Martin Lewis urges public to use anti-scam phone number

The three-digit hotline connects customers directly to their bank and blocks fraudsters from spoofing calls

Don't Miss

Most Read

Martin Lewis is encouraging bank customers to remember a simple three-digit code that could protect them from fraudsters.

The consumer champion has been spreading awareness about dialling 159, a special number that connects people directly to their legitimate bank when they are worried about potential scams.

In a video shared on social media in May, Mr Lewis explained how the service works when someone receives a suspicious call claiming to be from their bank.

"If you get a call from your bank, you're not sure it's really them, they're asking for personal details, you're a little bit worried. Just say 'I'm going to call you back via your switchboard', hang up and dial 159," he advised.

The service provides a straightforward way to verify whether you are speaking to your actual bank.

When you dial 159, an operator asks which bank you would like to reach and then connects you directly to their official switchboard.

It is designed as an anti-fraud measure that helps people access legitimate contact details without having to search for them.

"This is done as an anti-scam and anti-fraud initiative so that you can always get through to a legitimate number without having to look it up. Just remember 159," Mr Lewis explained.

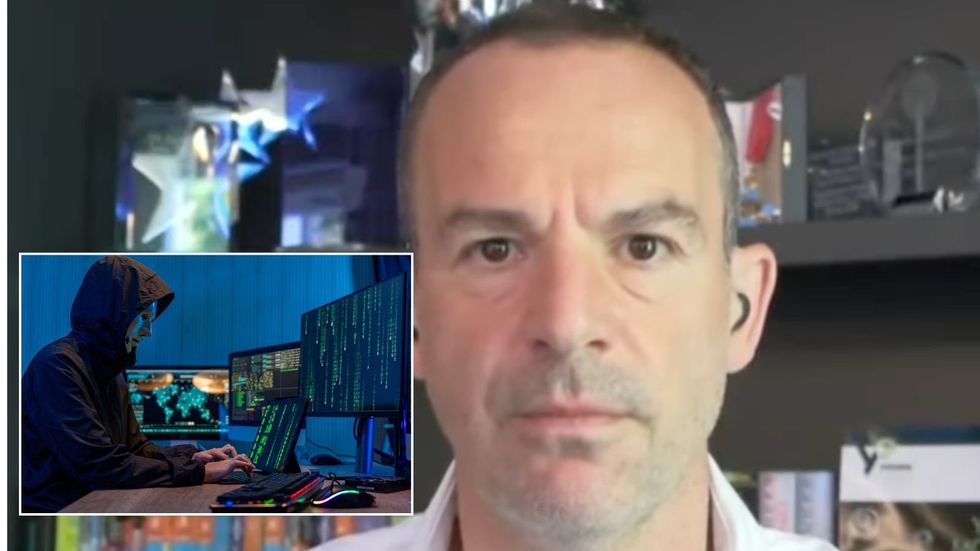

Martin Lewis is urging bank customers to remember the three-digit code 159, which connects you directly to your bank to avoid scams

|ITV GMB/GETTY

The system interrupts the scam process at the crucial point when people might be pressured into transferring money.

The service is operated by StopScamsUK and includes 21 banking and building society brands that have signed up to participate.

This represents 99 per cent of the UK market, with major institutions like Barclays, HSBC, Lloyds, Halifax, Bank of Scotland, NatWest, Santander and Nationwide all covered.

Digital banks such as Monzo and Revolut are also part of the scheme.

Phone theft surge heightens scam risk

Mr Lewis’s advice comes amid a surge in phone thefts across the UK, with new data from device protection provider SquareTrade (part of Allstate) revealing a 425 per cent rise in snatch-related claims between June 2021 and May 2025.

The figures align with Metropolitan Police statistics, which show London now accounts for 42 per cent of all UK phone thefts, followed by Ilford and Birmingham.

The Metropolitan Police recently seized 1,000 stolen phones in a single week, underscoring the scale of the issue.

Beyond the £1,200 average device cost, victims face risks to banking apps, crypto wallets and cloud data, all of which thieves can now gain access to – creating a cascading breach that can compromise a victim's entire digital ecosystem for months.

Despite the risks, only 20 per cent of Londoners have any form of device insurance, even though 58% report being vigilant about theft.

Latest Development

Digital banks such as Monzo and Revolut are also part of the scheme.

| MONZOThe initiative was established in 2021 as a memorable and straightforward method for UK banking customers to connect safely with their financial institutions.

It is specifically designed to protect people at the moment they're most vulnerable to being tricked into making fraudulent payments.

One of the key advantages of 159 is that fraudsters cannot manipulate or fake it.

While scammers can spoof regular phone numbers to make it appear they are calling from your bank, the three-digit code is protected from this type of deception.

The number can also connect callers to several telephone providers, including BT, O2, Sky, Three, Vodafone, TalkTalk and Virgin

| PAThe 159 hotline has fielded more than 800,000 calls since it began operating.

Beyond banking services, the number can also connect callers to several telephone providers, including BT, O2, Sky, Three, Vodafone, TalkTalk and Virgin.

StopScamsUK describes the service as a memorable and simple method for connecting banking customers securely with their financial providers.

The organisation says it disrupts the scammer's tactics at the critical moment when victims are most at risk of being manipulated into transferring funds or sharing sensitive information.