1.4 million Britons to be slapped with ‘shock tax bill’ on savings accounts: ‘Take urgent action!’

Fiscal drag could force millions of Britons to pay tax on their savings for the first time

Don't Miss

Most Read

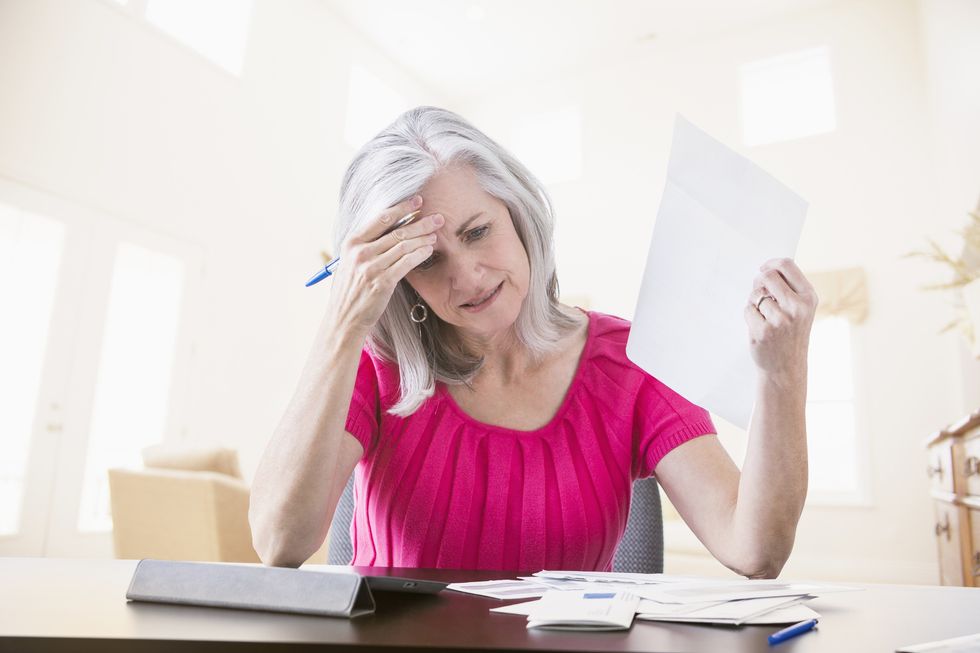

Millions of savers are set to be hit with a “shock tax bill” in the next few months, according to new research. Coventry Building Society is warning that 1.4 million individuals will be dragged into paying the higher rate of tax and see the amount they can earn on tax-free savings interest halved.

The Office for Budget Responsibility’s (OBR) Economic and Fiscal Outlook found 3.8 million taxpayers will pay more due to Chancellor Jeremy Hunt’s decision to freeze income tax thresholds. This results in fiscal drag, where wages rise but tax allowances remain the same, which causes people to inadvertently pay more tax.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Fiscal drag is dragging Britons into higher tax brackets

|GETTY

Around 1.4 million people will be pulled into the higher rate tax band, hence their Personal Savings Allowance will be slashed to just £500.

This basic rate for the Personal Savings Allowance is currently £1,000 which is the amount taxpayers can get in savings interest without having to pay tax.

This allowance will plummet to £500 for anyone who pays even a penny over £50,270, which is the threshold for paying the higher tax rate.

The Personal Savings Allowance is depleted entirely for Britons who pay the additional rate of tax on incomes earning more than £125,140.

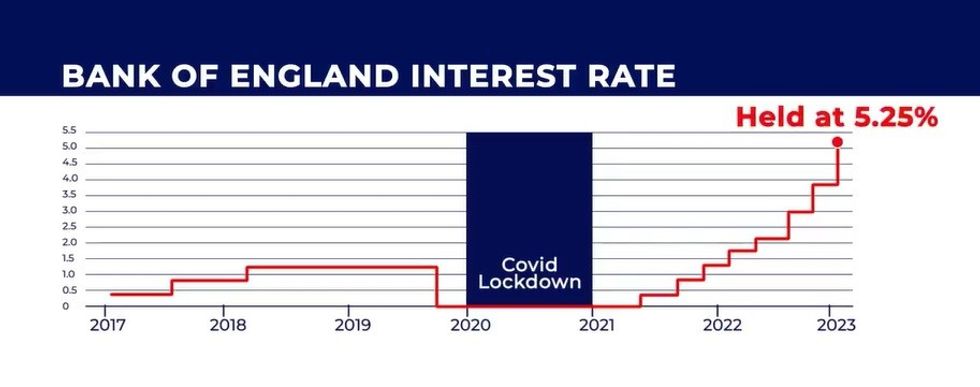

Recently, HM Revenue and Customs (HMRC) has reported large increases in savings income receipts due to recent hikes to interest rates and the Government’s decision to freeze thresholds.

In his Autumn Budget, the Chancellor confirmed the existing tax thresholds would remain frozen until 2028.

Jeremy Cox, the head of Strategy at Coventry Building Society, urged bank and building society customers to check whether they are at risk of paying more tax on their savings.

He explained: “Millions of savers will be hit with a shock tax bill or stealth changes to their tax codes as they exceed their Personal Savings Allowances in this tax year.

LATEST DEVELOPMENTS:

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWSHowever, the savings expert reminded savers of the “good news” that will protect their savings from income tax. Mr Cox added: “Everyone can save up to £20,000 in an ISA each tax year and any interest payments will be shielded from income tax from then on.

“Without the protection of an ISA, higher rate taxpayers need just £10,000 earning a ‘best buy’ rate of five per cent before the interest they receive uses up their £500 Personal Savings Allowance. After that they would be hit with 40 per cent tax on any additional interest they are paid.

“Tax bills will steadily rise for anyone with non-ISA savings that has exceeded their Personal Savings Allowance.

“There are only a few months left to make full use of this year’s tax-free ISA allowance of £20,000, but a new and completely separate £20,000 allowance for the 2024/25 tax year will be available from April 6.”