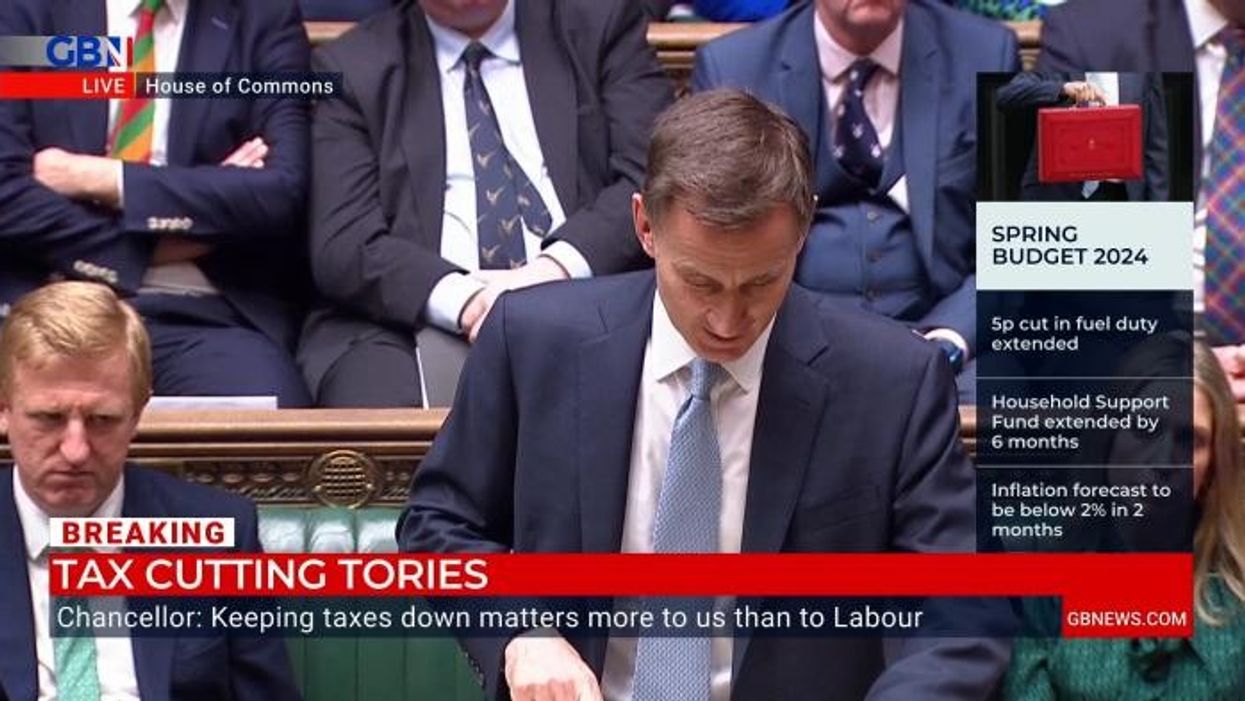

Capital gains tax on property sales to be cut in boon for home sellers, Hunt confirms in Budget

Chancellor Jeremy Hunt said a cut to the capital gains tax rate on property would encourage sales

Don't Miss

Most Read

The capital gains tax (CGT) rate on property sales will be slashed, Chancellor Jeremy Hunt announced in today’s Spring Budget.

Mr Hunt said the levy’s top rate of tax will be slashed from 28 per cent to 24 per cent which he claims will bring in more money as the reduction will encourage greater transactions.

Britons pay CGT on the profit they make when selling or disposing an asset that has increased with value, with the gain being subject to tax and not the amount of money received.

The capital gains tax-free allowance is currently £6,000 , but will be cut to £3,000 next month. The top rate of capital gains tax is 28 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Chancellor announced changes to capital gains tax

|GETTY/PA

However, the Chancellor today said this rate would be reduced to 24 per cent in a move to assist those looking to sell their property.

This cut to the top rate of CGT was part of a wider package of reforms to the current property tax system which were outlined in the Budget this afternoon.

Furthermore, he announced plans to abolish stamp duty relief for anyone buying more than one home.

On top of this, the Government is set to scrap the tax breaks which make it more profitable for people with a second home to let out their properties to holidaymakers rather than to long-term tenants.

Other notable announcements from the Chancellor included another cut to National Insurance and an overhaul of the non-dom tax status system.

Stevie Heafford, a tax partner at HW Fisher, highlighted that Jeremy Hunt’s cut to capital gains tax could be put to use in paying for these Budget announcements.

He said: “The thinking behind reducing higher capital gains tax rate on residential property from 28 per cent to 24 per cent is that this will encourage more housing transactions and increase revenues overall.

“The revenues gained can fund other planned tax cuts such as further reductions in National Insurance.”

LATEST DEVELOPMENTS:

The property market faces uncertainty | GETTY/PA

The property market faces uncertainty | GETTY/PADespite this, some experts in the property market warned that Mr Hunt’s announcement was a “missed opportunity” for the sector.

Ben Beadle, the chief executive of the National Residential Landlords Association, explained: “The Chancellor has once again ignored calls to revitalise long-term investment in quality rented homes in favour of tinkering at the margins for short-term gain.

“Increasing taxes on holiday lets and cuts to capital gains tax will make no meaningful difference to the supply of long-term rental properties.

“Meanwhile, those reliant on housing benefits still do not know if their benefits will be frozen from next year or not.”