Inflation surges to highest level in 19 months as pressure mounts on Rachel Reeves

GB NEWS

Figures from the ONS have confirmed inflation rose last month despite Rachel Reeves's attempts to bolster the economy

Don't Miss

Most Read

Latest

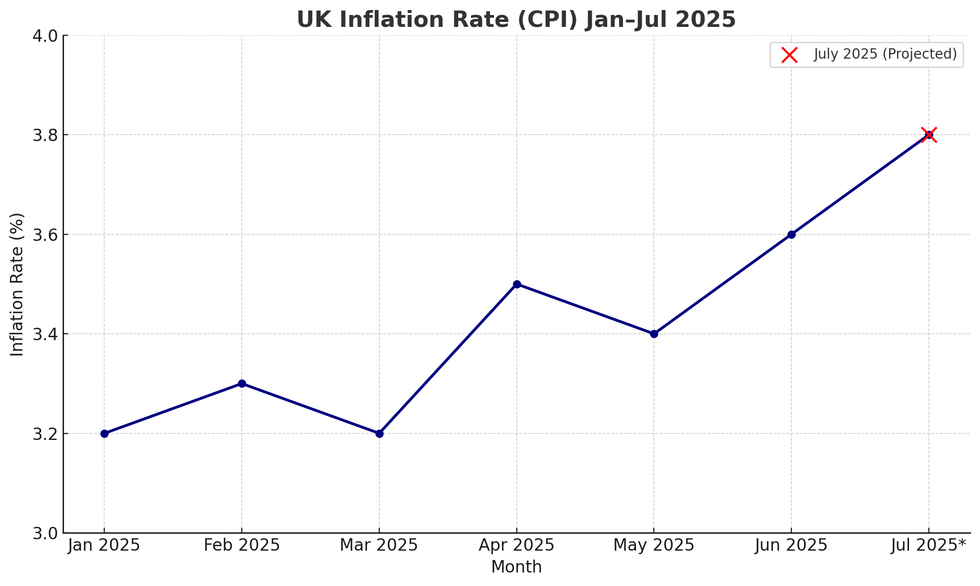

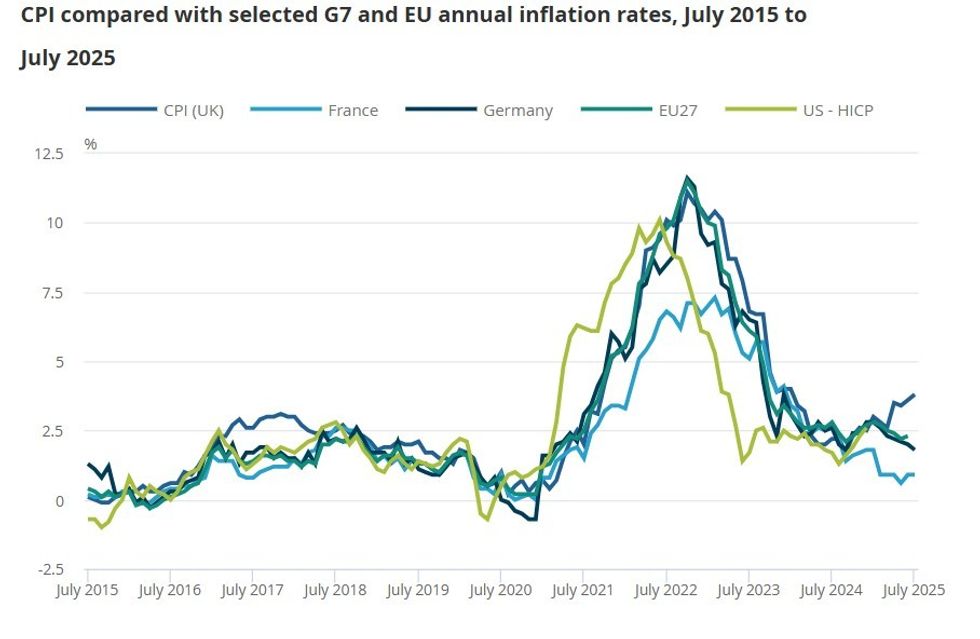

The consumer price index (CPI) rate of inflation for the 12 months to July 2025 has risen to 3.8 per cent, according to the latest figures from the Office for National Statistics (ONS).

This represents another hurdle for Chancellor Rachel Reeves as she attempts to bolster the economy and improve Britain's gross domestic product (GDP) growth.

Today's inflation figures come after the Bank of England's decision to slash the base rate from 4.25 per cent to four per cent, bringing down the cost of borrowing.

It also is the highest level the CPI inflation rate has came in at since January 2024. Notably, the central bank has projected inflation will peak at four per cent later this autumn.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Inflation SHOCK as CPI rate increases to 3.8% |

Inflation SHOCK as CPI rate increases to 3.8% | GETTY

ONS chief economist Grant Fitzner confirmed the main driver of inflation was higher air fares, which experienced the largest July increase since the ONS began collecting that data on a monthly basis in 2001.

“This increase was likely due to the timing of this year’s school holidays,” he explained.

Mr Fitzner also noted that the cost of food has continued to go up in Britain, “with items such as coffee, fresh orange juice, meat and chocolate seeing the biggest rises".

The ONS figures highlighted inflation for food and non-alcoholic beverages came in at 4.9 per cent in the year to July, up from 4.5 per cent in the year to June.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has inflation changed this year?

|CHAT GPT

Reacting to today's figures, Ms Reeves said: "We have taken the decisions needed to stabilise the public finances, and we’re a long way from the double-digit inflation we saw under the previous government, but there’s more to do to ease the cost of living.

"That’s why we’ve raised the minimum wage, extended the £3 bus fare cap, expanded free school meals to over half a million more children, and are rolling out free breakfast clubs for every child in the country.

"Through our Plan for Change we’re going further and faster to put more money in people's pockets."

Kevin Brown, a savings expert at Scottish Friendly, broke down what this means for the cost of living in Britain.

MEMBERSHIP:

- Bournemouth is just the beginning. Vigilante groups are coming to a town near you - Renee Hoenderkamp

- Rachel Reeves' deceitful tax will leave you £82k poorer. And that's not even the worst of it - Kelvin MacKenzie

- Three SHOCK graphs expose who is REALLY crossing the Channel in small boats - and it's NOT women and children

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- POLL OF THE DAY: As the Chancellor eyes a property tax raid, do you fear further hikes in the Autumn budget? VOTE NOW

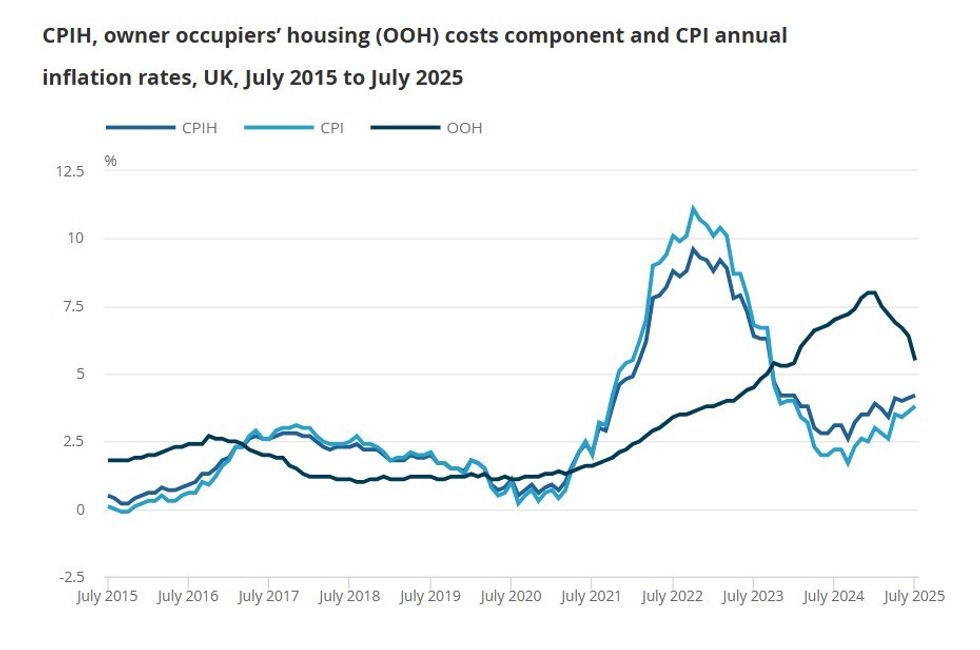

Households have been fluctuating costs in recent months

|ONS

Mr Brown shared: "Today’s inflation reading is another blow for UK households already contending with rising bills. Families may no longer face the double-digit surges of two years ago, but with prices still running at nearly twice the Monetary Policy Committee’s (MPC) two per cent target, households are still very much in the grip of the cost of living squeeze.

“Everyday essentials, from food to energy, take their toll and rail passengers now face the prospect of another hefty jump in fares, with today’s figure used to calculate price rises for next year."

LATEST DEVELOPMENTS:

How does UK inflation compare to the rest of the world

|ONS

Ben Thompson, the deputy CEO, Mortgage Advice Bureau, added: "Another consecutive and frustrating rise in inflation was expected - nonetheless, this news is disappointing.

"While borrowing costs have continued to ease, there remains this delicate balance between controlling inflation and ensuring economic growth. It's a complex picture, and July’s highly anticipated Oasis reunion tour will no doubt have contributed to these financial ripples.

"As for future rate cuts, it's a wait-and-see situation, albeit the view is we are near or at the top in terms of inflation. Recent news regarding employment and wage growth is likely to influence decision making, as is the continued low economic growth.

"Until inflation looks to be under control and visibly heading on a downward path, we won’t see interest rates fall. This, however, may not be that far away, so one more cut this year remains possible."