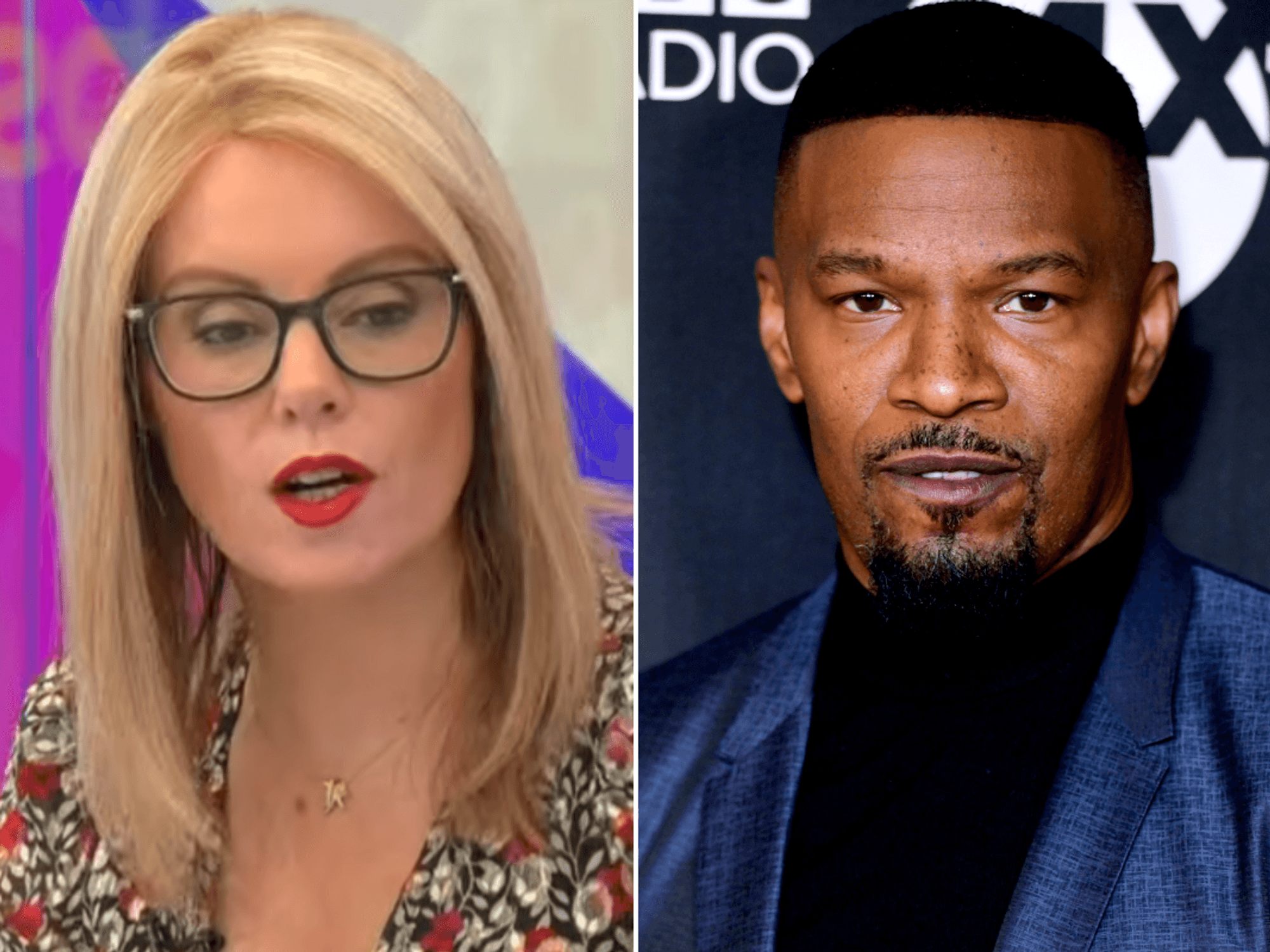

Rachel Reeves urged to be 'bold' over tax and spending or face 'Groundhog Day' Budget

Rachel Reeves is about to make this entire country weep, says Patrick Christys |

GB News

Think tank warns Britain risks recurring fiscal crises without bold action

Don't Miss

Most Read

Latest

Rachel Reeves has been urged by the Institute for Fiscal Studies (IFS) to deliver significant tax increases in her November Budget, or risk long-term fiscal instability.

The think tank warned that without bold action, Britain could enter a cycle of recurring tax rises.

The IFS have highlighted how the Chancellor’s decision to maintain minimal fiscal headroom left her exposed to predictable forecast changes.

The think tank calculates that Ms Reeves needs £22billion to preserve financial stability while maintaining her existing £10billion fiscal buffer.

This cushion against her debt rules has been criticised as inadequate, with the institute calling for a substantial expansion to prevent what it describes as "groundhog day" scenarios.

"When choosing to operate her fiscal rules with such teeny tiny headroom, Ms Reeves would have known that run-of-the-mill forecast changes could easily blow her off course," IFS director Helen Miller said.

TRENDING

Stories

Videos

Your Say

Such repeated fiscal crises would see the Treasury repeatedly scrambling to restore its financial position through additional tax measures, creating uncertainty that could damage Britain’s economic prospects.

This buffer represents the third smallest cushion any Chancellor has maintained since 2010, far below the £30billion typical reserve.

The think tank argues that expanding this margin substantially is essential.

It warns that such limited headroom leaves the Treasury exposed to routine forecast adjustments that could derail fiscal planning.

Rachel Reeves is facing mounting pressure to deliver significant tax increases

|GETTY

Rising borrowing costs, weaker growth projections and new spending commitments since spring have contributed to the Government’s constrained position.

Long-term borrowing costs have reached levels unseen since the previous century, while bond markets express concern about Britain’s fiscal stance.

Helen Miller from the IFS issued a stark warning, saying that Ms Reeves will "almost certainly" need to implement further tax increases despite her autumn assurances to the contrary.

"For Rachel Reeves, the Budget will feel like groundhog day. This is, to a large extent, a situation of her own making," Ms Miller said.

LATEST DEVELOPMENTS

|

| GETTY

The IFS stressed that this precarious position stems from deliberate choices rather than unavoidable circumstances, with persistent uncertainty weighing on economic confidence.

The Chancellor faces growing tension between Labour’s campaign commitments and fiscal reality.

The party pledged to protect voters from increases to income tax rates, employee national insurance contributions and VAT during last year’s campaign.

Yet the IFS suggests these sources represent the most straightforward route to raising substantial funds.

Alternative proposals circulating in Westminster include potential levies on banking profits and wealthy individuals, though such measures are unlikely to raise enough revenue.

Ms Reeves must also satisfy her self-imposed fiscal rules, which she calls "non-negotiable": eliminating borrowing for daily Government spending and ensuring debt falls relative to national income before this parliament concludes.

A Treasury spokesperson said: "The Chancellor’s non-negotiable fiscal rules provide the stability needed to help to keep interest rates low while also prioritising investment to support long-term growth."

Officials highlighted Britain’s position as the fastest-growing G7 economy during the year’s first half, while acknowledging public frustration with stagnation.

Many business leaders have pleaded the government to not hike taxes

| GETTY"For too many people our economy feels stuck. They are working day in, day out without getting ahead," the spokesperson said.

The Treasury rejected any return to austerity, pledging instead to pursue growth through regulatory reform, planning system modernisation and infrastructure investment.

The Chancellor’s Budget is scheduled for November 26.

More From GB News