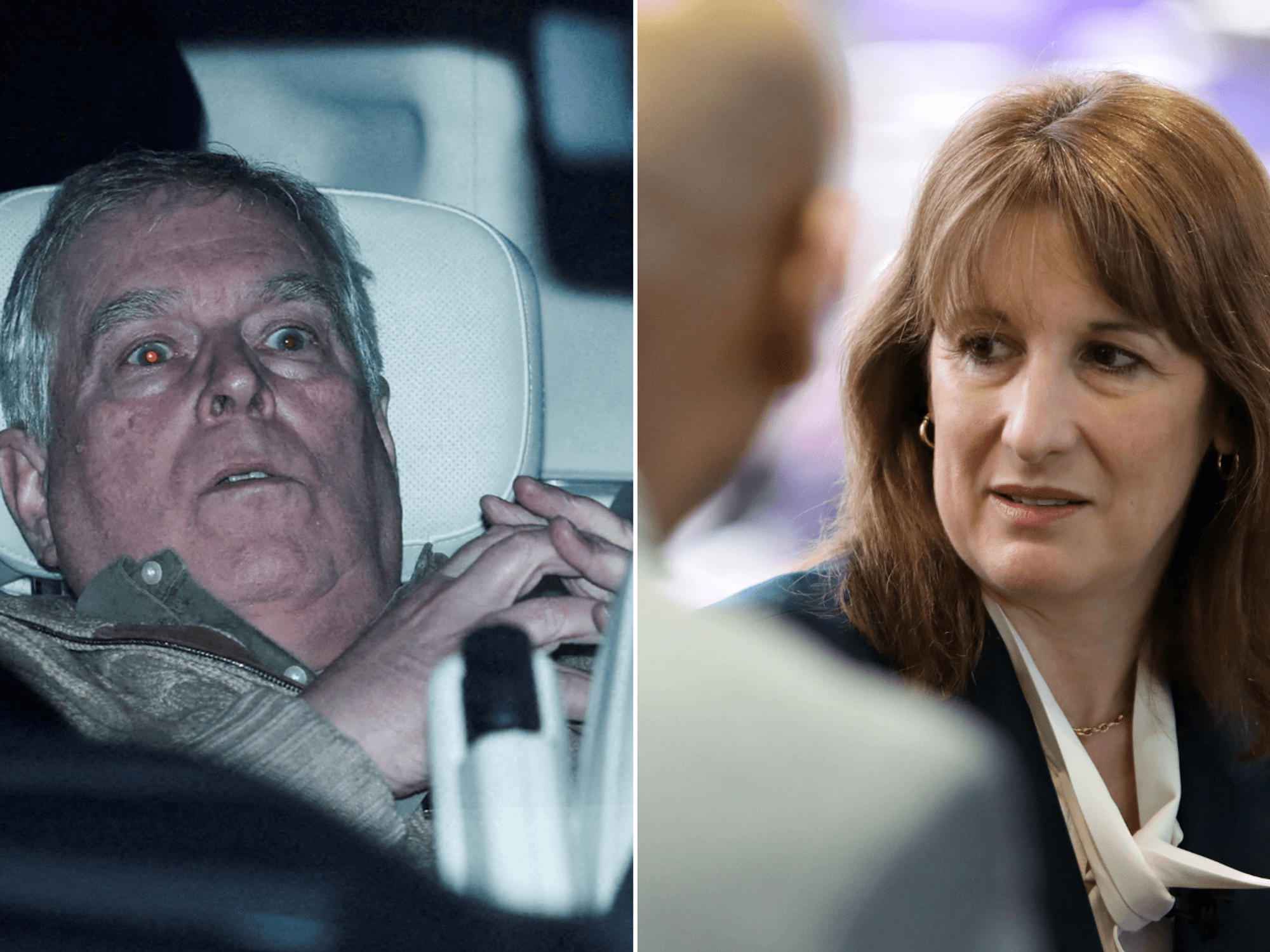

ISA row continues as savers hit with 'unfair' £1,000 penalty for accessing their own cash - 'it’s a Government clawback!'

Clare Muldoon blasts Rachel Reeves for targeting tax-free cash ISAs - 'Abhorrent!' |

GBNEWS

While the popularity of Lifetime ISAs has grown - it is still helping only a limited number of people

Don't Miss

Most Read

Latest

Savers are being warned that Lifetime ISAs (LISAs) come with a hidden sting in the tail that could leave them with less money than they put in.

Despite growing in popularity since their 2017 launch, the accounts have been slammed as "unfair" by financial experts.

The 25 per cent withdrawal charge for non-qualifying uses is not just "a clawback of the Government’s bonus". It also takes a portion of the saver’s own contributions.

An expert has explained the financial sting is often misunderstood, even by those with strong financial literacy. Many do not realise the true impact of the penalty until it is too late.

Rachael Griffin, tax and financial planning expert at Quilter said: "HMRC’s recently published ‘Understanding the Use of the Lifetime ISA’ report lays bare the confusion that remains.

"In particular, the revelation that even financially literate savers, including those actively contributing to their LISA, did not realise that the 25 per cent penalty on non-qualifying withdrawals can leave them with less than they originally invested."

As the new £20,000 ISA allowance resets, experts say now could be the ideal time to fix savings to make the most out of one's money | GETTY

As the new £20,000 ISA allowance resets, experts say now could be the ideal time to fix savings to make the most out of one's money | GETTYThe new report has shown that LISAs have expanded significantly, with the number of accounts rising from 64,000 in 2017 to over 1.3 million in 2023. However, only 228,000 savers have used their LISA to buy a first home.

This sharp contrast has raised questions about how effectively the product supports first-time buyers, which was one of the scheme’s original aims

For example, a saver who deposits £4,000 and receives the £1,000 government bonus would lose £1,250 if they withdraw the full amount early, ending up with just £3,750

Griffin continued: "People simply do not realise it's not just a clawback of the government bonus. It's a loss on their own money."

People can't claim the government bonus from both a Help to Buy ISA and a Lifetime ISA | GETTY

People can't claim the government bonus from both a Help to Buy ISA and a Lifetime ISA | GETTYThe scale of the problem was revealed through Freedom of Information data obtained last year October. Around 74,000 savers were hit with penalties in 2022 to 2023, including nearly 16,000 who lost £1,000 or more.

Griffin said: "Once they understood this, there was broad consensus that the current rules feel unfair and that the withdrawal charge should be reduced to 20 per cent."

Such a reduction would allow savers to break even in cases where circumstances force them to access their savings early.

The FOI also found that more than 6,100 savers faced penalties above £2,000 and a further 851 individuals were charged over £5,000 each.

These figures have fuelled calls for urgent reform of the LISA withdrawal rules. Many critics are arguing that many savers are being punished for needing to access their own money.

Griffin explained the Lifetime ISA is failing in its current form and should be redefined as a "First Homes Account"

| GETTYGriffin explained the Lifetime ISA is failing in its current form and should be redefined as a "First Homes Account."

She argues the product’s dual-purpose design creates confusion, especially when compared to clearer and more efficient retirement options like pensions.

Griffin also calls for a reduction in the 25 per cent withdrawal penalty and updates to the outdated age and property price caps.

While she does not support scrapping the LISA entirely, she believes its scope should be narrowed to focus solely on helping first-time buyers.