HSBC issues apology after banking app outage sees thousands of customers unable to access their accounts - 'I have bills to pay!'

HSBC customers are having trouble accessing their accounts

| PA

According to DownDetector, over 7,000 users reported issues with the HSBC banking app

Don't Miss

Most Read

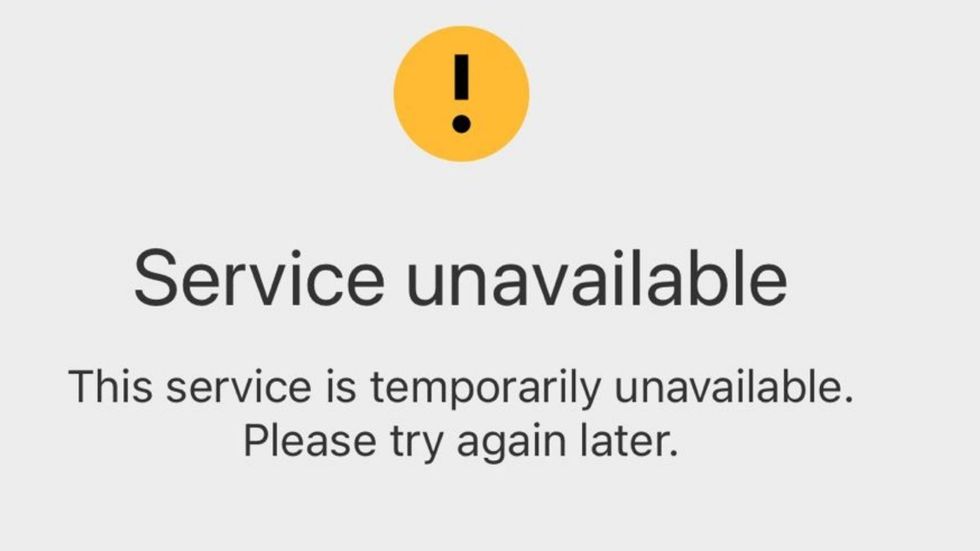

HSBC has issued an apology after thousands of customers were left without access to their HSBC banking app this morning.

Customers took to social media to complain about the outage - on the final working day of the month, when typically salaries are paid.

Taking to X, one user wrote: "Hi @HSBC_UK is the app working today? I can't access my accounts, says service unavailable! It's payday so I have bills to pay and I cannot log in!"

Another said: "Classic @HSBC_UK with the banking app being down on payday."

A HSBC UK spokesperson said: “Earlier issues with HSBC UK’s online and mobile banking services, as well as a separate payments issue affecting multiple banks, are now fixed.

"We’re really sorry to our customers who were impacted, and we continue to monitor systems closely. “

HSBC UK says the 'service is temporarily unavailable' when customers try to log into mobile banking app | GB NEWS

HSBC UK says the 'service is temporarily unavailable' when customers try to log into mobile banking app | GB NEWSAccording to DownDetector, complaints started first thing this morning around 8am.

Prior to the update from the Bank, customers were left confused this morning as to why they couldn't access their accounts.

One person on X said: "@HSBC_UK your app is saying service unavailable, down detector is showing nearly 500 reports of an outage but your website is saying there's no issue ... There IS an issue, can someone look into it please.

"@HSBC_UK app is down and I need access!! When will it be fixed please?", asked another.

Personal banking customers were able to log into Online and Mobile Banking from about 12 pm.

The outage was caused by an internal technical error.

Unlike telecom companies, banks are not required to compensate customers for service disruptions.

However, if people incur costs due to these issues, they may be able to get reimbursed.

The news comes after reports this week that HSBC have joined other major lenders in reducing mortgage rates following hints of a summer base rate cut by the Bank of England.

HSBC's cuts came into effect on Wednesday, with brokers expecting more mortgage companies to follow suit.

Nicholas Mendes, a mortgage expert at John Charcol, said: “Given that most recent lender repricing has involved increases, there is now potential for reductions. We’ve seen some movement, but this latest reprice from HSBC is certainly going to spur on the market.”

Moneyfacts, the financial data provider, said on Tuesday that the average rate on a new fixed-rate deal lasting for two years was 5.96 per cent, while the typical rate on a new five-year fix was 5.53 per cent. Both of these averages have stayed steady over the past few days.

There are around 1.6 million existing borrowers on relatively cheap fixed-rate deals under three per cent expiring this year.

If these home owners do not sign a new fixed deal, they will be left on the standard variable rate, which can be very expensive.

Homeowners are encouraged to seek advice from mortgage lenders to try and get the best possible deals available.