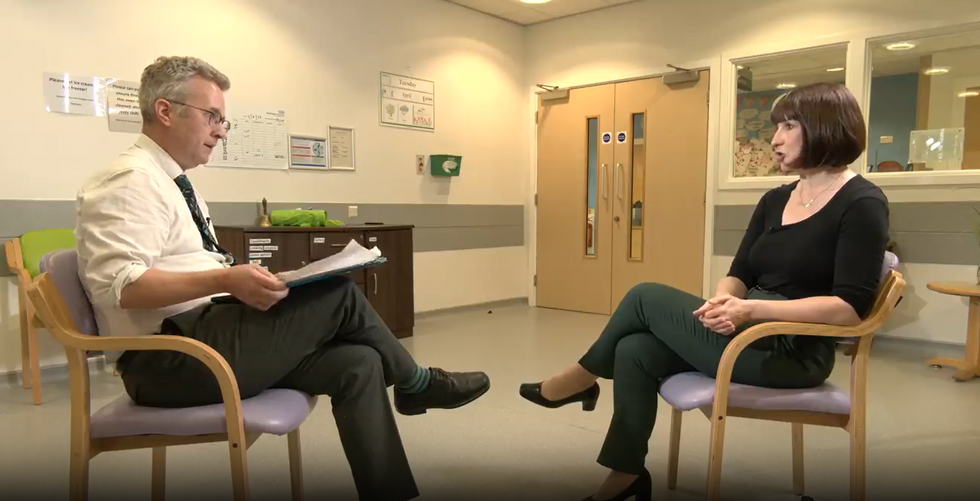

Watch: GB News' Christopher Hope speaks to Rachel Reeves

|GB News

The Shadow Chancellor's pledge to stamp out 'fraud, avoidance, evasion, wherever it exists' comes alongside a litany of proposed Labour measures to tighten the 'tax gap'

With additional reporting by Christopher Hope

Don't Miss

Most Read

Latest

Labour will "crack down" on benefit cheats if it wins the next General Election, Shadow Chancellor Rachel Reeves has vowed following the party's pledge this morning to close a number of tax "loopholes" to boost spending.

Speaking to GB News, Reeves stressed the importance of stamping out a range of fraudulent tax practices in order to tighten the "tax gap" - the difference between the money HM Revenue and Customs (HMRC) is owed and the revenue it actually receives.

She told GB News' Political Editor Christopher Hope today: "It is important that we crack down on fraud, avoidance, evasion, wherever it exists.

"I think it's really important that we root out wherever it exists - whether that is in the benefits system - because I want money to go to people that really need it."

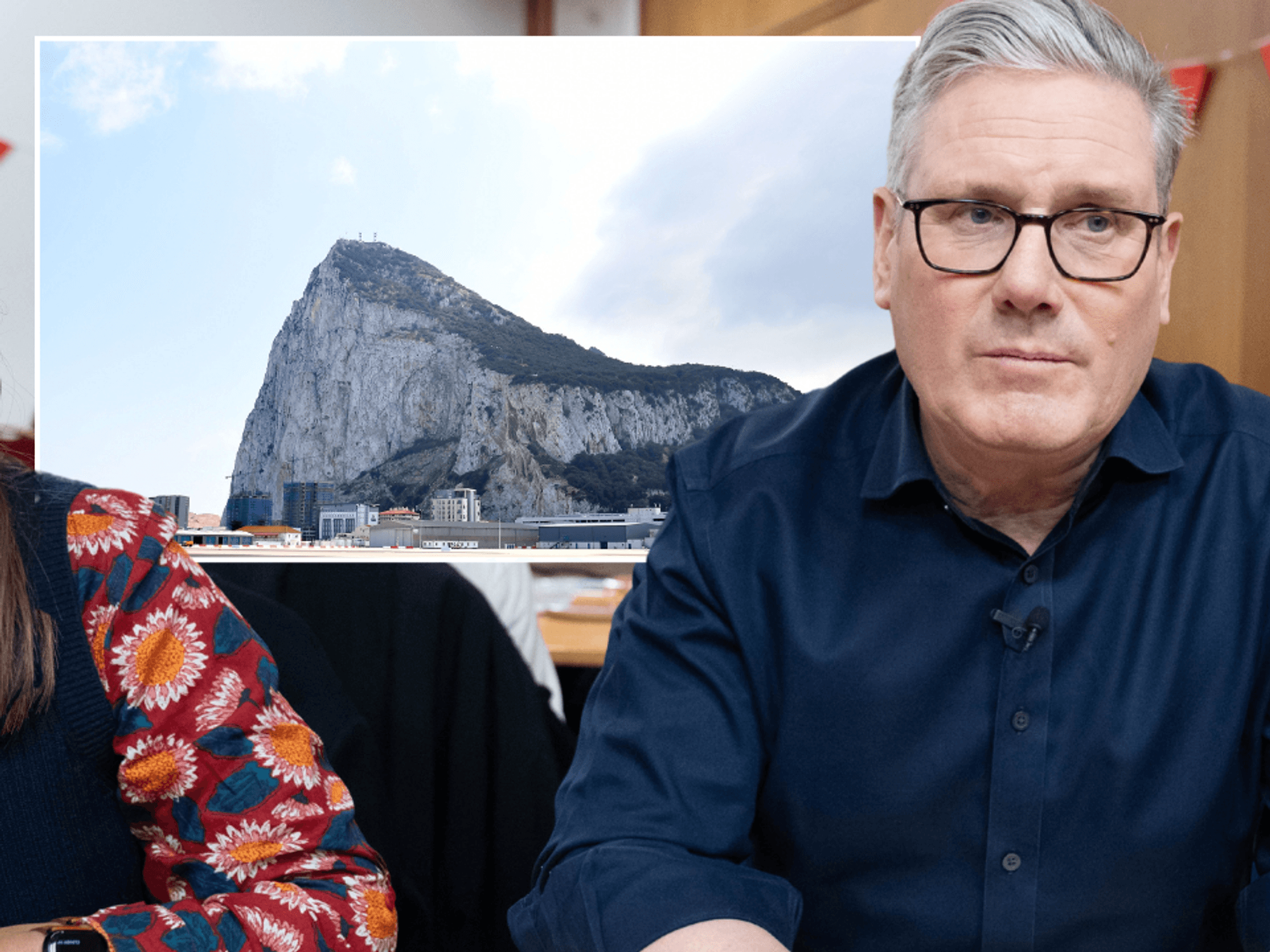

Reeves stressed the importance of stamping out a range of fraudulent tax practices to GB News' Christopher Hope today

|GB News

Reeves also blamed HMRC's phone-line failures - 841,000 calls were dropped this January alone - for contributing to the gap, which she said had increased by £5billion in the last year.

She told GB News: "At the moment, if you try and phone up HMRC, if you've got a tax query, you're lucky - very lucky - if someone answers the phone.

"And as a result, there are simple errors being made when people are submitting their taxes; similarly, there's no requirement that tax schemes are registered with HMRC to establish whether they are legal or not.

"So you will have some people who are doing things that they think are okay, but they're not - and a simple answer to a simple question can often mean the right amount of tax is paid.

MORE LIKE THIS:

Labour will "crack down" on benefit cheats if it wins the next General Election, Shadow Chancellor Rachel Reeves told GB News | GB News

Labour will "crack down" on benefit cheats if it wins the next General Election, Shadow Chancellor Rachel Reeves told GB News | GB News"But at the moment, that tax gap went up £5billion in the last year alone - I want that money to be coming into HMRC to fund our frontline public service."

Reeves later added that if a Labour Government managed to close the gap, £2billion of the £5billion raised would fund investments in the NHS and UK schools.

The Shadow Chancellor had told the BBC earlier today that closing the tax gap was not "rocket science" and cited previous Governments' successes in doing just that.

She also said a Labour Government would move "pretty quickly" to "ramp up" the number of HMRC staff.

In her interview with GB News, Reeves also called on people who live in Britain to pay their "fair share" of tax to contribute to the country's public services.

The Shadow Chancellor took aim at "non-doms" - UK residents whose home for tax purposes is outside the country - and vowed to change existing rules to ensure they paid their "fair share".

She said: "Britain is a brilliant place to live and work and that's why so many people want to come here to live and work - but if you choose to come to Britain, you should contribute to public services in the same way that everyone else does.

"Whether it's paying for our army and our armed forces, whether it's paying for the police on our streets, or in this case, paying for our NHS and our schools - if you make Britain your home you should pay your taxes."