ISA tax raid SLAMMED as 'clumsy' with Rachel Reeves called to make saving 'easier'

GB NEWS

Finance experts are urging the Chancellor to improve the ISA status quo

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves is being called to make ISAs "easier" for Britons to access and avoid a stealth tax raid on savings during her Autumn Budget on November 26.

Investment platform AJ Bell has submitted comprehensive proposals to the Treasury advocating significant reforms to individual savings accounts and pension protections before Ms Reeves delivers her fiscal statement

The financial services firm's pre-Budget submission centres on simplifying the current ISA framework whilst safeguarding retirement savings through legislative commitments.

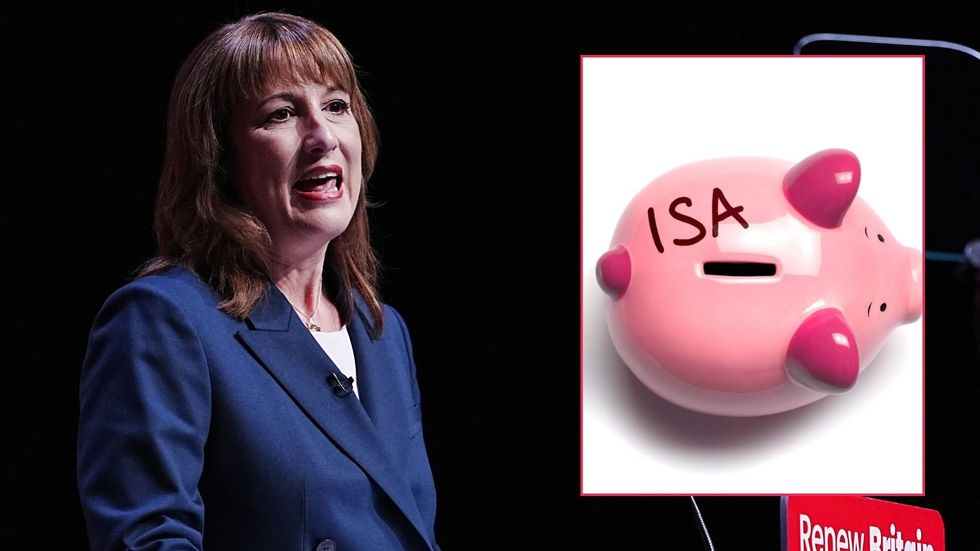

This comes amid speculation that the Treasury is exploring cutting the tax-free allowance linked to ISAs to £10,000, down from £20,000.

The Chancellor is being called to make ISAs 'easier'

|GETTY / PA

Tom Selby, AJ Bell's director of public policy, emphasised the Government's ambition to create a retail investing revolution in Britain, noting excessive cash holdings that could generate better returns through long-term investment strategies.

The proposals address concerns about potential modifications to pension taxation and seek to streamline investment products to enhance accessibility for savers.

Notably, the primary recommendation centres on merging cash ISAs and stocks and shares ISAs into a unified tax wrapper, eliminating the current siloed structure that often traps savers in cash holdings.

AJ Bell estimates approximately three million UK residents maintain balances exceeding £20,000 in Cash ISAs while holding no investments in Stocks and Shares ISAs.

Uncertainty surrounds the fate of the £20,000 cash ISA allowance | GETTY

Uncertainty surrounds the fate of the £20,000 cash ISA allowance | GETTY According to the investment platform's calculations, redirecting merely half these cash deposits into investment vehicles would release an additional £30billion for productive deployment.

"A conservative estimate suggests there are around three million people in the UK with £20,000 or more invested in cash ISAs and no money invested in Stocks and Shares ISAs. If just half of that money was invested, an additional £30billion of investment would be unlocked," the submission states.

"Reports that Government is once again considering using stick rather than carrot to address this challenge through a clumsy cut to the Cash ISA allowance are concerning."

The platform has initiated a parliamentary petition demanding the Government establish a "pension tax lock" - a formal pledge to maintain current allowances for pension tax-free cash and contribution tax relief throughout this Parliament.

"Every Budget is preceded by feverish speculation about possible tax changes, including to pensions tax-free cash and tax relief on contributions," Mr Selby commented.

He warned that uncertainty damages public confidence in retirement planning, noting that many individuals rushed to withdraw tax-free cash or boost contributions before the previous Budget due to fears these benefits might disappear.

The submission also advocates reforming lifetime ISA by cutting the early withdrawal penalty from 25 per cent to 20 per cent, eliminating what effectively amounts to a 6.25 per cent Government-imposed charge on savers accessing funds for purposes other than home purchases or retirement after age 60.

"This penalty feels grossly unfair when you consider the unpredictable financial challenges facing millions of younger people today," the platform argues.

LATEST DEVELOPMENTS:

Stocks and Shares ISAs are the top pick for younger savers | GETTY

Stocks and Shares ISAs are the top pick for younger savers | GETTYAdditional proposals include updating the £450,000 maximum qualifying property price for first-time buyers using lifetime ISA funds, which has remained static since the product launched in 2017 despite substantial property price increases.

The platform suggests removing age restrictions preventing individuals over 39 from opening accounts, potentially expanding the product's appeal as a retirement savings vehicle, particularly for self-employed workers.

AJ Bell has strongly criticised Government plans to incorporate unused pension funds into inheritance tax (IHT) calculations from April 2027, warning the changes would create excessive complexity and hardship for grieving families.

The platform argues the proposed system would burden personal representatives, beneficiaries, scheme administrators and HMRC with an unnecessarily convoluted process during estate settlements.