Santander launches 98% mortgage with £10,000 deposit as experts hail 'good news for first time buyers'

New five-year fixed deal targets first-time buyers struggling to raise large deposits

Don't Miss

Most Read

Latest

Santander has launched a new mortgage product allowing first time buyers to borrow up to 98 per cent of a property’s value with a deposit of £10,000.

The product, called My First Mortgage, is a five year fixed rate deal priced at 5.19 per cent.

Borrowing under the scheme is capped at £500,000, and Santander said the mortgage comes with no arrangement fee.

The lender said the product is aimed at helping first time buyers who struggle to save for large deposits despite being able to afford monthly repayments.

TRENDING

Stories

Videos

Your Say

John Everest, Director of Everest Mortgage Services, told GB News: "The main issue buyers face is saving for that deposit. This may be the turning point of where first time buyers can do it on their own two feet."

With that initial lump-sum causing such a barrier for those attempting to get on the first wrung of the housing ladder, Mr Everest said "year on year help from parents have been fuelling deposits to help their children on the ladder.

"London and the south struggle most where deposits can easily be £50,000 - £60,000+ due to property prices are so high."

The launch comes as lenders compete for a greater share of the first time buyer market. First time buyers accounted for around a third of all mortgage lending last year.

Santander, one of the UK’s six largest mortgage lenders, said its decision to introduce the product was based on research showing that deposit requirements remain the biggest barrier to home ownership.

The bank said rising rental costs and wider cost of living pressures have made it increasingly difficult for prospective buyers to save.

Its analysis found that allowing buyers to purchase a home with a £10,000 deposit could reduce the average time spent saving by around four years, which Santander said could significantly accelerate access to the housing market for eligible borrowers.

New five-year fixed deal targets first-time buyers struggling to raise large deposits

|GETTY

The mortgage is subject to several restrictions.

Santander will only lend on houses under the scheme, and the product is not available for flats. It is also not available in Northern Ireland.

Borrowers are limited to a maximum loan size of 4.45 times their annual income.

David Morris, head of homes at Santander, said the product was designed to address affordability challenges facing first time buyers.

Mr Morris said, “Last year, the average first time buyer with Santander put down a deposit of more than £85,000, a figure that can feel unattainable for today’s aspiring homeowners, whether that is a result of more modest income, limited family financial support, rising rental costs and, in some cases, childcare expenses.”

LATEST DEVELOPMENTS

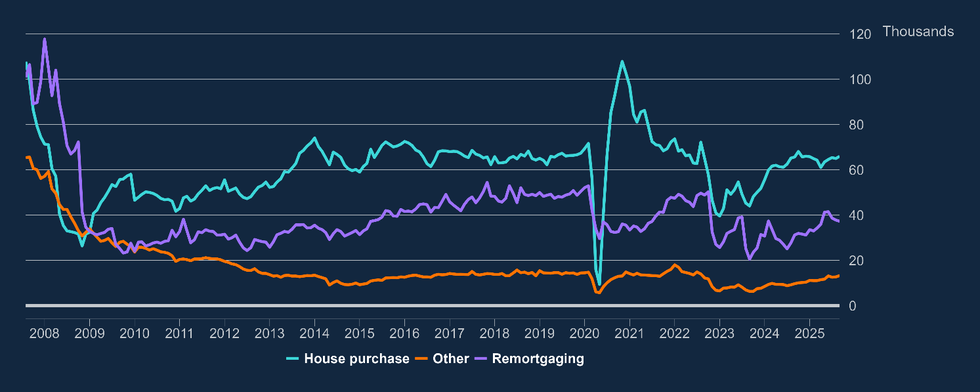

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDHe said the bank wanted to help customers who do not have access to family support.

Mortgage brokers said the interest rate is broadly comparable with existing high loan to value products. Industry figures said the pricing is similar to many mortgages requiring a 95 per cent loan to value ratio.

Andrew Montlake, managing director of mortgage broker Coreco, said the five year fixed term reduces risk for borrowers.

He said, “The fact you have to take on a five year fix is very sensible because after five years of payments, you have a little less risk of going into negative equity.”

The longer fixed period gives borrowers more time to build equity, which is particularly beneficial for buyers entering the market with small deposits.

Aaron Strutt, product director at mortgage broker Trinity Financial, said borrowers should consider making overpayments if possible.

Mr Strutt said, “It often makes sense to make overpayments, if possible, to try and reduce the loan to value so it is closer to 90 or 95 per cent.”

He said borrowers are likely to find more competitive rates once they reach lower loan to value brackets.

Mr Strutt added that Santander’s position in the market could influence other lenders, saying, “This move may well tempt other big lenders back into offering more sub five per cent deposit mortgages to new customers.”

The launch follows efforts by the Treasury to encourage lenders to support first time buyers.

The Government introduced a guarantee scheme last year aimed at supporting high loan to value mortgages

| GETTYThe Government introduced a guarantee scheme last year aimed at supporting high loan to value mortgages, with ministers saying the policy was designed to improve access to home ownership.

Other lenders have introduced alternative products targeting buyers with limited savings.

Skipton Building Society offers a Track Record mortgage allowing 100 per cent borrowing based on rental payment history.

Barclays offers a Family Springboard mortgage requiring relatives to provide a 10 per cent deposit. Yorkshire Building Society accepts deposits as low as £5,000 on selected products.

Santander said it expects demand for the new mortgage to be strong and said the product reflects ongoing changes in buyer behaviour and affordability pressures within the housing market.

Mr Everest said: "2026 is shaping up to be an interesting year with lenders already we've seen so much positive change to help purchasing homes not just for first time buyers.

"It's a big move so lenders may wait to see how the market reacts before making any decisions themselves."

More From GB News