Pensioner 'pandering' killing economy GDP growth as young Britons face highest tax burden since World War II

GB NEWS

The Intergenerational Foundation is taking aim at consecutive Governments for failing to grow the economy at the expense of the 'grey vote'

Don't Miss

Most Read

Latest

Researchers from a leading think tank are warning that "pandering to the grey vote" by politicians is hindering consecutive Government's ability to bolster the UK economy's gross domestic product (GDP) growth.

The Intergenerational Foundation suggest this persistent stagnation stems from policies that favour pensioner voters at the expense of economic dynamism.

It argues that Britain has become a "gerontocratic society" where political decisions prioritise pensioner interests over growth-boosting reforms.

Britain's economic prospects continue to deteriorate as growth forecasts fall to just 1.1 per cent for 2025, according to recent International Monetary Fund (IMF) predictions. This marks a significant reduction from earlier projections of 1.6 per cent.

A leading think tank is criticising MPs for "pandering to the grey vote" at the expense of the grey vote

|GETTY

The UK has struggled with anaemic growth since the 2008 financial crisis, averaging only 1.5 per cent annual real GDP growth between 2010 and 2023. Per capita GDP growth has been even weaker at 0.9 per cent yearly.

Toby Whelton, a researcher for the Intergenerational Foundation, said: "The issue is not so much demographic but democratic. Older generations possess disproportionately more electoral voting power."

He points to voting statistics from the 2019 general election, where over-55s cast 15.6 million collective votes compared to just 4.8 million from 18-35 year-olds.

"In order to get elected and stay in power, politicians must pander to the grey vote," Whelton explained. "Such a vast democratic deficit can mean that the economy and society become bent to the political will of older voters and ignore the interests of the young."

The triple lock mechanism ensures state pensions rise annually by the highest of inflation, average earnings growth, or 2.5 per cent. Critics claim this guarantee has effectively severed the connection between pension increases and broader economic performance.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

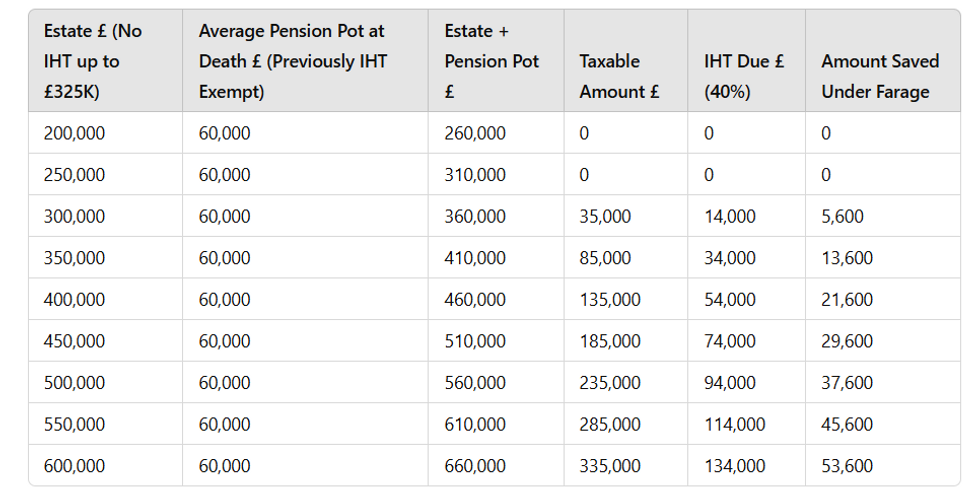

How much could you save? Pension pot | GBN

How much could you save? Pension pot | GBN"Even if the economy or earnings do not grow, the state pension will still ratchet up by 2.5 per cent each year," Whelton noted.

Asset values have similarly decoupled from economic growth. Property prices have more than doubled during two decades of sluggish expansion, benefiting over-50s who control 78 per cent of Britain's property wealth.

Private pensions have maintained roughly eight per cent annual growth whilst the FTSE 100 has averaged 5.6 per cent yearly increases over the same period.

"Growth does not matter to the older electorate: their incomes, wealth and access to government services are untethered," Whelton said. "By implication, a Government subservient to the preferences of the gerontocracy will not prioritise growth either."

Experts warn that British workers currently face the highest tax burden since World War II, constraining economic growth through reduced productivity and consumption.

MEMBERSHIP:

- Why did the Chancellor really cry at PMQs? GB News blows the lid on an extraordinary moment in British politics

- POLL OF THE DAY: Do you back Rachel Reeves to deliver the next Budget? - VOTE NOW

- EXPOSED: Labour quietly rubber-stamps sweeping EU regulation on the WHOLE of Britain in SHOCK Brexit betrayal

- Get FIVE free entries into The Great British Giveaway when you become a GBN member

- EXPOSED: Labour quietly pushing through three Bills that threaten free speech as all eyes on benefits cuts

Graduates bear an additional nine per cent marginal tax through student loan repayments under an increasingly punitive system.

Whelton added: "An obvious way to increase economic growth would be to lower taxes on earned income and instead tax wealth, yet successive governments have been unwilling to do this as increased taxes on wealth would disproportionately impact older voters."

Expert consensus indicates that realigning with the EU, particularly through single market membership, could boost long-term growth by four to five per cent. Despite this potential economic benefit, Governments refuses to consider such moves.

The think tank referenced current polling shows over half of Britons support a second referendum, with a majority favouring rejoining the EU. Among 18-25 year-olds, support reaches 84 per cent.

However, older generations remain the most ardent Brexit supporters, creating a political barrier to EU realignment.

LATEST DEVELOPMENTS:

Britons are concerned about the rising tax burden | GETTY

Britons are concerned about the rising tax burden | GETTY "Despite realigning with the EU being an open goal for economic growth, the government will not even entertain it due to fears of upsetting older voters," Whelton said.

This reluctance to pursue EU realignment exemplifies how electoral calculations override economic rationality, with Governments prioritising the preferences of older Leave voters over policies that could stimulate growth.

Housing policies have systematically inflated property prices through demand-boosting measures like Right to Buy schemes and stamp duty holidays, while planning restrictions and local opposition have constrained supply.

"Whether it is the taxation system, housing policy, EU relations, government expenditure or infrastructure investment, countless policies that would grow the economy have been ruled out due to the pressures of gerontocracy," Whelton concluded.

He warned that when faced with inevitable trade-offs between economic growth and the demands of an ageing electorate, "the grey vote seems to always win."