Netflix deal under fire as Paramount launches £80bn hostile takeover offer for Warner Bros.

The streaming giant confirmed its nearly $83billion dollar deal to buy Warner Bros. film and television studios last week

Don't Miss

Most Read

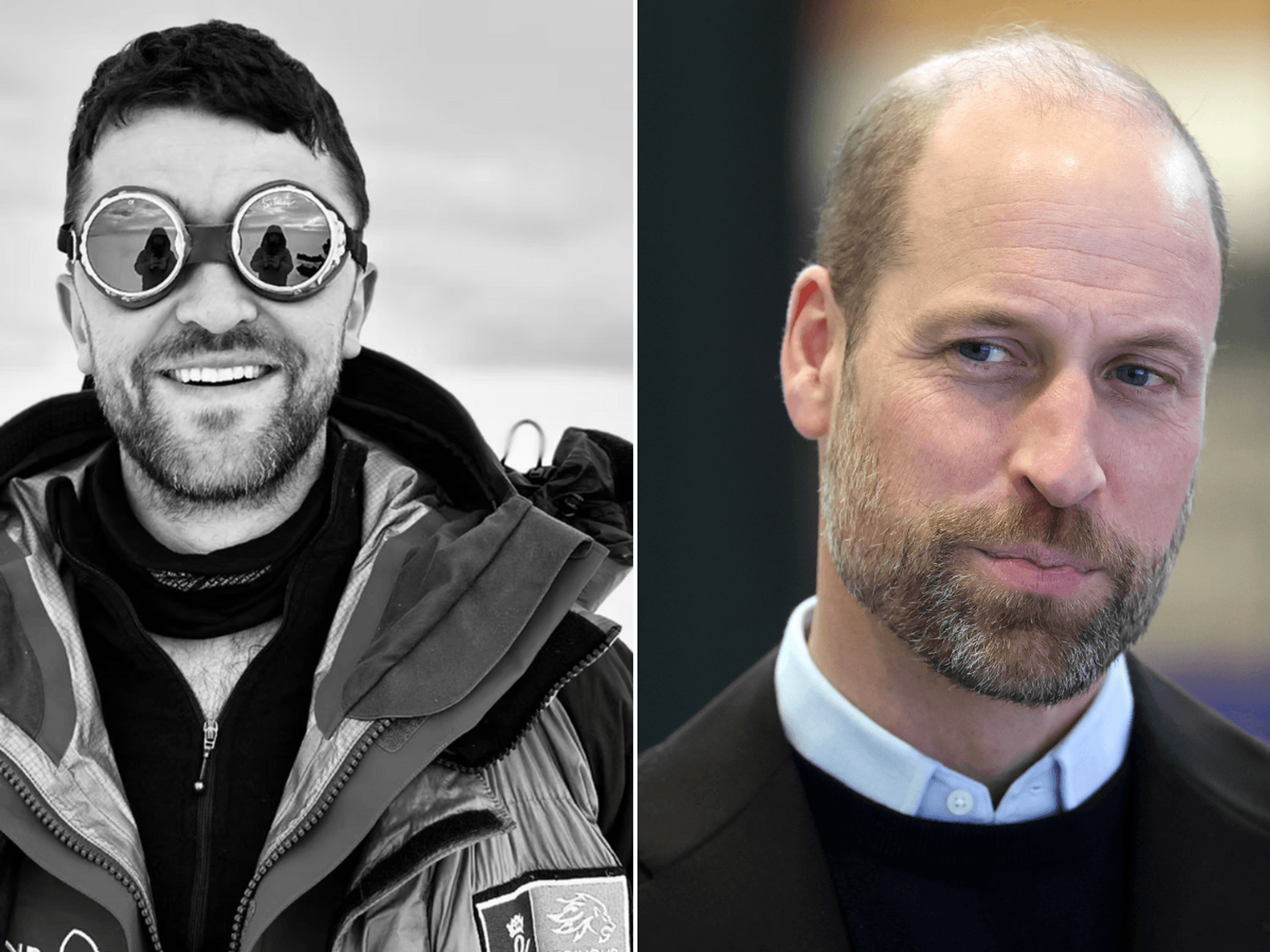

Global film studio Paramount has launched a $108billion (£80billion) hostile takeover bid for Warner Bros Discover as a major bidding war in Hollywood begins, the company confirmed in a statement earlier today.

Last week, Netflix announced plans to purchase Warner Bros. film and television studios as part of a landmark $82.7billion (£62billion) deal which could permanently change the entertainment industry.

David Ellison, Paramount's chief executive, has called Netflix's offer an "inferior proposal" and is telling Warners shareholders that his coalition promises $18billion (£13.5billion) more in cash.

Mr Ellison's father, Larry Ellison, is the chief technology officer at tech giant Oracle and a close ally of President Donald Trump, who has raised competition concerns over the Netflix-Warner merger.

Paramount has launched a hostile takeover offer for Warner. Bros

|GETTY

In a statement, a Paramount spokesperson shared: "The Paramount offer for the entirety of WBD provides shareholders $18billion more in cash than the Netflix consideration.

"WBD’s Board of Directors recommendation of the Netflix transaction over Paramount’s offer is based on an illusory prospective valuation of Global Networks that is unsupported by the business fundamentals and encumbered by high levels of financial leverage assigned to the entity."

Mr Ellison added: "WBD shareholders deserve an opportunity to consider our superior all-cash offer for their shares in the entire company. Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion.

"We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process.

Donald Trump has raised concerns about the deal

| REUTERS"We are taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximize the value of their shares."

As part of Netflix's offer, the world's largest streamer is offering $27.75 per share, which will see each Warner Bro. shareholder receive $23.25 in cash and $4.50 in shares of Netflix common stock.

Furthermore, Netflix Netflix is putting forward a $5.8billion reverse breakup fee if Government regulators do not approve the deal.

This slightly topped the $5billion that Paramount Skydance had offered in its latest bid before the announcement before confirmation of the merger late last week.

LATEST DEVELOPMENTS

Superman would become a Netflix property under the deal

| DCOver the weekend, President Trump asserted that a deal struck by Netflix to buy Warner Bros. Discovery "could be a problem" because of the size of the combined market share.

Danni Hewson, AJ Bell head of financial analysis, shared: "It could also be argued that Netflix is picking off the cherry on top of the Warner Bros empire and leaving the problem of what to do with the cable networks to someone else once that part of the business is spun off.

"For Netflix, the benefits are obvious. Adding the likes of Game of Thrones, Harry Potter and the DC Universe to its roster of content is a huge win, as is snapping up all those streaming subscribers that currently plump for HBO Max.

"Netflix has offered an olive branch to a nervous Hollywood, with promises to keep releasing Warner Bros studio films on the big screen. It might be a streaming behemoth but it’s also a disrupter, a relatively new kid on the block that was once looked down on by the boss of the very studio it’s now going to own."

More From GB News