Nationwide Building Society says mortgage customers can now borrow up to six times income

Customers can now borrow more under new lending rules

Don't Miss

Most Read

Nationwide Building Society has broadened its high loan-to-income mortgage offering, enabling home movers and remortgage customers to access borrowing worth up to six times their annual earnings.

They confirmed that both new and existing customers looking to relocate or switch their mortgage deal can now benefit from the enhanced lending terms.

This expansion follows regulatory adjustments introduced last year that have opened the door for lenders to offer more generous income multiples.

Previously, Nationwide had reserved its six times income lending primarily for first-time buyers through its Helping Hand scheme, which launched the enhanced terms in September 2024.

TRENDING

Stories

Videos

Your Say

The latest move extends similar support to a wider pool of borrowers seeking to progress on the property ladder.

To qualify for the increased borrowing capacity, applicants must meet specific income thresholds set by the building society.

Individual borrowers need to earn at least £75,000 annually, whilst those applying jointly must have a combined household income of no less than £100,000.

These minimum earnings requirements remain unchanged from the previous lending criteria.

The enhanced terms apply to mortgages with a loan-to-value ratio of up to 95 per cent, meaning borrowers can secure financing with just a five per cent deposit.

Under the former rules, eligible customers in these categories were limited to borrowing 5.5 times their income.

Customers can now borrow more under new lending rules

| GETTY/NATIONWIDEFor those remortgaging without seeking additional funds, Nationwide already permits even higher multiples of up to 6.5 times income at the same 95 per cent loan-to-value threshold.

The practical impact of these changes is substantial for those meeting the income criteria.

A sole applicant earning £75,000 who previously could access up to £412,500 may now secure as much as £450,000, representing an additional £37,500 in borrowing power.

Joint applicants with combined earnings of £100,000 see an even greater uplift, with potential borrowing rising from £550,000 to £600,000 – a £50,000 increase.

The announcement comes amid growing demand for higher income multiples among property buyers.

LATEST DEVELOPMENTS

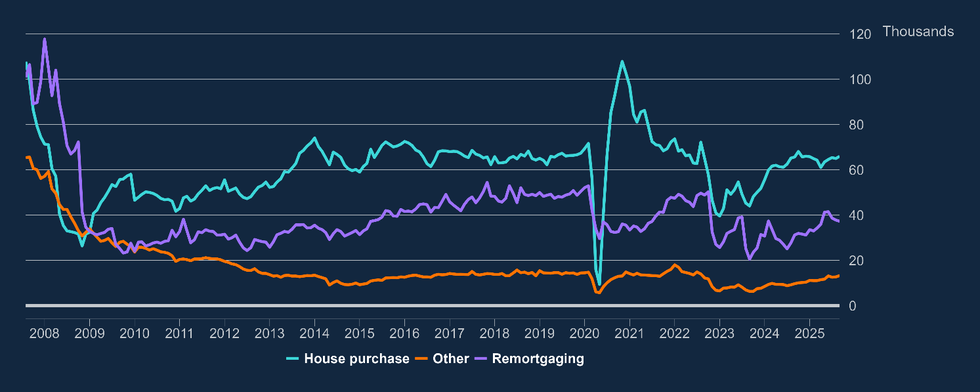

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDNationwide reported that first-time buyer mortgages taken at five times income or above surged by 57 per cent in 2025 compared with the previous year.

The building society also noted a five-fold rise in first-time buyers securing loans between 5.5 and six times their earnings over the past twelve months.

Henry Jordan, Nationwide's group director of mortgages, described the government and regulatory shifts as transformative for the market.

"The Government and regulatory changes last year have been a game changer for first-time buyers," he said.

The building society saw a five-fold rise in first-time buyers securing loans between 5.5 and six times their earnings

|GETTY

"Alongside our Helping Hand expansion to six times income in September 2024, they've enabled greater support for those who need it most."

Jordan added: "Our latest announcement means we will provide similar support to those looking to move home or remortgage to Nationwide."

Nicholas Mendes, mortgage technical manager at John Charcol, welcomed the development.

"It supports borrowers who are constrained by income multiples rather than the monthly cost, and it shows how lenders are adapting to the reality of today's housing market," he said.

More From GB News