Rachel Reeves could U-turn on inheritance tax amid latest Jeremy Clarkson pressure

Jeremy Clarkson fumes at Victoria Derbyshire in fiery interview - ‘Classic BBC’ |

BBC Newsnight

Whitehall officials weigh major adjustment to ‘family farm tax’ after months of pressure from rural communities

Don't Miss

Most Read

Ministers are said to be examining significant changes to the controversial agricultural inheritance tax measures, with discussions centering on a fivefold increase to the current threshold.

Officials within Whitehall are understood to be considering raising the limit from £1million to £5million — a move that would exempt smaller agricultural holdings from the levy introduced in last year’s Budget.

The Department for Environment, Food and Rural Affairs is drawing up proposals to present to the Treasury ahead of the Chancellor’s Budget on November 26.

It follows months of pressure from the agricultural sector, which has mounted an extensive campaign against what critics have branded the “family farm tax” since its announcement twelve months ago.

TRENDING

Stories

Videos

Your Say

The Chancellor unveiled the reforms in October 2024, imposing a 20 per cent levy on agricultural estates exceeding £1million, with implementation set to start from April 2026.

Previously exempt from such taxation, farming families now face substantial bills that campaigners warn could force generational businesses to sell land or shut down.

The announcement triggered unprecedented demonstrations, with around 13,000 agriculturalists descending on Westminster.

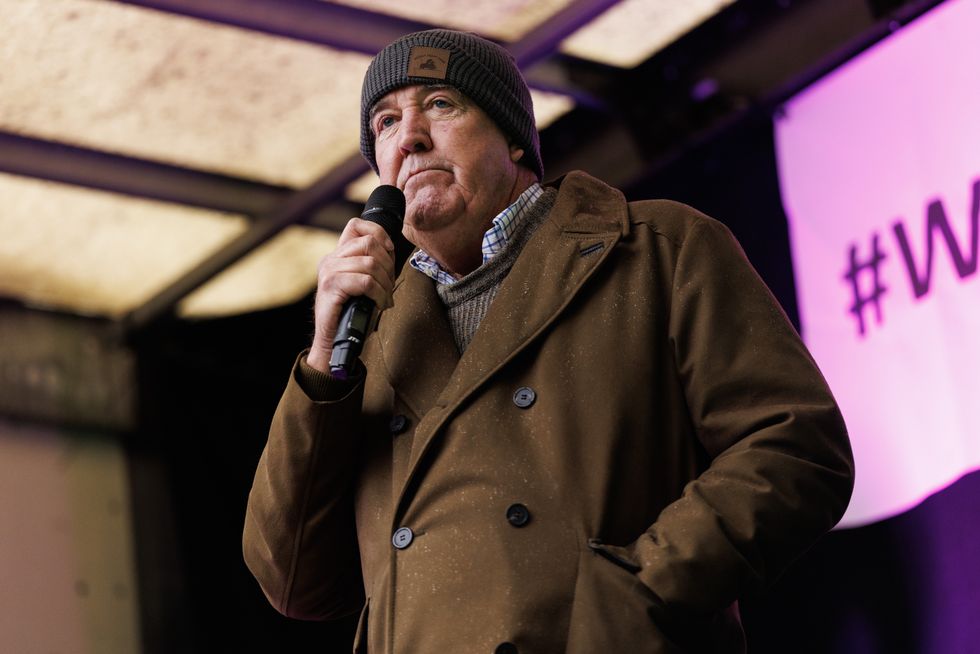

Jeremy Clarkson - who owns a 1,000-acre farm in Oxfordshire - was a prominent figure in the agricultural movement, pushing back against Chancellor Rachel Reeves’s reforms.

Placards branding the Prime Minister as “the farmer harmer” captured the depth of rural anger - with Mr Clarkson among them.

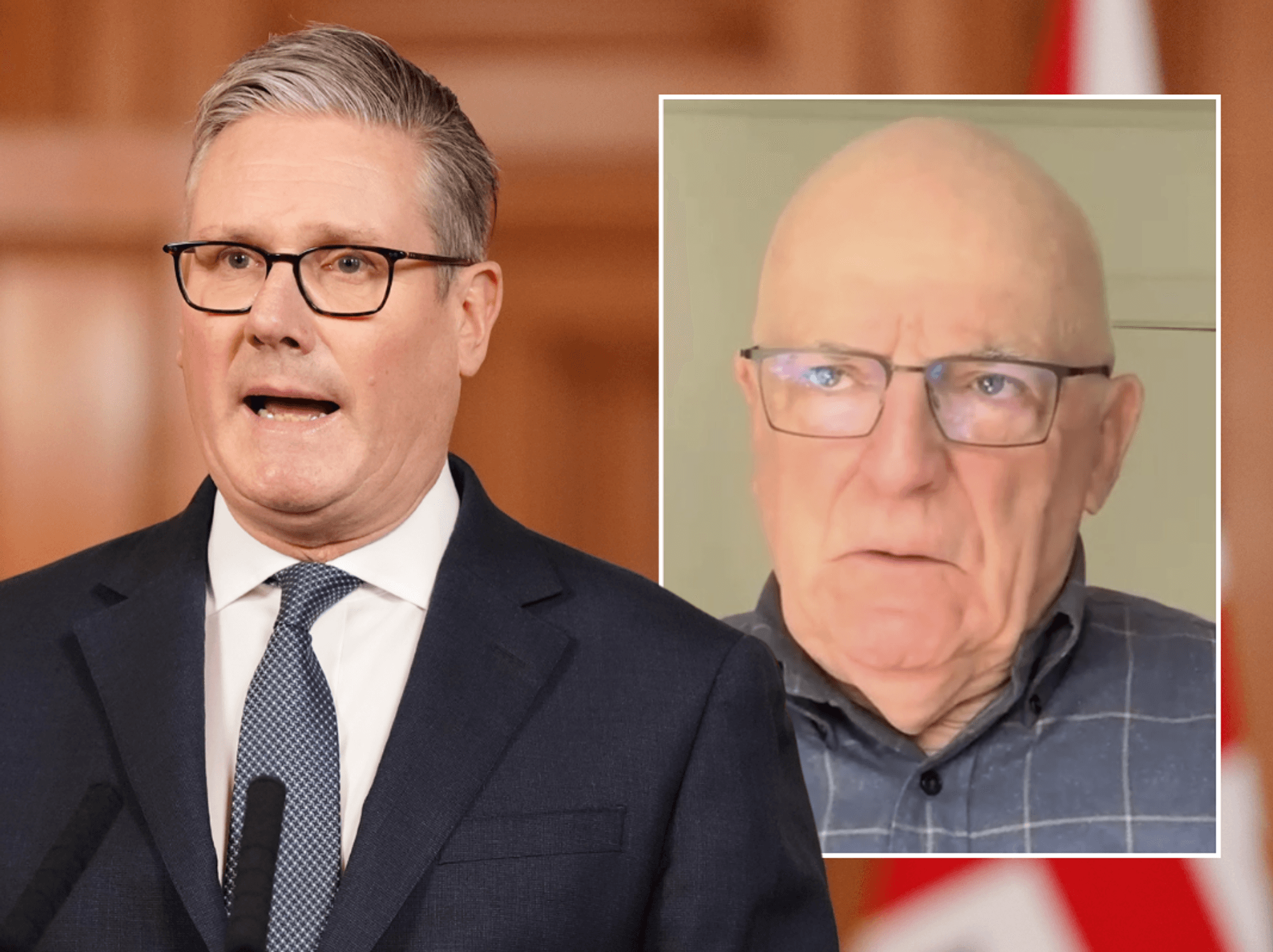

Jeremy Clarkson's campaign against Rachel Reeves' tax reforms have taken a new turn

|GETTY

The Treasury maintains the measure will affect only 2,000 of the wealthiest agricultural estates and raise £2billion annually.

But under the proposed changes, the 50 per cent relief for holdings above the new threshold would be removed.

This would mean larger agricultural enterprises could face the full 40 per cent inheritance tax rate on assets above £5million.

Senior farming figures warn this could drive larger operators to divide their businesses or sell land to avoid the levy, potentially hitting food production.

The Sunday Times reports that discussions have so far focused mainly on threshold adjustments, though the Treasury has declined to comment on what it calls “speculation”.

Scepticism remains high in the farming community, with many saying trust has been “irreparably damaged”.

Latest Developments

Farmers have been protesting Chancellor Rachel Reeves' Autumn Budget policy for several months | PA

Farmers have been protesting Chancellor Rachel Reeves' Autumn Budget policy for several months | PARichard Cornock, who runs a small dairy farm in south Gloucestershire that has been in his family since 1822, became visibly emotional discussing the policy.

He said: "I've been under so much stress like most farmers worrying about this tax," he said, pausing mid-interview as he struggled to continue."

Mr Cornock, who hopes to pass the holding to his 14-year-old son Harry, revealed he had explored life insurance options but was refused coverage because of a heart condition.

Asked whether a policy shift could restore trust in Labour, he replied bluntly: “The damage has been done.”

Political reaction has been swift. Shadow Environment Secretary Victoria Atkins said the Chancellor should “scrap the tax altogether” rather than simply adjust it.

"It is not good enough for Rachel Reeves simply to tinker with this awful tax grab — she should drop it entirely," she said, pledging that the Conservatives would reverse the measure if returned to power.

The Countryside Alliance’s Mo Metcalf-Fisher pointed to the “crippling anxiety” caused in rural communities.

Financial Secretary James Murray (Lord Livermore) defended the reforms, insisting they strike a balance between supporting farmers and funding public services.

The row has drawn in high-profile voices, including broadcaster Jeremy Clarkson, who has become a vocal opponent of the so-called “Tractor Tax”

| GETTYThe row has drawn in high-profile voices, including broadcaster Jeremy Clarkson, who has become a vocal opponent of the so-called “Tractor Tax”.

The television presenter Jeremy Clarkson has fuelled speculation about a potential political run in the latest development of his campaign against Rachel Reeves' inheritance tax reforms.

The broadcaster hinted he could challenge Ed Miliband in Doncaster North as farmers wage a growing campaign against the Government’s plan to impose a 20 per cent inheritance tax from April 2026 on farms valued above £1million.

Mr Clarkson joined approximately 13,000 farmers who gathered in Westminster last year to protest against the decision, urging the Government to "back down" and "be big enough" to acknowledge they "made a mistake" with the policy.

More From GB News