Bank of England issues major update for savers as rate setter warns 'this is necessary'

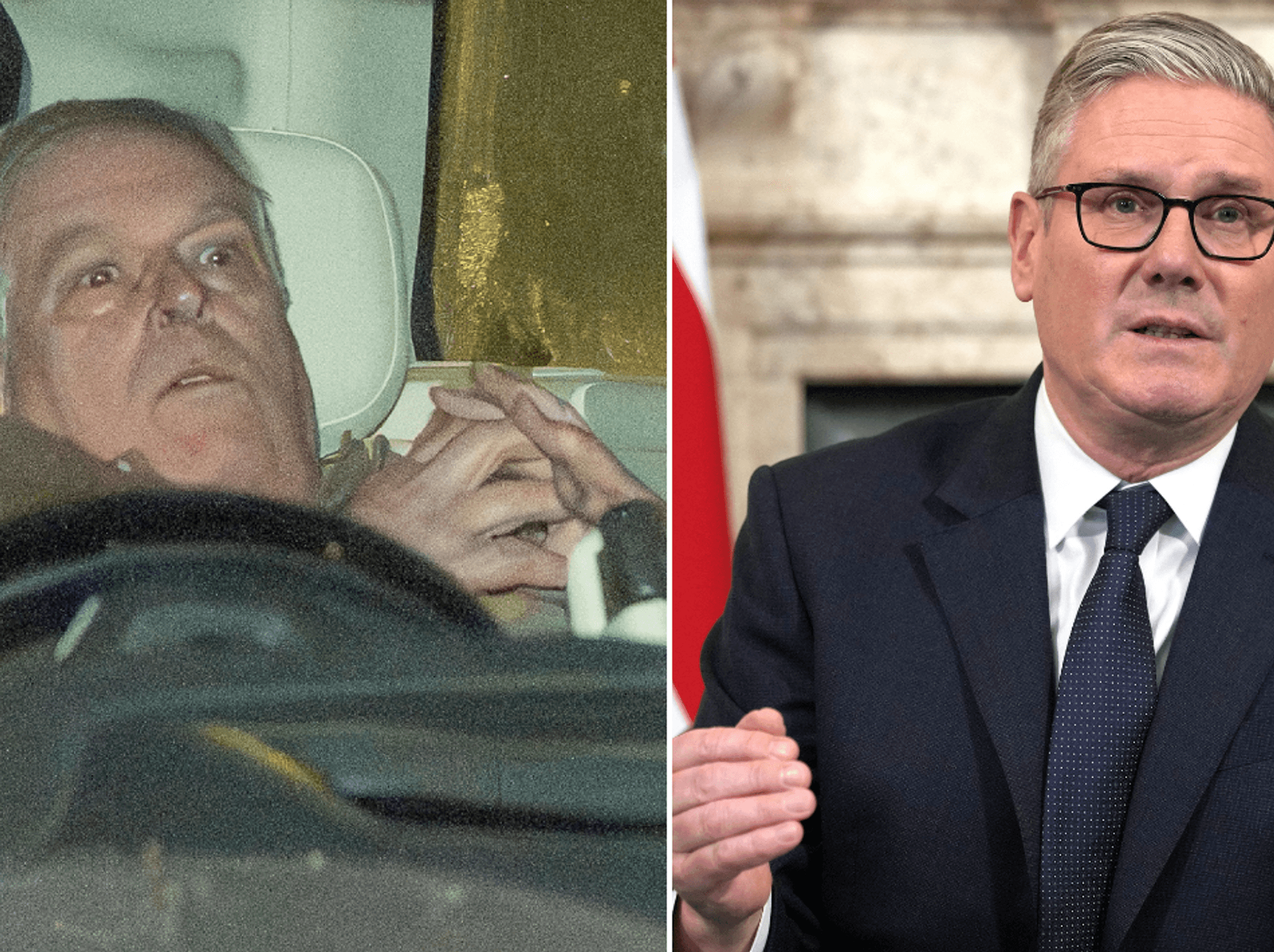

Nigel Farage and Richard Tice meet with Andrew Bailey at Bank of England |

GB News

Catherine Mann argues high interest rates are needed to restore household confidence and spending power

Don't Miss

Most Read

A Bank of England policymaker has argued maintaining elevated interest rates will ultimately boost household spending, despite current concerns about weak consumer demand.

Catherine Mann, an external member of the Bank's Monetary Policy Committee, laid out her thoughts during a Resolution Foundation event.

She acknowledged her stance does appear to contradict conventional economic thinking about stimulating growth through lower borrowing costs.

The economist argued keeping monetary policy restrictive for an extended period is essential to tackle persistent inflation, even though consumption among UK households remains subdued, and is hampering overall economic growth.

TRENDING

Stories

Videos

Your Say

Catherine Mann argues high interest rates are needed to restore household confidence and spending power

|GETTY/PA

Ms Mann's position represents a deliberate choice to prioritise inflation control over immediate consumption concerns, with the goal of creating conditions for stronger spending in the future.

She explained that while reducing monetary policy restrictiveness would be the appropriate response if weak consumption were the sole issue, the reality of elevated inflation and inflation expectations demands a different approach.

"If the consumption gap was my only concern, reducing the restrictiveness of monetary policy would be appropriate," she stated during her speech.

"However, in light of elevated inflation and expectations, maintaining restrictiveness for longer would be appropriate."

The policymaker emphasised that restrictive monetary policy, which involves maintaining interest rates at elevated levels, remains necessary despite its impact on growth.

Bank of England Governor Andrew Bailey warns the UK is "not out of the woods" regarding inflation

| Getty ImagesThe Bank held rates at 4 per cent during its September meeting, with Governor Andrew Bailey warning the UK was "not out of the woods" regarding inflation.

Ms Mann's stance reflects a calculated trade-off between addressing immediate consumption weakness and achieving longer-term price stability.

Official figures reveal that UK inflation stood at 3.8 per cent in August, nearly double the Bank of England's 2 per cent target.

The data shows food and drink prices have risen for five consecutive months.

Ms Mann highlighted the cumulative effect of recent price increases, noting that UK prices have risen by 30 per cent since before the inflation surge of 2021 to 2022.

Latest Developments

UK inflation trends since 2023

|ONS/CoPilot

"This means that UK households have experienced 12 years of inflation in a little over two years," she told the Resolution Foundation event.

The substantial price increases have fundamentally altered household budgets, with consumers facing costs that would typically accumulate over more than a decade compressed into just two years.

"It is perhaps counterintuitive that in order to create an environment conducive to growth, monetary policy must remain restrictive for longer."

She insisted this strategy is essential for achieving the Bank's inflation objectives.

"But this is necessary to bring inflation sustainably back to our 2 per cent target in the medium term," she explained during her Resolution Foundation speech.

More From GB News