Savings crisis: Rachel Reeves told to overhaul 'unfair' ISA rules as Britons face 25% charge

Savers urged to be careful of tax on savings interest |

GB NEWS

ISA savers who make non-qualifying withdrawals face a significant charge on their cash

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves faces calls to scrap "unfair rules" attached to Lifetime ISAs in an effort to improve the number of first-time homebuyers purchasing property.

Since their launch in 2017, the number of Lifetime ISA accounts has grown from just 64,000 in the 2017-18 tax year to over 1.3 million in 2023-24, and were created to help Britons with the purchase of their first home.

It is possible to contribute up to £4,000 annually and the Government adds a 25 per cent bonus, up to a maximum of £1,000 per year.

However, when someone withdraw money for any other purpose outside of buying a home, retiring or after being diagnosed with a terminal illness, they will incur a withdrawal charge of usually 25 per cent on the amount taken out.

The Chancellor is being urged to reform ISA rules

|GETTY / PA

Recent correspondence from HM Revenue and Customs (HMRC) to the Treasury Committee reveals the scheme is helping only a limited number of people, with analysts citing the strict rules on withdrawals.

The data shows that only 228,000 individuals have actually used a Lifetime ISA towards the purchase of their first home since the scheme began.

Regional disparities in LISA usage are stark, with London showing particularly low utilisation despite its large population of young adults.

In the capital, just 18,350 people have used a LISA to purchase their first home, placing it at the lower end of the scale compared to other regions.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

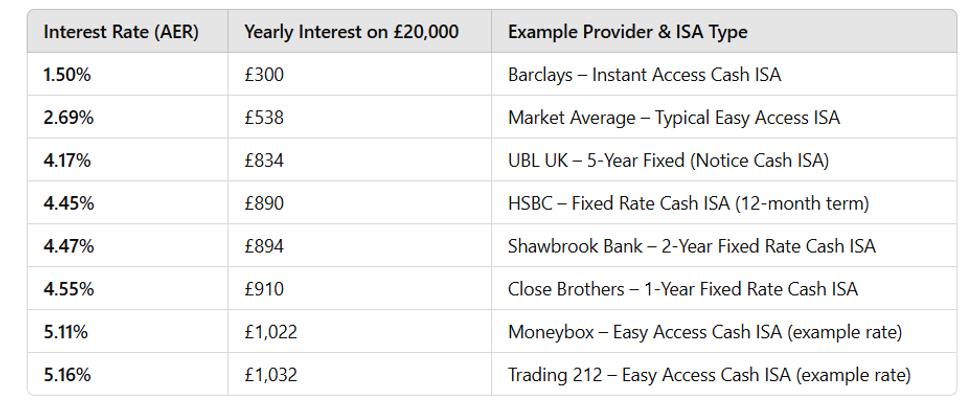

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNThis represents a mere 0.56 per cent per cent of Londoners aged 18 to 40 who have successfully used the scheme to get onto the property ladder.

By contrast, the South East saw the highest number of individuals utilising the LISA, with 38,650 first-time buyers benefiting from the scheme. The North West recorded the second highest level of use with 27,900 individuals.

At the opposite end of the spectrum, the North East saw the lowest uptake with just 7,650 people using a LISA for their first home purchase.

These regional differences highlight significant variations in how effectively the scheme works across different parts of the country. London's low LISA utilisation rate can be directly attributed to the scheme's £450,000 house price cap.

Rachael Griffin, tax and financial planning expert at Quilter, noted: "Even financially literate savers, including those actively contributing to their LISA, did not realise that the 25 per cent penalty on non-qualifying withdrawals can leave them with less than they originally invested."

She explains that many do not understand the levy not just a clawback of the Government bonus but results in a loss of their own money.

LATEST DEVELOPMENTS:

Interest rate hikes from the Bank of England have been passed down to savings products | GETTY

Interest rate hikes from the Bank of England have been passed down to savings products | GETTY "Once they understood this, there was broad consensus that the current rules feel unfair and that the withdrawal charge should be reduced to 20 per cent," Griffin notes.

This reduction would at least allow savers to break even if circumstances forced early withdrawals, preventing their own contributions from being "unfairly reduced".

The situation comes amid reports that Reeves is considering significant changes to ISA products that could further impact savers, with a dramatic reduction in the current tax-free savings allowance across accounts from £20,000 to £4,000.

While savers can only currently deposit £4,000 a year into a LISA without paying a tax, this counts towards the overall £20,000 allowance that can be split across multiple ISA accounts.