Pension savers could get ‘generous increase’ to retirement pots in Jeremy Hunt’s Budget

UK issued 'crisis' warning as state pension age set to increase to … |

Jeremy Hunt could scrap an ongoing stealth tax which is resulting in people paying more tax on their pension savings in a couple of weeks time

Don't Miss

Most Read

Retirement savers could be awarded a “generous increase” to their pension pot following the Spring Budget next month, an expert has suggested.

Analysts are calling on Chancellor Jeremy Hunt to address the issue of fiscal drag which has been a bi-product of the freeze on tax allowances.

Becky O’Conner, the director of Public Affairs at PensionBee, said Mr Hunt is “unlikely” to announce any direct changes to the pension taxation system in light of certain changes.

However, she suggested the Chancellor may scrap a stealth tax impacting low earners and pensioners.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

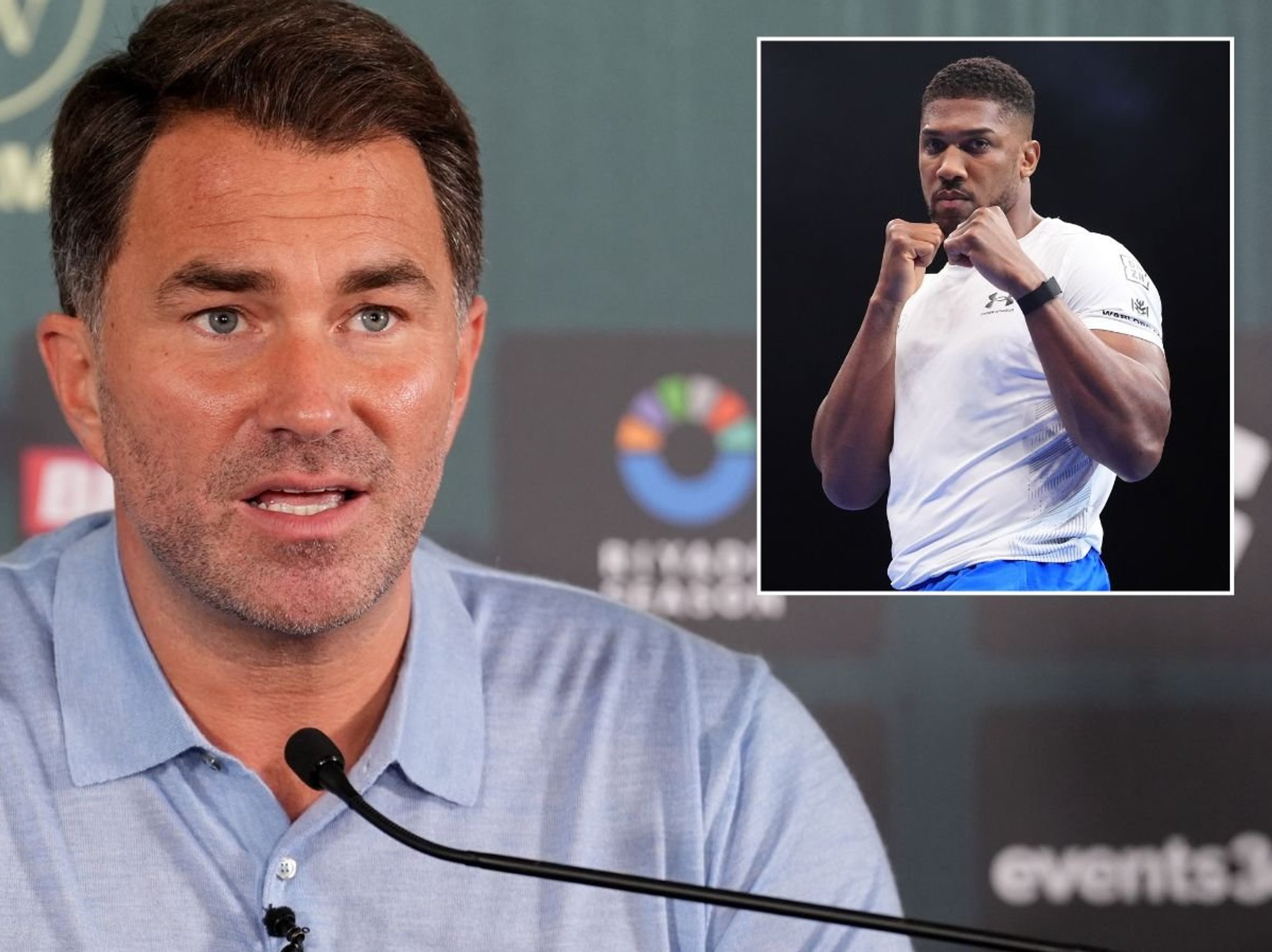

Hunt is being called to raise tax allowances to help pension savers

|GETTY

Recent pension reform includes last year’s abolition of the Lifetime Allowance, hiking the Annual Allowance from £40,000 to £60,000 and raising the Money Purchase Annual Allowance from £4,000 to £10,000.

However, Ms O’Conner highlighted how increasing the personal tax allowance would benefit multiple generations, including older Britons.

She said: “One move the Chancellor could make for everyone, but especially pensioners and others on low incomes, would be to increase the personal tax allowance from its current level of £12,570.

“This would also counter accusations that the Government has been pursuing a policy of ‘fiscal drag’, allowing wage growth to bring more people over tax thresholds and generating more revenue.”

In the Autumn Budget last year, Mr Hunt confirmed that the existing freeze on tax allowances would remain in place until April 2028.

Experts have warned that this is contributing to fiscal drag and leading to households paying more tax than they would otherwise.

However, this is not the only threshold that PensionBee’s director of Public Affairs believes should be raised.

Ms O’Connor added: “Another move that could benefit many people, but especially the older generation, would be to increase the personal savings allowance for tax on interest.

LATEST DEVELOPMENTS:

Britons are being taxed on their savings due to frozen thresholds

| PEXELS“Currently, basic rate taxpayers can receive £1,000 in interest without paying tax. As interest rates have increased, the likelihood of savers facing tax liabilities from going over these thresholds has increased.

“It’s possible that the Government could look to win over savers, in particular older savers who tend to have larger balances, with a generous increase here.”

Mr Hunt will announced any further changes to pension, tax or savings rules during the Spring Budget on March 6, 2024.