Mortgage disaster as inflation rise 'slams the door' on Bank of England interest rate cut

Homebuyers have been forced to contend with record-high mortgage repayments as a result of the Bank of England's interest rate hikes over the years

Don't Miss

Most Read

Latest

Economists are warning today's inflation announcement likely "slams the door" on any "meaningful reduction" in mortgage rates over the coming months.

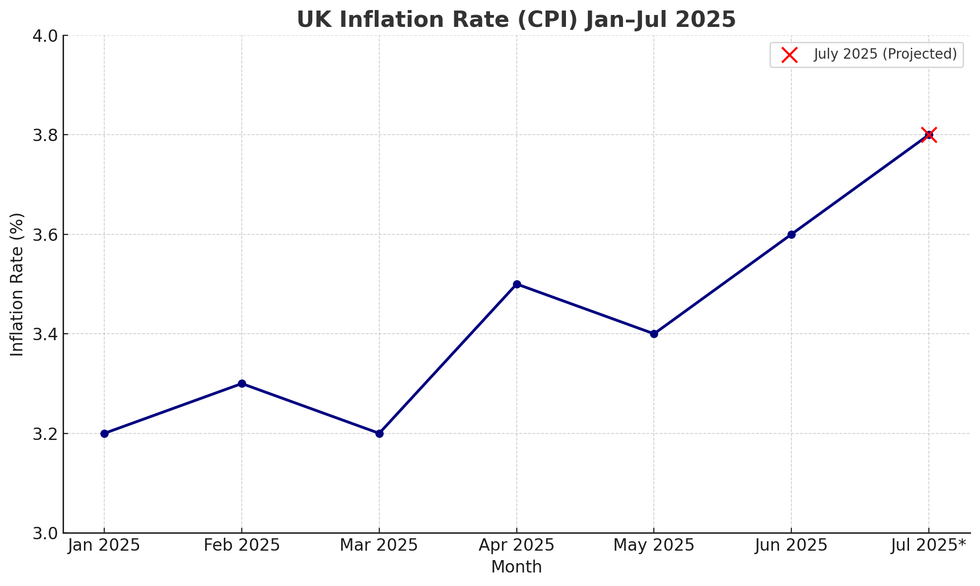

The consumer price index (CPI) rate for the 12 months to July 2025 jumped to a more-than-expected 3.8 per cent, with analysts warning this could impact the Bank of England's decision-making regarding interest rates.

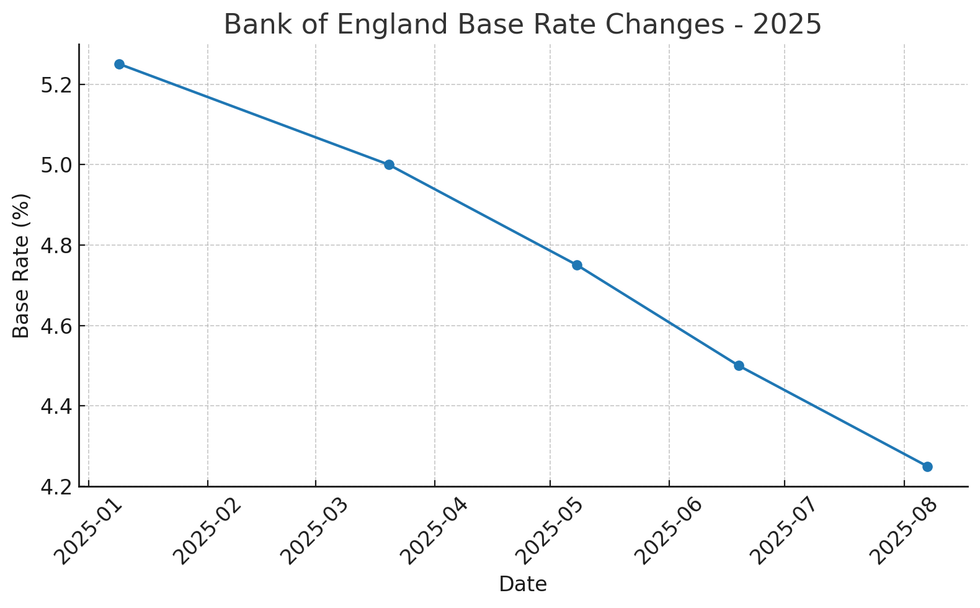

Earlier this month, the central bank's Monetary Policy Committee (MPC) voted to slash the UK's base rate from 4.25 per cent to four per cent, reducing the cost of borrowing.

Analysts have previously predicted at least more rate reduction from the Bank in 2025, which would likely be passed onto mortgage lenders in much-needed relief for homebuyers.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Economists are warning mortgage rates will not be 'reduced significantly' after today's inflation figures

|GETTY

Pantheon Macroeconomics estimates inflation will continue to stick at a 3.7 per cent on average for the rest of the year as the CPI rate remains "miles above target", which the Bank of England set at two per cent.

The group's economist Elliott Jordan-Doak explained: "We expect headline inflation to remain above three per cent until April 2026, forcing the MPC to stay on hold for the rest of this year at least."

Andrew Wishart, an economist at Berenberg, noted the committee's members are likely to not slash rates in 2025 due to the global food prices and energy costs contributing to inflationary pressure this quarter.

He shared: "The five per cent in services prices in July is sufficient to keep headline CPI inflation at 2.5 per cent even if prices in all other categories stopped rising."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has inflation changed this year

|CHAT GPT

Suren Thiru, an economics director at the Institute of Chartered Accountants in England and Wales (ICAEW), said: "July’s outturn probably extinguishes hope of a September interest rate cut, while strengthening underlying inflationary pressures calls into question whether policymakers will be able to relax policy again this year."

On how today's announcement impacts the property market, Peter Stimson, director of Mortgages at the lender MPowered: "This latest jump in inflation will slam the door on the prospect of any meaningful reduction in mortgage interest rates in the coming weeks.

"The mortgage swaps market, which tracks interest rate expectations and is used by mortgage lenders to determine the fixed interest rates they offer to borrowers, had been suggesting that the next base rate cut might come in November.

"But today’s painful jump in inflation means that base rate cut may now be pushed back into 2026, and as a result we are unlikely to see any further rate cuts from lenders in the immediate term."

MEMBERSHIP:

- Interactive map reveals how many migrants have entered on Keir Starmer's watch - find out the number in YOUR area

- Labour's property tax is about to wipe out the middle classes in London and the South East - Kelvin MacKenzie

- Trigger warning: What I have to say about Notting Hill Carnival will deeply upset the woke - Peter Bleksley

- Reform UK faces eight pivotal tests in 24 hours as Nigel Farage gears up for battle following shock resignation

- POLL OF THE DAY: Following the Epping win, should we close all migrant hotels? VOTE NOW

"Competition between lenders is intense but mortgage rates may well have fallen as far as they can for now. They may even creep up over the next month or so as lenders recalibrate in response to rising swap rates."

According to the latest data compiled from Moneyfactscompare, the average two-year fixed and five-year residential mortgage rates sit at 4.98 per cent and five per cent today, respectively.

LATEST DEVELOPMENTS:

The Bank of England base rate has fallen dramatically this year

|CHAT GPT

In comparison, the average two-year buy-to-let residential mortgage rate today is 4.90 per cent, while the five-year deal offers 5.23 per cent. Both are unchanged from the day before.

Furthermore, the average two-year tracker rate mortgage also sits unchanged and offers homebuyers 4.67 per cent. The average standard variable rate as of August 1 2025 is 7.42 per cent.

The Bank of England's MPC members will next to meet to discuss the future trajectory of interest rates in Britain on September 18, 2025.

August 2025's CPI inflation rate will be announced by the ONS on September 17, 2025.

More From GB News