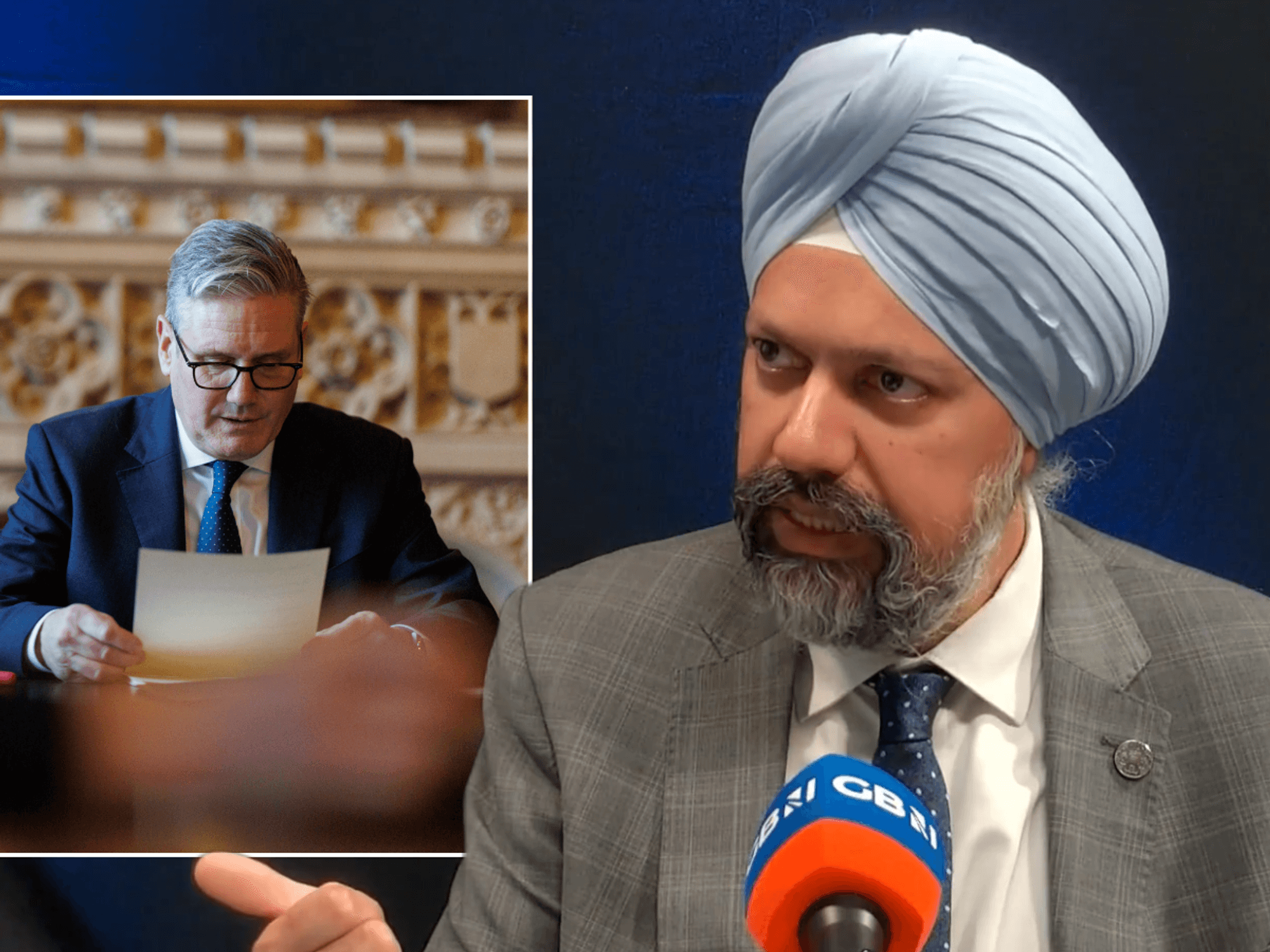

‘Major reform needed’ as taxpayers set to pay £2.5billion pension boost bill for civil servants

The 'triple lock' is a commitment to increase state pensions

|GETTY

The public sector pensions bill hit a record £2.6trillion, making it larger than the size of the UK economy, the latest Treasury figures have shown

Don't Miss

Most Read

Latest

Taxpayers in the UK are having to foot the bill for a big pay rise for retired civil servants.

These workers have seen their retirement pot rise by £333billion to £2.64trillion by the 2021-2022 financial year, the Treasury said.

Among the five million workers are doctors, civil servants and teachers.

Their yearly ‘gold plated’ retirement income is linked by law to the previous September’s inflation figure, which stood at 6.7per cent in 2023 because of the triple lock.

This pay rise is the second biggest, after last year’s 10.1 per cent boost.

The 'triple lock' is a commitment to increase state pensions by whichever is highest of average earnings growth, CPI inflation, or 2.5 per cent.

Public sector pensions are inflation proof in a way less generous private sector retirement pots are not.

Those in the private sector will usually be part of a defined contribution pension scheme, with the size of retirement pots determined by investment performance.

However, defined benefit ‘gold plated’ public sector pensions promise an inflation-proof income guaranteed by the taxpayer.

This is paid as a percentage of either their final or career average salary.

Critics have accused the Government of creating a “pensions aristocracy” through its generous inflation-linked schemes for these civil workers.

Baroness Altmann, a former pensions minister, said many public sector workers are unaware of how lucky they are.

She said: “It’s long been the case that a public sector job will result in you being the aristocracy of pensioners.

“You will have inflation-linked income for life, and it won’t fall if inflation is negative.

“Of course public sector workers deserve good pensions, but they often don’t appreciate how good they already have it, and that their pensions have become far more generous than anything available in the private sector.”

There are around 114 civil servants claiming over £100,000 a year from their pensions.

The number getting more than £50,000 a year jumped by 53per cent from 3,092 in 2022 to 4,741 last year.

The Government does not pay for these increases, instead the tax payer has to foot the bill.

LATEST DEVELOPMENTS:

Neil Record, former chairman of the Institute for Economic Affairs think tank, likened the public sector pension system to a “ponzi scheme”, with taxpayers set to lose out.

He said: “It’s like a ponzi scheme. These pension schemes are too expensive, but the Government hasn’t felt this yet.

“There’s a huge intergenerational unfairness too. The current generation is paying for these lucrative pension schemes but aren’t going to have them themselves.

“Major reform is needed. It can’t go on like this. It’s a big strategic mistake.”

A Government spokesman said: “We have reformed public service pensions, saving £400billion.

“They are an important part of remuneration for hard-working public sector workers and the reforms strike the right balance between rewarding Crown servants and being fair to the taxpayer.”