State pension triple lock declared 'unsustainable' as Labour urged to tackle payment increases

IEA's Tom Clougherty discusses the controversy of the state pension triple lock.mp4

|GB NEWS

A leading think tank has suggested a new model to the existing state pension triple lock

Don't Miss

Most Read

The state pension triple lock has been declared "unsustainable and needs "fixed to save it" with analysts urging the Labour Government to introduce reform and make significant savings as part of the upcoming Budget.

Ezra Cohen and Matthew Stubbs, researchers from the Centre for British Progress, claim an alternative mechanism for raising state pension every year could save the Treasury £6.2billion by 2030; rising to £35billion in savings by 2045.

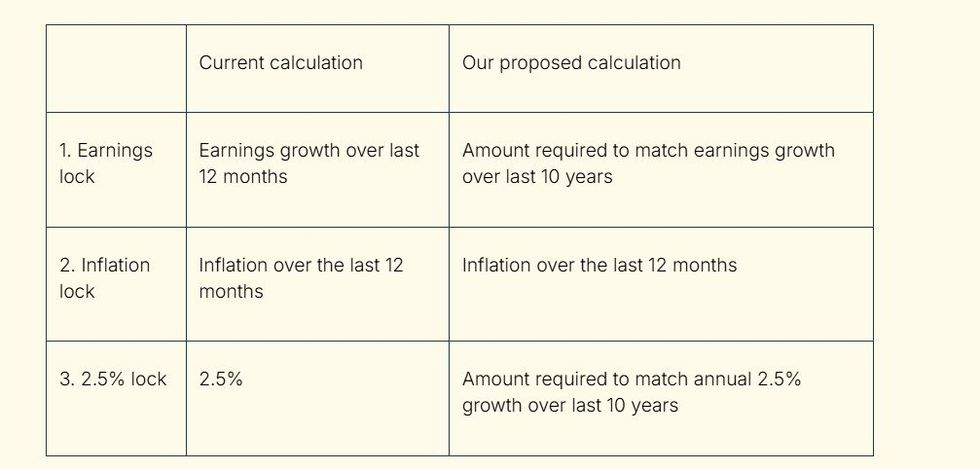

Thanks to the triple lock, state pension payment rates increase annually by either the rate of consumer price index (CPI) inflation, average wage growth or 2.5 per cent; whichever is highest.

However, the Office for Budget Responsibility (OBR has identified the pension guarantee as a "large financial risk" to Britain's economy, finding annual costs have soared to £15.5billion compared to initial projections of £5 billion when the Coalition government introduced the measure in 2010.

The state pension has been declared "unsustainable" and needs "fixed", a think tank claims

|GETTY / CENTRE FOR BRITISH PROGRESS

The watchdog's latest Financial risks and sustainability report highlights how Britain's public finances remain in a "relatively vulnerable position" following repeated government decisions to abandon spending consolidation plans.

This pattern has resulted in a "substantial erosion of UK's capacity to respond to future shocks", according to the OBR's assessment. The OBR's analysis reveals the triple lock will drive state spending upwards by 1.6 percentage points of GDP across the next five decades.

As such, the increase represents £46billion in today's terms, matching the combined annual expenditure on waste management, prisons, local roads and transport, school infrastructure investment, fire services, medical research and street lighting.

Pension costs have climbed steadily from two per cent of gross domestic product (GDP) during the 1950s to approximately five per cent today. The watchdog projects this figure will reach 7.5 per cent of Britain's total economic output within fifty years if the current mechanism remains unchanged.

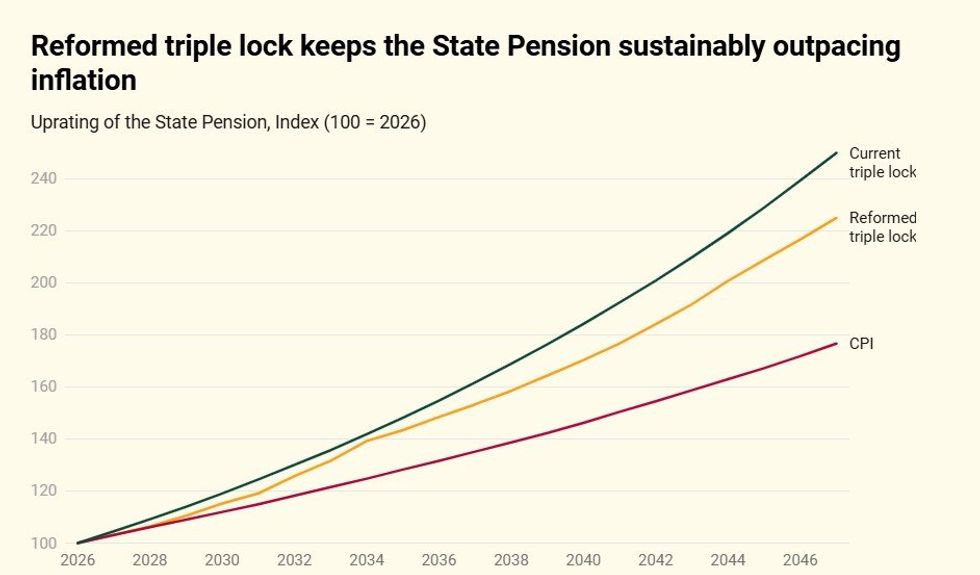

The reformed triple lock could save the Government billions

|CENTRE FOR BRITISH PROGRESS

A new report from the Centre for British Progress has pinpointed critical defects in the triple lock mechanism that threaten its long-term viability. Researchers Ezra Cohen and Matthew Stubs argue the current formula contains "fundamental flaws" that create unsustainable financial anomalies.

The researchers explain that the system "double counts" price increases through a problematic sequence. When inflation surges in one year, it typically drives wage growth the following year, resulting in pensioners benefiting from the same economic pressure twice.

"It is guaranteed to 'double count' price increases, because a spike in inflation one year is typically reflected in an increase in wages the next, an increase which is added to pensions twice over," the pair wrote.

"It is unsustainable for pensions to forever receive ‘double dip’ treatment every time earnings and inflation spike."

Rather than scrapping the policy entirely, Mr Cohen and Mr Stubs recommend modifying how the mechanism calculates pension increases. Their proposal involves extending the measurement period for two of the three locks from twelve months to ten years.

This adjustment would maintain all three protective elements whilst preventing the rapid cost escalation that threatens the system's future, the think tank has determined.

"We propose changing the way the triple lock is calculated, so that two of the 'locks' reflect changes over a ten year period, rather than just the last 12 months," the researchers stated.

This approach aims to eliminate the double-counting effect whilst ensuring pensioners continue receiving meaningful protection against economic volatility. The researchers acknowledge opposing viewpoints on triple lock reform whilst maintaining that change is necessary to preserve the policy.

The think tank has out forward a new proposal for the state pension triple lock

|CENTRE FOR BRIITSH PROGRESS

They note that approximately one in six pensioners in Britain currently experience poverty, making the protection offered by the triple lock vital for many vulnerable households.

"This is a vitally important point. But the best way to ensure that those pensioners are helped through the triple lock is to ensure that it will be sustained," Cohen and Stubs argued.

Notably, the paper emphasises that the current government has pledged to maintain the triple lock, making reform rather than abolition the practical path forward.

The researchers warn that without modification, the policy faces inevitable suspension or abandonment as costs become politically and economically untenable.