Council tax house price lottery: How owners of multi-million-pound homes pay 0.03%

Bradford residents slam council for 10% tax rise |

GB News

Fresh analysis reveals a threefold difference in proportional council tax between London and northern cities

Don't Miss

Most Read

Britain's council tax regime has created a profound disparity between regions, with homeowners in the capital contributing merely 0.27 per cent of their property's worth annually, while residents in Newcastle Upon Tyne and Preston shoulder 0.79 per cent.

Analysis from PropertyData reveals a threefold difference in proportional burden between London and northern cities.

The figures expose how the current framework, rooted in property assessments from 1991, has produced vastly unequal outcomes across the nation.

Wandsworth residents with Band D properties face bills of £990.07 despite average house values reaching £691,000.

TRENDING

Stories

Videos

Your Say

Their Newcastle counterparts pay £2,463.98 for Band D homes worth typically £205,000.

This geographic imbalance has prompted Labour to explore potential reforms to the antiquated system that determines local taxation across England.

The most striking disparities emerge when examining individual properties across the country.

A Kilburn residence that changed hands for £3.46million in July 2024 attracts annual council tax of merely £2,940.96, representing 0.03 per cent of its market value.

The property sits in Band F, reflecting its 1991 assessment between £120,001 and £160,000.

Council tax burden in northern cities is triple that of London, fresh data reveals

|GETTY

Meanwhile, a Preston home in the same band, purchased for £202,500 in December 2024, incurs £3,396.94 yearly, equating to 1.67 per cent of its worth.

Another North West London property fetched £4.3million in August 2024 yet generates council tax of just £2,487.85, or 0.06 per cent of its value.

A comparable Band E dwelling in Preston, sold for £148,500 in July 2025, faces an annual bill of £3,015.67, representing 2.03 per cent of the purchase price.

The mathematics reveal an extraordinary gulf in proportional taxation between regions.

Preston residents with Band E properties effectively contribute twenty-nine times more relative to their home's worth than owners of equivalent London properties.

Latest Development

Residents in Newcastle Upon Tyne and Preston pay 0.79 per cent of their house price in council tax

|GETTY

Liverpool households surrender 0.73 per cent of their property value annually, while Nottingham residents pay 0.72 per cent.

Southern areas fare considerably better, with Romford and Chelmsford homeowners contributing just 0.48 per cent of their properties' market value.

The typical Band D property across England attracts £2,280 in council tax for 2025 to 2026, yet this masks enormous regional variations.

These disparities stem from valuations frozen since 1991, when property markets bore little resemblance to today's landscape.

The consequence is a postcode lottery where northern communities bear disproportionate burdens while affluent southern districts enjoy minimal taxation relative to their wealth.

Michael Dent, director at PropertyData, characterises the system as "unfair and arbitrary".

Mr Dent points to the reliance on theoretical valuations from thirty-four years ago, creating what he describes as "a geographic and individual property lottery".

The disparity has widened as property values have evolved unevenly across Britain since 1991."

Properties in the same council tax band are supposed to be worth roughly the same nationally, but uneven price growth has resulted in wide variations in the average value of Band D properties by city," Mr Dent observes.

His analysis underscores how the frozen valuations have transformed council tax into an accident of geography rather than a fair contribution to local services.

Areas experiencing rapid property appreciation have seen their proportional tax burden shrink dramatically while regions with modest growth face escalating relative costs.

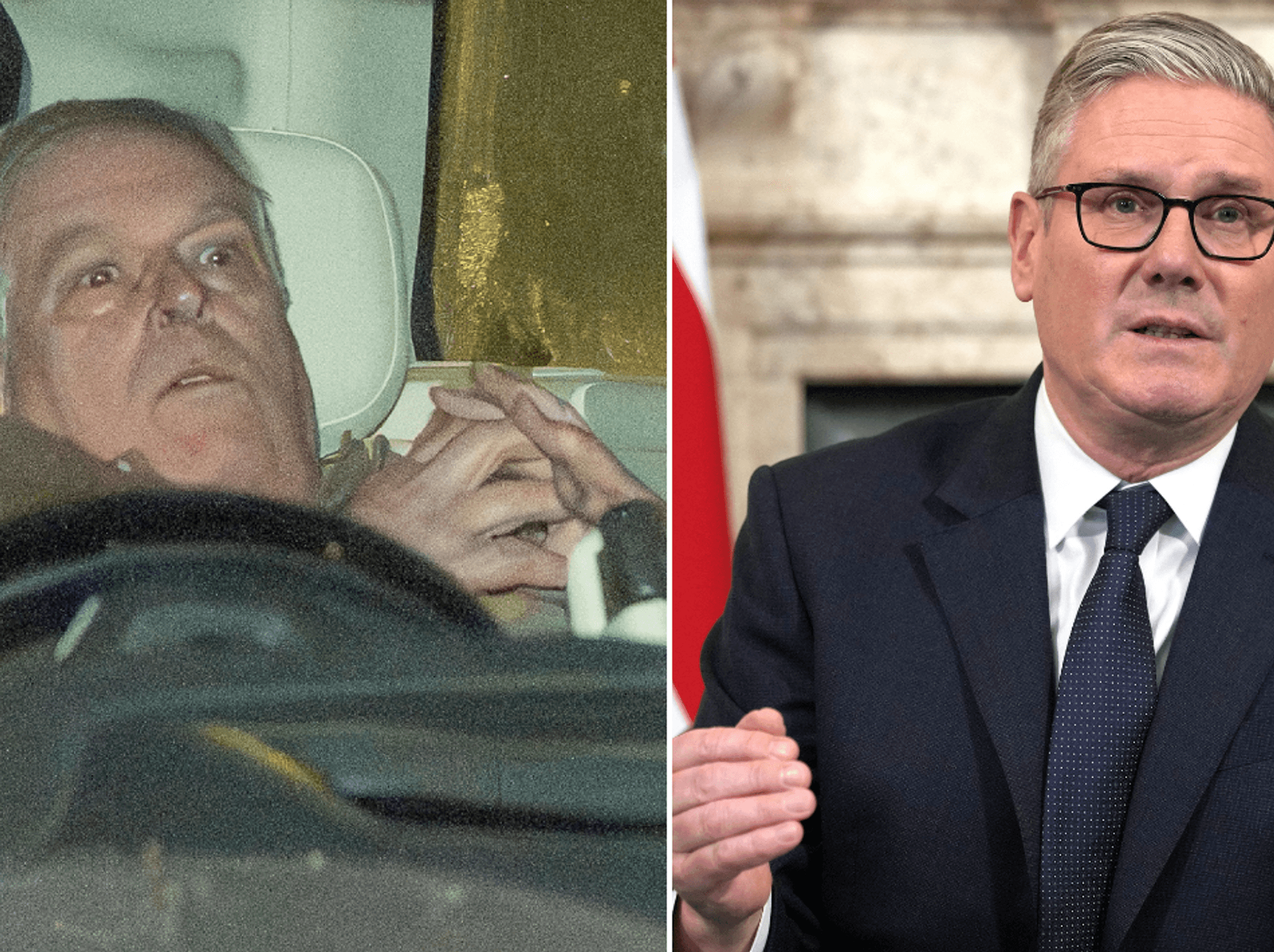

Housing Secretary Steve Reed has ruled out revaluing existing council tax bands before 2029, but the introduction of new categories is still on the table

|GETTY

Treasury officials are reportedly examining comprehensive changes to property taxation ahead of the autumn statement on November 26.

One proposal from Tim Leunig at think-tank Onward suggests replacing stamp duty and council tax with unified levies, including a local charge of 0.44 per cent on properties up to £500,000, capped at £2,200.

Housing Secretary Steve Reed has excluded revaluation of existing bands before 2029, though additional categories remain possible.

Jeremy Leaf, former RICS residential chairman and north London estate agent, advocates creating at least two extra bands as a pragmatic solution.

"Lower income households generally are paying a higher percentage of their income on council tax," Mr Leaf notes, suggesting band expansion could generate revenue while avoiding the political challenges of comprehensive revaluation.

More From GB News