Rachel Reeves's ISA raid to 'constrain' savings returns for millions of Britons as tax-free allowance at risk

Savers urged to be careful of tax on savings interest |

GB NEWS

Reports suggest the Chancellor will reduce the tax-free savings allowance from £20,000 to £4,000

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves is rumoured to be considering drastic changes to ISA products which could "constrain" savings returns for millions of Britons.

It is understood Reeves is floating reducing the current £20,000 tax-free savings allowance to £4,000 as part of the Labour Government's review.

The Treasury is expected to release a paper on potential reforms, which might coincide with the Chancellor's Mansion House speech to City executives in July.

This follows Labour's confirmation in its Spring Statement in March that the Government is "looking at options for reforms" for Individual Savings Accounts.

Rachel Reeves is reportedly understood to be considering changes to ISA allowances | GETTY

Rachel Reeves is reportedly understood to be considering changes to ISA allowances | GETTY It should be noted that no official announcements have been made yet about the specific changes being considered and when they will be made.

As of today, the Government has only stated it is exploring potential reforms to get "the balance right between cash and equities".

Money Saving Expert Martin Lewis has taken to social media to address concerns about the possible changes to cash ISA limits.

He clarified: "They're talking about lowering the limit of how much money you could put in in future, so there's no need to panic about your existing cash ISAs if the rumours are correct."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

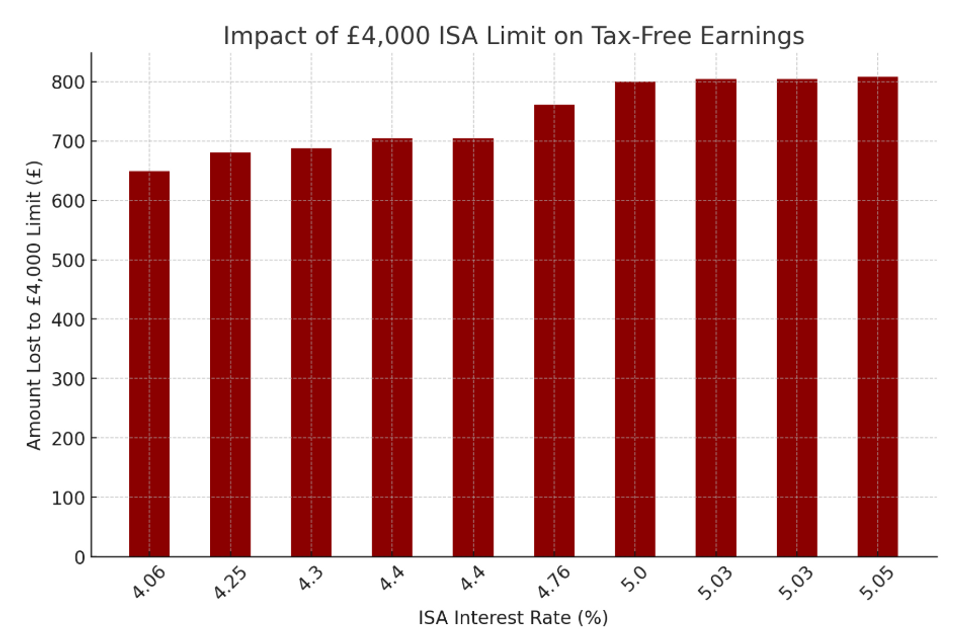

Amount lost to £4,000 limit on tax free earnings for different types of ISAs | GBN

Amount lost to £4,000 limit on tax free earnings for different types of ISAs | GBNLewis noted that if announced in the Autumn Budget, changes could take effect immediately or be delayed until January or April 2026.

He urged immediate action for savers: "If you are planning to save into a cash ISA this tax year and you've got the money, getting the money in sooner would seem safer - in case there is a risk of the allowance being cut."

Investment adviser Peter Rice from Moneyfarm has offered insight into alternative options if the cash ISA allowance is reduced.

He said: "Should the proposal to reduce the Cash ISA allowance to £4,000 come into effect, the savings options available to consumers would be further constrained."

Rice emphasised that Stocks and Shares ISAs can offer lower-volatility options suitable for cautious savers.

"There is a range of alternatives—money market funds or low-risk bonds, to name a couple—which can help people adopt a cautious position whilst still making use of the full £20,000 allowance," he explained.

LATEST DEVELOPMENTS:

Martin Lewis gave the savings warning on The Martin Lewis Money Show Live | PA

Martin Lewis gave the savings warning on The Martin Lewis Money Show Live | PAHe stressed that financial services providers must offer high-quality guidance to help consumers meet both short and long-term goals.

Alongside potential ISA changes, the Labour Government is working with the Financial Conduct Authority (FCA) on targeted support.

This move aims to "give people the confidence to invest" in a wider range of financial products.

More From GB News