HMRC to ‘chase people’ for more tax after Hunt’s Spring Budget, Liam Halligan warns

Liam Halligan video wall analysis on Jeremy Hunt's Spring Budget

|GB NEWS

Chancellor Jeremy Hunt announced multiple changes to taxes in the Government's Spring Budget

Don't Miss

Most Read

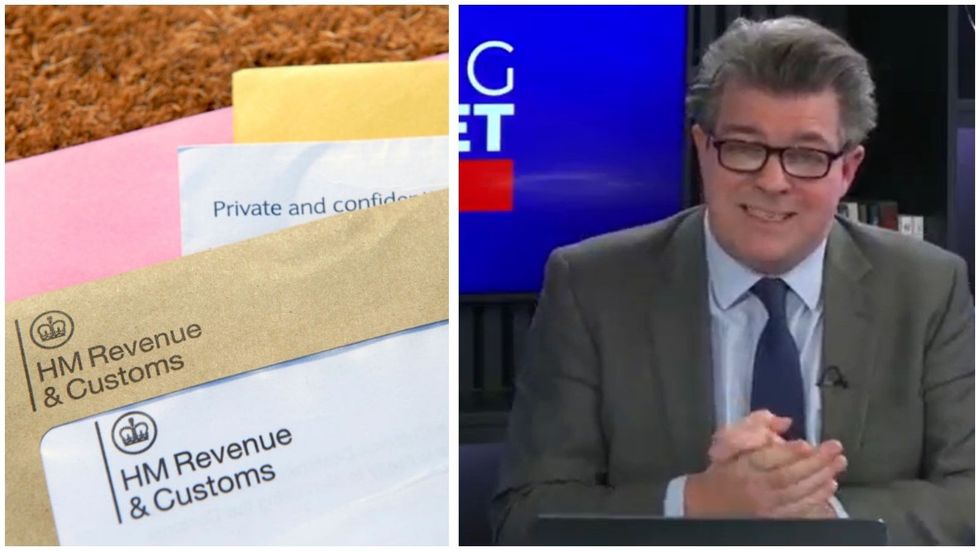

HM Revenue and Customs (HMRC) will have more power to “chase people” who have underpaid tax, GB News’ Economics and Business Editor Liam Halligan has warned.

The economics expert highlighted one of the most underreported developments when it comes to taxes from today’s Spring Budget.

Chancellor Jeremy Hunt announced various tax cuts earlier today, including a reduction in the rates to National Insurance and capital gains tax (CGT).

However, Mr Hunt also confirmed that more funding will be reserved for HMRC “to make sure the tax that is owed is paid”.

What did you think of Chancellor Jeremy Hunt's Spring Budget? Get in touch by emailing money@gbnews.uk.

HMRC will have more funding to clampdown on underpaid tax, Liam Halligan warned

|GETTY/GB NEWS

This is part of a wider plan to tackle tax non-compliance by making further investments, including in HMRC’s capacity to collect tax debts.

According to the Government, these measures are forecast to generate over £4.5billion of tax revenue by the 2028-29 tax year.

In a statement following today’s Budget, the Treasury asserted the £4.5billion in funding would save “the public purse” nearly £10billion when combined with the Budget’s other tax reforms.

Appearing on GB News, Mr Halligan cited that this was a “huge amount” of money” to be earned from a tax clampdown.

He said: “There was … something which was doing a lot of work in terms of the Government's sums making the ledger add up.

“The Chancellor mentioned that he's going to give a bit more money to HMRC ‘to make sure that the tax that is owed is paid’ i.e. clamping down on tax avoidance.

“£4.5billion quid more. That's a huge amount of money to assume HMRC is going to be able to [be] chasing people that it believes owe more tax.

“That hasn't attracted much attention, but it's doing an awful lot of heavy lifting there.”

LATEST DEVELOPMENTS:

Mr Hunt outlined changes to taxes in his Spring Budget earlier today

| PAThe amount of unpaid UK tax has remained at an all-time low of 4.8 per cent.

Figures from HMRC in June 2023 estimated the difference between the total amount of tax expected to be paid and the total amount of tax actually paid.

At the time, Jonathan Athow, HMRC’s Director General for Customer Strategy and Tax Design, said the Government department’s role was to “ensure everyone pays the correct amount”.

He explained: “These figures show most taxpayers and businesses pay what they should.

“This important research enables us to better help those making common mistakes or failing to take sufficient care, as well as tackling the minority deliberately hiding their income.”