State pension disaster looms as 26 million retirees face 'sharp drop' in savings if triple lock axed

Shadow Work and Pensions Secretary Helen Whately MP shares her view on Labour's asylum system reforms |

GB NEWS

Under the triple lock, state pension payment rates rise every year in line with either inflation, average wage growth or 2.5 per cent; whichever is highest

Don't Miss

Most Read

Up to 26 million retirees in the UK would face a "sharp drop" in their savings if the state pension triple lock in its current form is axed, a former Government minister has warned.

Freedom of Information (FoI) data secured by Sir Steve Webb has exposed projections indicating a severe escalation in retirement poverty should the Government abandon the state pension triple lock.

The analysis demonstrates that as many as 26.1 million working-age Britons could suffer substantial declines in their quality of life upon retirement if pensions were adjusted solely for inflation.

Department for Work and Pensions (DWP) calculations reveal a stark contrast to current estimates, which presume the triple lock mechanism will persist for five decades. This assumption appears increasingly unrealistic according to pension experts, who anticipate policy changes ahead.

State pension triple lock reform could see a 'sharp drop in living standards' for millions of retirees in the future

|GETTY

Present Government statistics indicate 14.6 million individuals FACE bleak retirement prospects, experiencing significant reductions in their living standards after leaving employment.

However, these calculations rest on the premise that the triple lock arrangement will remain intact for half a century.

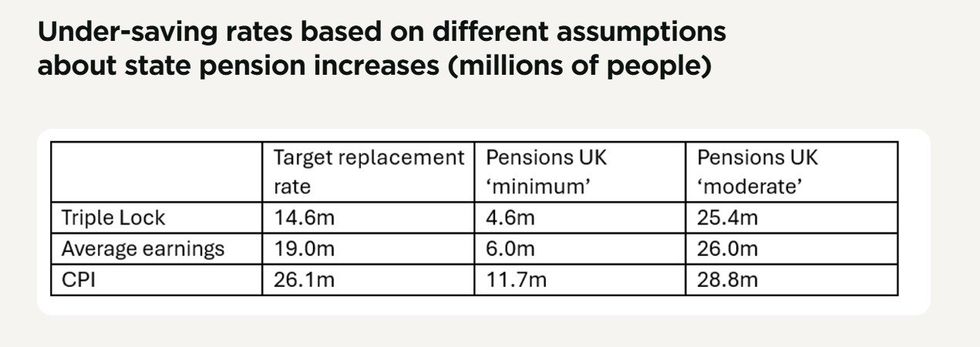

Alternative modelling conducted by the DWP examines scenarios where state pensions increase either through wage growth connections or purely through inflation adjustments, mirroring pre-2010 policy.

The data shows 19 million people, representing 56 per cent of workers, would encounter dramatic lifestyle changes if pensions tracked earnings.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR Under inflation-only adjustments, this figure balloons to 26.1 million, affecting 77 per cent of the workforce.

The FOI data establishes three retirement income benchmarks: a target replacement rate requiring median earners to maintain 67 per cent of pre-retirement income, with 80 per cent needed for lower earners and 50 per cent for higher earners; Pensions UK's minimum threshold for basic retirement needs; and their moderate standard for middle-tier retirement living.

Without the triple lock, 1.4 million additional pensioners would fall below Pensions UK's minimum threshold under earnings-linked increases.

Price-linked adjustments would push over seven million more beneath this basic standard.

Currently, 25.4 million people—73 per cent—face missing the moderate living standard. Abandoning the triple lock could add 3.4 million to this figure.

The revelations emerge as speculation mounts regarding potential Budget measures targeting workplace pension arrangements.

It is understood Chancellor Rachel Reeves is contemplating raising £2billion through restrictions on salary sacrifice pension schemes.

Mr Webb, partner at pension consultants LCP, characterised the findings as "shocking figures" that expose how "the true state of under-saving for retirement in Britain is far greater than has previously been admitted".

Mr Webb broke down how many will people will be impacted if the triple lock is reformed in certain ways

|LCP

He emphasised that "very few people expect the triple lock to continue for another fifty years," yet government estimates rely on this assumption.

Mr Webb warned that replacing the mechanism would see "around 1 in 3 of today's workers set to retire short of even a bare 'minimum' standard of living."

"Against this backdrop, the Chancellor should be taking measures in the Budget to boost pension saving, not undermine it," the former pensions minister concluded.

The Chancellor will announce any changes to pension policy during the Budget statement on November 26.

More From GB News