Stamp duty slammed as ‘lose-lose tax’ as levy ‘damaging’ UK economy

Experts are urging the Government to consider reform to stamp duty

Don't Miss

Most Read

Stamp duty on shares has been slammed as a “lose-lose tax” which is discouraging investing, according to a recent survey.

A recent poll conducted by interactive investor suggests that the levy is “damaging” the UK economy.

Some 82 per cent of investors polled shared that ending the stamp on UK shares would encourage more investment in UK-listed companies.

Furthermore, 57 per cent of respondents admitted that stamp duty would make them think twice about investing in UK shares in the future.

For years, interactive investor has called for stamp duty reform on shares in the UK and believes this overhaul will be popular with investors.

Currently, Britons will have to pay a tax or duty of 0.5 per cent on the transaction when buying shares.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

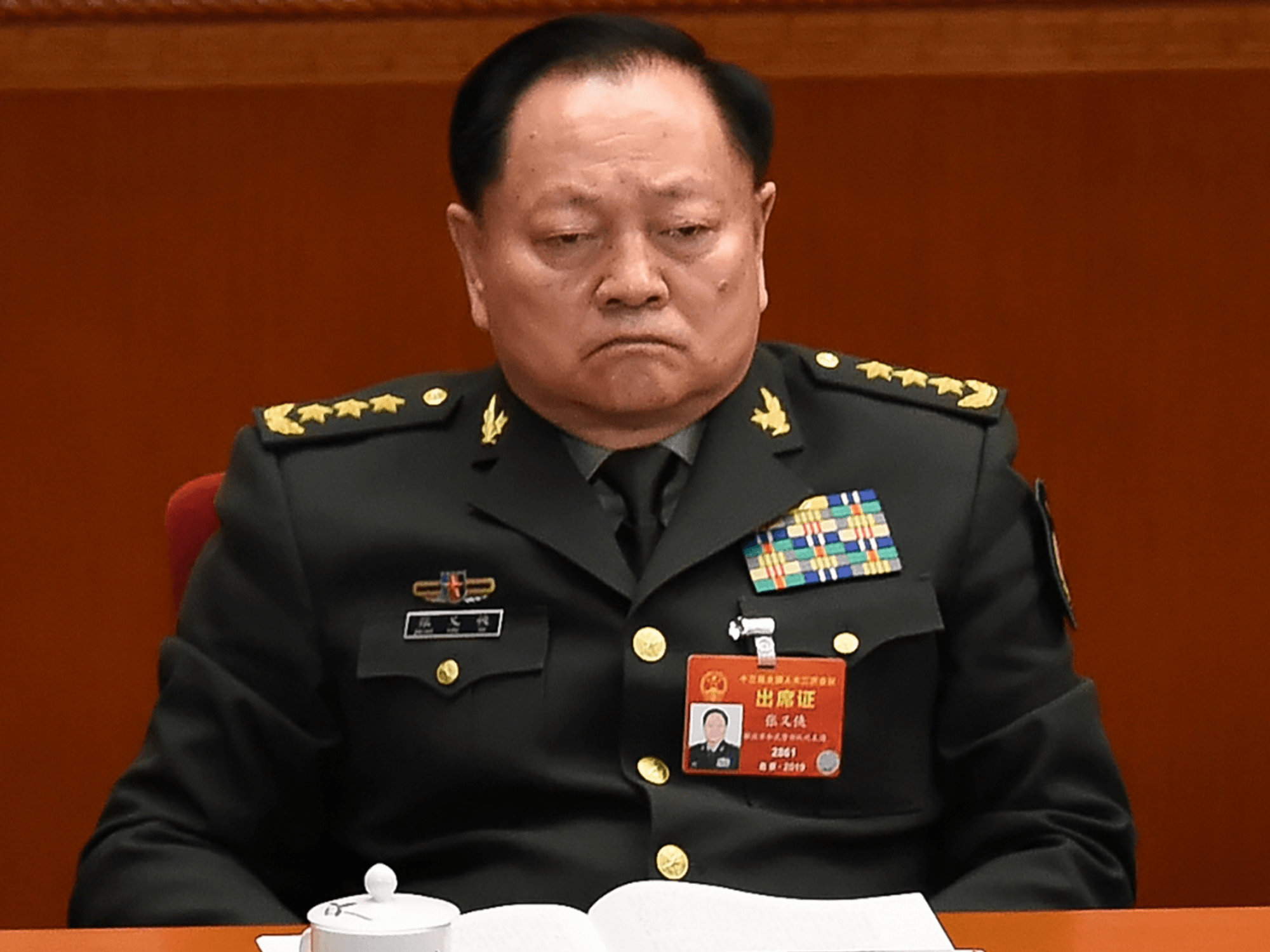

Experts are calling for reform to stamp duty

|GETTY

If someone chooses to buy shares electronically, they will have to pay Stamp Duty Reserve Tax (SDRT).

When someone opts to buy shares using a stock transfer form, they will pay stamp duty if the transaction is more than £1,000.

Tax needs to be paid when buying existing shares in a company incorporated in the UK or for an option to buy shares.

As well as this, Britons need to pay stamp duty on any interest in shares, shares in foreign companies and rights arising from shares.

However, there are some instances in which stamp duty does not need to paid when it comes to shares.

These include when given shares for nothing, subscribing to a new issue of shares in a company or purchasing hares in an ‘open ended investment company’ (OEIC) from the fund manager.

Richard Wilson, interactive investor’s CEO, slammed stamp duty as an “unnecessary lose-lose tax” which is damaging the country’s economy.

He explained: “Our research is a snapshot but is indicative of a wider issue which deserves urgent attention.

“The overwhelming majority of investors think that stamp duty is an unnecessary barrier that penalises people for backing British shares – and we couldn’t agree more! This demonstrates the real cost to UK plc.

“This is a pernicious tax that penalises listed companies that help put the ‘great’ in British business.”

LATEST DEVELOPMENTS:

Investors believe the "lose-lose" tax is hurting the economy

| GETTYThe finance expert questioned whether stamp duty could exist in its current form due to its ability to “dissuade” four in 10 potential investors.

Wilson added: “What’s more, the majority of respondents say that it will make them think twice about investing in UK shares in the future. Is this really what we want for the UK market?

“It’s a lose-lose tax. Higher transaction costs due to stamp duty also undermines market liquidity, which is the lifeblood of an efficient stock market.

“As the UK grapples to maintain its competitiveness, stamp duty is a big barrier to investment and growth, damaging the health of the broader UK economy.”