State pension means testing 'raised' as DWP triple lock declared unaffordable

Shadow Work & Pensions Secretary Helen Whately speaks to GB News Breakfast |

GB NEWS

New figures have called into question how long the state pension triple lock can continue in its current form

Don't Miss

Most Read

Means testing the state pension is among the proposals being "raised" by analysts due to growing concerns about the long-term affordability of the Department for Work and Pensions (DWP) benefit.

The state pension triple lock faces unprecedented pressure as new data reveals its annual cost could soar to £15.5billion by 2030, which three times higher than initial projections.

According to the Office for Budget Responsibility's (OBR) latest fiscal risks and sustainability report, the nation's finances in a "vulnerable position" due to welfare spending.

The watchdog forecasts the debt-to-GDP ratio will surge from 94 per cent today to 270 per cent by the early 2070s with state pension spending represents the second-largest increase in non-interest Government expenditure.

Pensioners are worried about their future | GETTY

Pensioners are worried about their future | GETTY The OBR has concluded that if current policies continue, Government debt will not be sustainable in the long term, raising serious questions about the future viability of the triple lock guarantee introduced in 2011.

Under the triple lock mechanism, the state pension rises annually by the highest of inflation, wage growth, or 2.5 per cent. This policy, combined with an ageing population, has dramatically increased benefit costs according to the OBR.

State pension spending has surged from approximately two per cent of the UK economy to five per cent currently. The OBR projects this will reach 7.7 per cent by the early 2070s.

Claire Trott, the head of Advice at St. James's Place, acknowledged the political sensitivities of reforming the triple lock "With many pensioners still living in poverty, and also being a reliable voting demographic, few politicians are willing to risk tampering with it."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

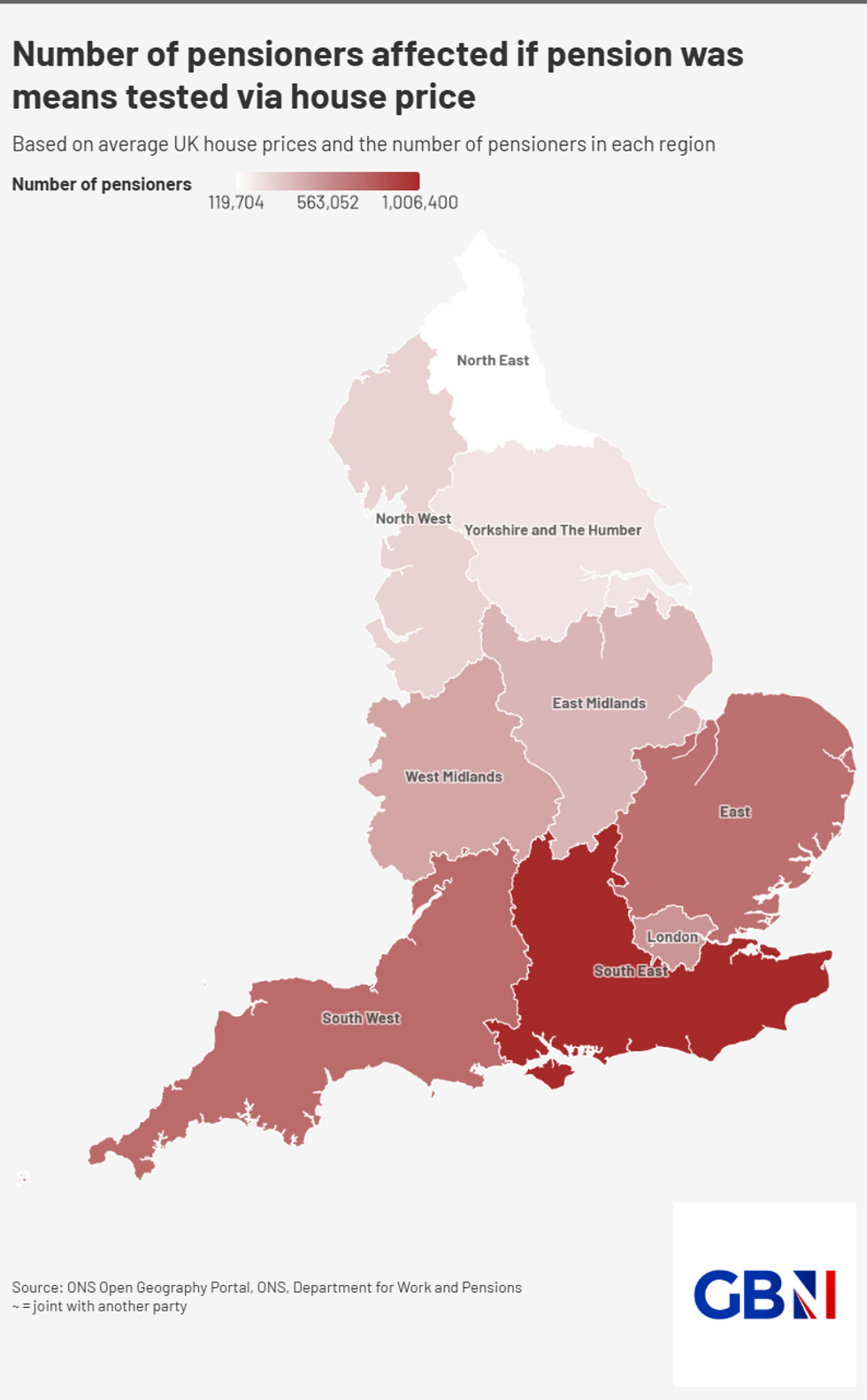

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNShe suggested raising the state pension age as "arguably the most viable and publicly palatable option in the longer term, as people continue to live and work for longer".

“If reform were to be considered, any proposal would need to ensure adequate support for those on the lowest incomes," Trott explained. "Means testing is often raised as a solution, but in practice it’s unlikely to be pursued, given the cost and complexity of implementation outweighing the savings.

"There are other options such as freezing the State Pension and increasing access to Pension Credit which might be a more pragmatic route – it’s already in place and better targeted to those who need help most.

“Raising the state pension age has been controversial in the past, but it’s arguably the most viable and publicly palatable option in the longer term, as people continue to live and work for longer.”

Catherine Foot, director at the Standard Life Centre for the Future of Retirement, warned: "In all but its least optimistic life expectancy scenarios, the OBR projects significant increases in public spending."

She explained that "a sizeable portion of this increase will be driven by more people receiving the state pension for longer, as well as the triple lock driving up the State Pension amount people receive. At the same time, rates of individual retirement savings are falling far behind what our longer lifespans now require."

LATEST DEVELOPMENTS:

The Treasury has to contend with an expensive state pension bill

| PAFoot's research indicates the UK is on track for a retirement crisis by 2040 if current trends persist, with the majority of retirees expected to have insufficient savings. "That isn't a reality the Government or pensioners want to face," she said.

New research reveals a widespread lack of retirement planning awareness across the UK. Hargreaves Lansdown found that only 34 per cent of people have a clear idea of how much income they will need in retirement, rising marginally to 37 per cent among those aged over 55.

Helen Morrissey, the head of retirement analysis at Hargreaves Lansdown, said: "Just over one third of people could be sleepwalking into a retirement nightmare by not knowing how much income they will need in later life.

Both Morrissey and Foot urged the Government to begin an adequacy review at the earliest opportunity. Foot stressed: "We urge the Government to commit to begin the adequacy review at the earliest opportunity and set out a roadmap to improving retirement adequacy."

More From GB News