UK economy sees highest growth since early 2024

Labour's history of economic woes and recessions |

GBNEWS

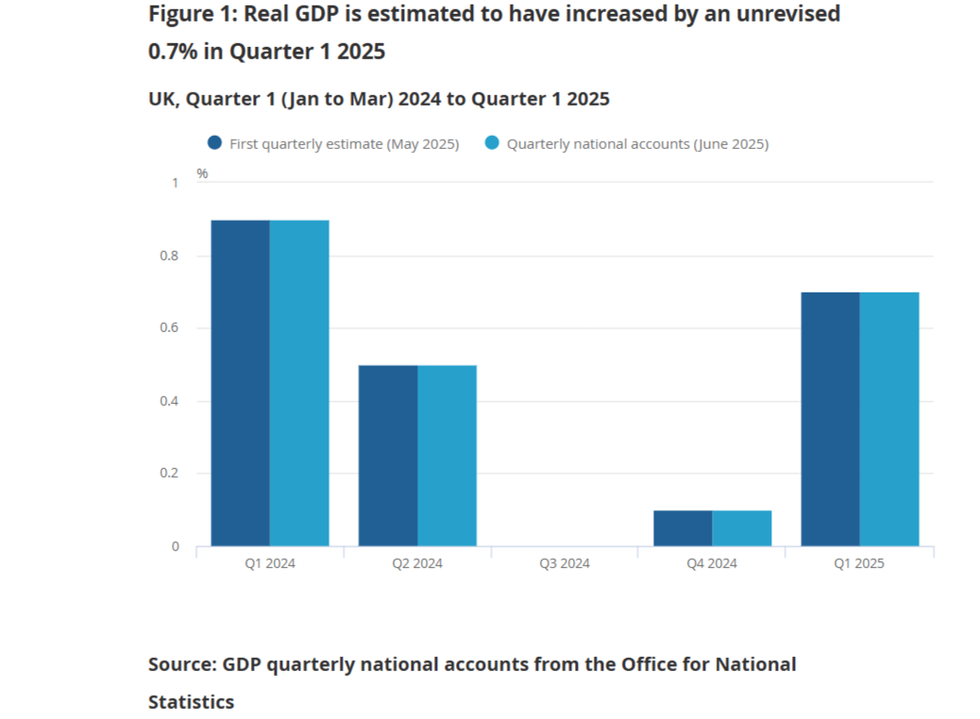

This marks the highest GDP rate since the first quarter of 2024

Don't Miss

Most Read

Latest

The UK economy expanded by 0.7 per cent between January and March, according to the Office for National Statistics (ONS)

The increase in gross domestic product (GDP) was driven by growth across all three main sectors.

Services output rose by 0.7 per cent, while production increased by 1.3 per cent and construction edged up by 0.3 per cent.

This first-quarter GDP figure was unrevised from the ONS’s initial estimate, confirming a steady start to the year after two quarters of economic contraction in 2023.

The last time the economy saw faster quarterly growth was in the first three months of 2024, when it grew by 0.9 per cent.

The household saving ratio, a measure of how much people save, fell for the first time in two years, to 10.9 per cent from 12 per cent, as they spent more on fuel, rent and restaurant meals.

The data comes as Chancellor Rachel Reeves faces mounting pressure to balance investment-led recovery with strict fiscal rules.

While the quarterly growth has been welcomed by the Treasury as evidence of economic momentum, many households are still grappling with high living costs, elevated tax burdens, and limited disposable income, raising questions over whether this recovery is reaching the publ

The data comes as Chancellor Rachel Reeves faces mounting pressure to balance investment-led recovery with strict fiscal rules.

|GETTY

The ONS said that while the quarterly out-turn was unrevised, monthly growth was slightly higher than first thought in March, at 0.4 per cent compared with the initial estimate of 0.2 per cent.

January saw zero growth and February saw expansion of 0.5 per cent, both unrevised.

Liz McKeown, ONS director of economic statistics, said: "While overall quarterly growth was unrevised, our updated set of figures show the economy still grew strongly in February, with growth now coming in a little higher in March too.

"There was broad-based growth across services while manufacturing also had a strong quarter. The saving ratio fell for the first time in two years this quarter, as rising costs for items such as fuel, rent and restaurant meals contributed to higher spending, although it remains relatively strong."

ONS updated set of figures show the economy still grew strongly in February

|ONS

The jump in Britain's economic output in early 2025 is not expected to last into the rest of this year. Data has already shown that gross domestic product fell by 0.3 per cent in April from March although the drop was exacerbated by one-off factors.

Matt Swannell, chief economic adviser to the EY Item Club, said: "After the strong start to 2025, the UK looks set for another year of weak growth, with headwinds continuing to intensify.

"On top of weakening real income growth, fiscal policy has been tightened, while some households will still feel the lagged effects of past interest rate rises.

"Global trade market volatility and the accompanying elevated levels of uncertainty have added to the headwinds."

Britain's property market saw a sharp increase in activity in the run-up to the March 31 expiry of tax break for some homebuyers.

The outlook has darkened since the start of April amid a sharp drop in employment, weak retail sales and plunging exports to the US.

Bank of England Governor Andrew Bailey has warned that the UK faces weak underlying growth, with business investment stalling and consumers tightening their spending.

Reeves’ £26 billion payroll tax hike came into force in April, a move she defended as essential for stabilising the public finances. However, critics say the measure has hit business confidence, dented hiring plans, and added to upward pressure on food prices.

Rachel Reeves’ £26 billion increase in a payroll tax kicked in at the start of April

| GBNEWSAdding to the strain, US President Donald Trump has triggered a fresh wave of global tariffs.

Although the UK secured a partial trade deal to soften the blow, British exporters are still bracing for disruption, with economists warning of knock-on effects for growth.

Thomas Pugh, chief economist at tax consultancy RSM UK, said: "Looking ahead, the second quarter will look substantially worse than the first quarter as there is some payback from activity brought forward to avoid taxes and tariffs.

"The big question now is whether the recent string of weak data in retail sales and employment is a one-off, due to the initial shock of tax increases and tariffs, or whether it’s the start of a new trend," he added.

More From GB News