Bank of England issues warning for anyone with a mortgage

Fresh data from the Bank of England’s Money and Credit report highlights continued pressure in the mortgage market

Don't Miss

Most Read

Latest

Homeowners are being warned that mortgage costs remain under pressure, even though rates for new borrowers are starting to ease.

The Bank of England says people taking out new mortgages are now getting slightly better deals, but many existing homeowners are still facing rising costs as older fixed-rate deals end.

In its latest Money and Credit report, the Bank showed that the 'effective' interest rate – the actual interest paid – on newly drawn mortgages decreased to 4.15 per cent in December from 4.20 per cent in November, offering some relief for buyers and those remortgaging.

However, the situation is different for people already on a mortgage. The average rate across all existing home loans increased slightly from 3.90 per cent to 3.92 per cent.

This gap shows that while new borrowers are beginning to see lower rates, many homeowners are still experiencing higher monthly payments as they move away from previously cheaper deals.

Nearly one million homeowners who fixed their mortgage in 2021 are set to face significantly higher repayments as those ultra-low deals expire next year.

Around 971,105 five-year fixed-rate mortgages taken out during the period of historically low interest rates will come up for renewal in 2026, with many borrowers having secured rates below two per cent.

With current remortgage rates much higher, some households could see their annual mortgage costs rise by as much as £2,124, according to Compare the Market.

Data from L&C Mortgages shows the average of the lowest five-year fixed remortgage rates among the ten largest lenders stood at 3.89 per cent in January 2026.

The figures apply to regulated mortgages only and exclude loans that may have been repaid early.

The average rate across all existing home loans increased slightly from 3.90 per cent to 3.92 per cent

| GETTYMortgage experts warn the increases could put added pressure on household budgets, particularly for families already juggling childcare and other rising living costs, and stress the importance of shopping around to limit the impact.

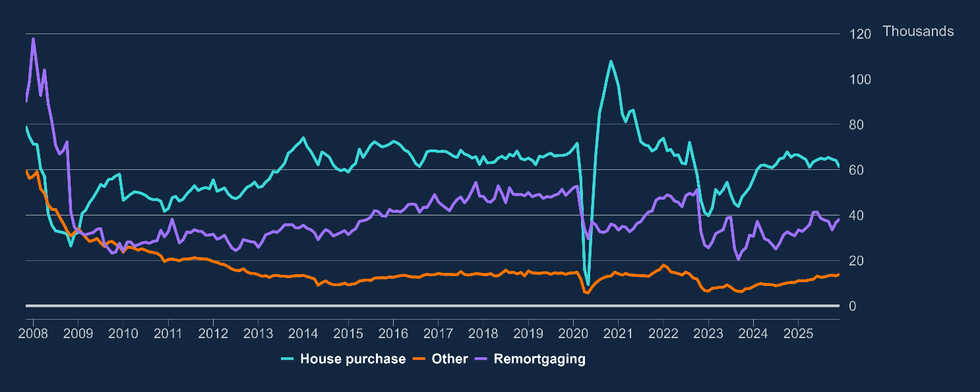

As affordability pressures mount, there are early signs the higher costs may be affecting borrowing decisions. Mortgage approvals for house purchases fell by 3,100 to 61,000 in December, pointing to a potential slowdown in future borrowing activity.

Net borrowing of mortgage debt held steady at £4.6 billion compared with November, whilst the annual growth rate for net mortgage lending remained at 3.4 per cent.

Gross lending dipped by £0.5billion to £23billion during the month, with repayments also declining by £0.6billion to £18.8billion.

In contrast, remortgaging activity showed signs of life. Approvals for switching to a different lender climbed by 1,600 to approximately 38,400.

Approvals for remortgaging (which only capture remortgaging with a different lender) rose by 1,600 to 38,400 in December

|BANK OF ENGLAND

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: "Remortgaging numbers rose, suggesting that borrowers coming off low rates are shopping around for the best rate possible rather than opting for the ease of sticking with their existing lender."

Frances McDonald, director of research at Savills, said of the housing market: "With lower mortgage rates and a reduced likelihood of any further changes to the property tax system, we expect more stability for both activity and prices throughout this year."

The outlook for spring appears encouraging for those seeking finance. Harris noted that lenders are eager to provide mortgages and have ample funds available to do so.

Major lenders have trimmed their rates recently, though some have pushed pricing back up in recent days.

Mr Harris expects mortgage rates to fluctuate rather than move decisively in either direction over the coming months.

Policymakers at the Bank of England are widely anticipated to maintain interest rates at 3.75 per cent when they convene next Thursday

| GETTYThe combination of competitive lending conditions and borrowers actively seeking better terms suggests the market is entering a more dynamic phase as warmer weather approaches.

Policymakers at the Bank of England are widely anticipated to maintain interest rates at 3.75 per cent when they convene next Thursday.

Markets are pricing in virtually no chance of a reduction on 5 February, following December's closely contested 5-4 vote in favour of a cut.

UBS economist Anna Titareva believes Governor Andrew Bailey and senior deputy governors will opt to hold, citing persistent wage pressures despite private sector pay growth falling to a five-year low of 3.6 per cent in November.

The investment bank forecasts two reductions this year, in March and June, which would bring rates down to 3.25 per cent.

Next week's meeting will feature revised Bank projections, with inflation expected to be adjusted downward thanks to falling energy costs and April's household bill rebate.

More From GB News