State pension boost for 13 million Britons confirmed by Rachel Reeves before Budget: 'We support pensioners!'

Finance expert discusses the controversy of the pension triple lock.mp4 |

GB NEWS

The state pension triple lock guarantees payment rates rise by at least 2.5 per cent every year

Don't Miss

Most Read

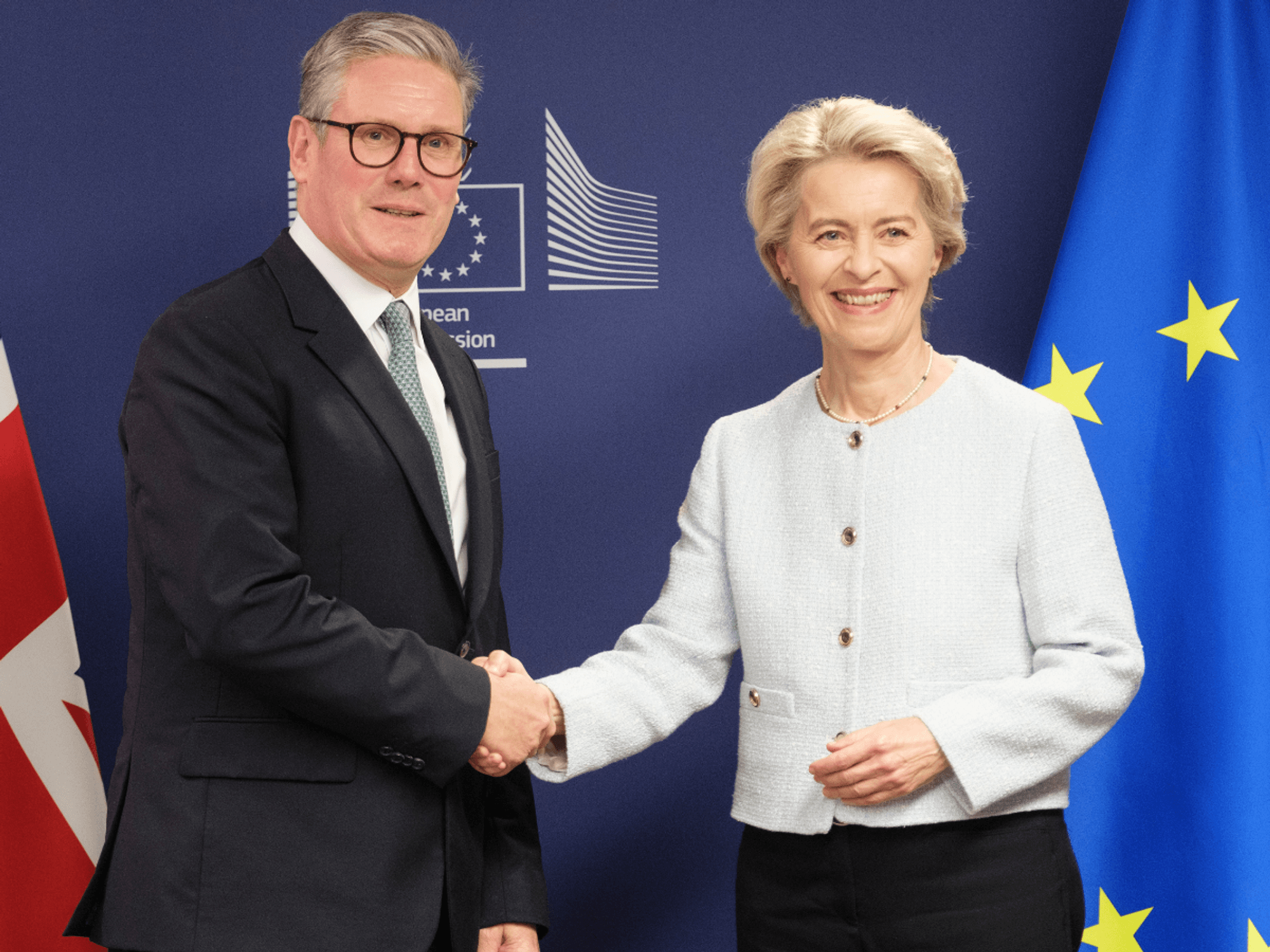

Chancellor Rachel Reeves is set to confirm a boost to state pension payments for 13 million retirees during her Budget statement this week on November 26.

This above-inflation payment hike will come into effect from April 2026 with recipients of the full, new state pension to be awarded with around £550 a year.

Thanks to the triple lock, state pension payment rates are guaranteed to rise annually in line with either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

Ahead of her fiscal statement, the Chancellor said: "Whether it's our commitment to the triple lock or to rebuilding our NHS to cut waiting lists we’re supporting pensioners to give them the security in retirement they deserve.

Rachel Reeves has committed to the state pension triple lock

|GETTY / PA

"At the Budget this week I will set out how we will take the fair choices to deliver on the country's priorities to cut NHS waiting lists, cut national debt, and cut the cost of living."

Ms Reeves acknowledged that inflation-hiked prices have "hit ordinary families most" and the British economy "feels stuck" for millions of households.

While pensioners are set to be awarded with a benefit boost in the Budget, reports suggest working-age Britons could be in line for a retirement savings hit from the Chancellor.

It is understood the Treasury is floating limiting how much workers can put in their pension pots under salary sacrifice schemes before paying National Insurance.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR How much will the state pension be?

This year payments will increase in line with average earnings growth for between May to July 2025, which came to an above-inflation rate of 4.8 per cent.

As such, the current full rate will rise from £230.25 per week to £241.30 over the same period. This means the full, new state pension will come to £12,547.60 per year.

Those on the basic state pension, which is for those who reached retirement age before April 2016, will see their payments jump from £176.45 per week to £184.90 weekly.

Basic state pension claimants, who have 35 years of National Insurance contributions under their belt and qualify for the full amount, will get £9,614.80 annually.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR Ahead of the Budget statement, Steve Cameron, pensions director at Aegon, said: "The Chancellor has continually emphasised she wants to support ‘working people’.

"And as the state pension is ‘pay as you go’ rather than funded, it’s today’s workers through taxes and National Insurance who pay for today’s state pensions.

"Every one per cent increase in the state pension costs around £1.1billion a year for all future years.

"While today’s pensioners are yesterday’s working people, if the Government decides to prioritise support for those currently working, could that mean a scaled back triple lock from next April?"

LATEST DEVELOPMENTS

Analysts have warned the full, new state pension will be "dangerously close" to being liable for tax due to the impact of frozen thresholds and fiscal drag.

Kindar Brown, a senior financial planner at Rathbones, explained: "Under the state pension triple lock, payments are set to rise by 4.8 per cent from April 2026, reflecting the May-July wage growth figure, which was the highest of the three triple-lock measures.

"This means the new state pension will sit just £22 below the frozen personal allowance, which currently sits at £12,570.

"However, with a multibillion-pound fiscal black hole to fill and a ballooning welfare bill, the Chancellor may yet reconsider the generosity of the triple lock."

More From GB News