EXPOSED: The staggering amount Rachel Reeves's tears cost the UK economy after stock market shock

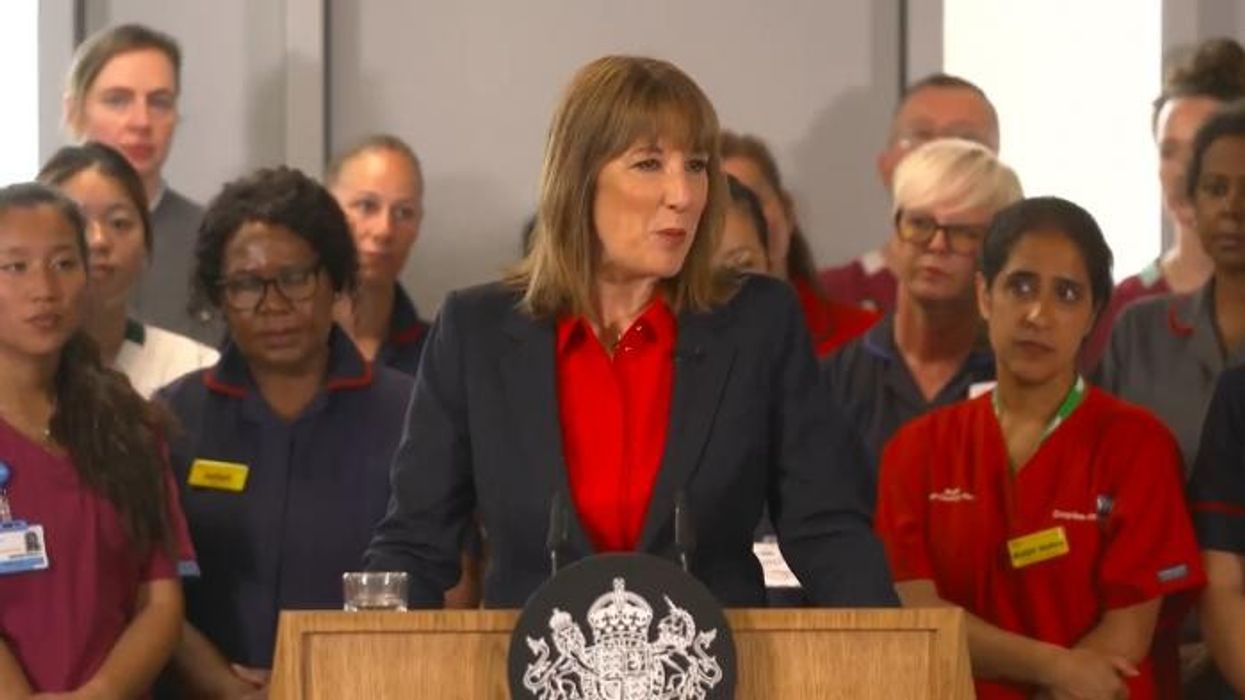

WATCH: Rachel Reeves makes a surprise appearance at the announcement of the NHS 10 year plan |

GB NEWS

The Chancellor is under more scrutiny following yesterday's stock market debacle

Don't Miss

Most Read

Latest

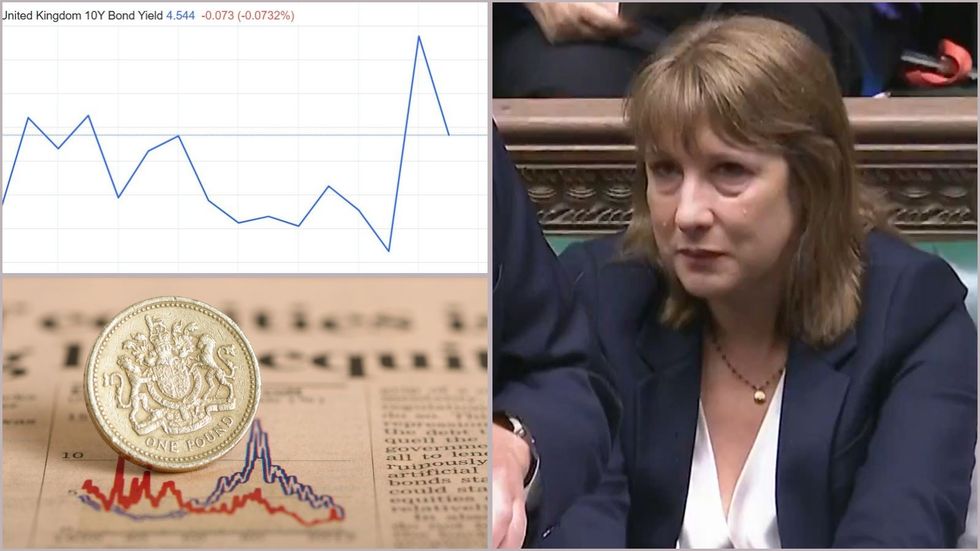

Chancellor Rachel Reeves's tears during Prime Minister's Questions (PMQs) yesterday are estimated to have cost the UK economy between £3-5billion in another blow to the Treasury's fiscal agenda.

While Reeves cited her visible upset as being due to a "personal issue", this did not stop the stock market from being thrown into turmoil at the prospect of her being removed from her post following Labour's major concessions on reforms to the benefits system in the Welfare Bill.

Financial markets have stabilised following Prime Minister Keir Starmer's declaration of support for the Chancellor today, reversing yesterday's dramatic sell-off that saw Government bonds and sterling plummet.

Dan Coatsworth, investment analyst at AJ Bell, said: "After yesterday's political chaos around the future of Rachel Reeves as Chancellor triggered a spike in UK Government bond yields, Starmer has now brought a sense of calm to markets."

Analysts are warning the Chancellor's tears cost the UK economy billions

|GETTY / PA / TRADING ECONOMICS

Gilt yields have pulled back from their peaks whilst sterling has rebounded against the dollar. The recovery extends to UK economically sensitive assets, with housebuilders and banks rallying in response to the renewed political stability.

In response to Reeves's appearance at PMQs, the 10-year gilt yield jumped by approximately 22 basis points to peak at around 4.68 per cent.

This made it the largest single-day rise since October 2022, in the wake of former Prime Minister Liz Truss and Chancellor Kwasi Kwarteng's infamous mini-Budget.

Sterling suffered a sharp decline of over one per cent, falling to approximately $1.3589 against the US dollar. The Telegraph reported that the market sell-off totalled £3billion.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

C

| PA"The initial sell-off in gilts and the pound was the market's way of saying it was losing faith in the economic outlook and political stability," Coatsworth explained, describing the reaction as "an electric shock for investors."

Danni Hewson, the head of financial analysis at AJ Bell, had warned yesterday that the spike in gilt yields might paradoxically strengthen Reeves's position.

"Ironically today's spike in gilt yields might help to shore up Reeves' position. Look out for one of her advisers popping a chart of today's gilt yield movements through the letterbox at Number 10," she said.

Hewson noted that markets reacted badly to speculation over the Chancellor's future "almost certainly because Reeves has been firm in her fiscal rules which limit Government borrowing."

- Why did the Chancellor really cry at PMQs? GB News blows the lid on an extraordinary moment in British politics

- POLL OF THE DAY: Do you back Rachel Reeves to deliver the next Budget? - VOTE NOW

- EXPOSED: Labour quietly rubber-stamps sweeping EU regulation on the WHOLE of Britain in SHOCK Brexit betrayal

- Get FIVE free entries into The Great British Giveaway when you become a GBN member

- EXPOSED: Labour quietly pushing through three Bills that threaten free speech as all eyes on benefits cuts

She warned that "the prospect of a new Chancellor opens up the possibility of tweaks to those rules before the Autumn Budget, and a looser approach to borrowing."

With the strict eligibility rules for Personal Independence Payments (PIP) now being axed, the Government now faces significant fiscal challenges following recent U-turns on winter fuel allowances and welfare reforms.

LATEST DEVELOPMENTS:

The Chancellor made an appearance at the Prime Minister's announcement of the 10-year plan for the NHS earlier today

|PA

City AM calculated the reversals created a £4.3billion gap, combining £3billion from the welfare U-turn with £1.3billion from reinstating Winter Fuel Payments.

"Given the Government's U-turns on Winter Fuel Allowance and welfare reforms, it now looks very likely we'll be facing more tax rises in the autumn," Hewson warned yesterday.

She highlighted additional pressure from the Office for Budget Responsibility's (OBR) admission of over-optimism in medium-term forecasts, which could mean growth downgrades.

The OBR had previously flagged a £5.5billion fiscal impact from PIP reforms, though post-U-turn net savings have vanished.

More From GB News