Don't Kill Cash: Businesses urge Jeremy Hunt to protect notes and coins as payment method

Businesses urge Jeremy Hunt to protect cash as payment method

|PA

A number of business organisations are putting pressure on Jeremy Hunt to protect cash as a critical payment method

Don't Miss

Most Read

Latest

A coalition of businesses have sent an open letter to Jeremy Hunt as the Chancellor faces renewed calls to protect cash as a payment method.

Signatories are urging the Treasury to take extra measures to protect cash given its continued importance to the financially vulnerable, digitally excluded and small businesses.

The group of businesses acknowledge the Government's recent release of its cash access policy statement as a positive first step.

However, the coalition is hoping Hunt will push on to ensure the robust funding and safeguarding of the UK's cash network.

A person withdraws money from a cash machine

| PAThe letter said: "We are writing to you as a collection of businesses and consumer organisations urging you to protect cash as a critical payment method now, and in the future, to uphold payment choice for people across the country.

"Cash remains the second most used payment method in the UK, comprising 15 per cent of all payments.

"In recent years, cash has become increasingly important as the cost-of-living crisis escalates, and it continues to be an essential budgeting tool for millions of people."

It added: "Much more is needed to ensure the UK’s free cash network is adequately funded and protected.

Cash machines at HSBC | PA

Cash machines at HSBC | PA"It is critical that the FCA address this issue as they move to provide the sector with more details and implement the Government’s plan – with their work adequately reflecting the conclusions of this Review."

The letter concluded: "Now is the time for the Government, financial services regulators and industry to come together to establish cash as a payment method of the future, maintain payment choice for businesses and give consumers the diverse payments landscape they require."

Signatories included Association of Convenience Stores chief executive James Lowman, Federation of Small Businesses external affairs head Craig Beaumont, NoteMachine chief executive Steve Makaritis, Positive Money head of policy Gordon Balmer and Rural Services Network chief executive Kerry Booth.

The quintet also individually expressed their concerns about cash in the current financial climate.

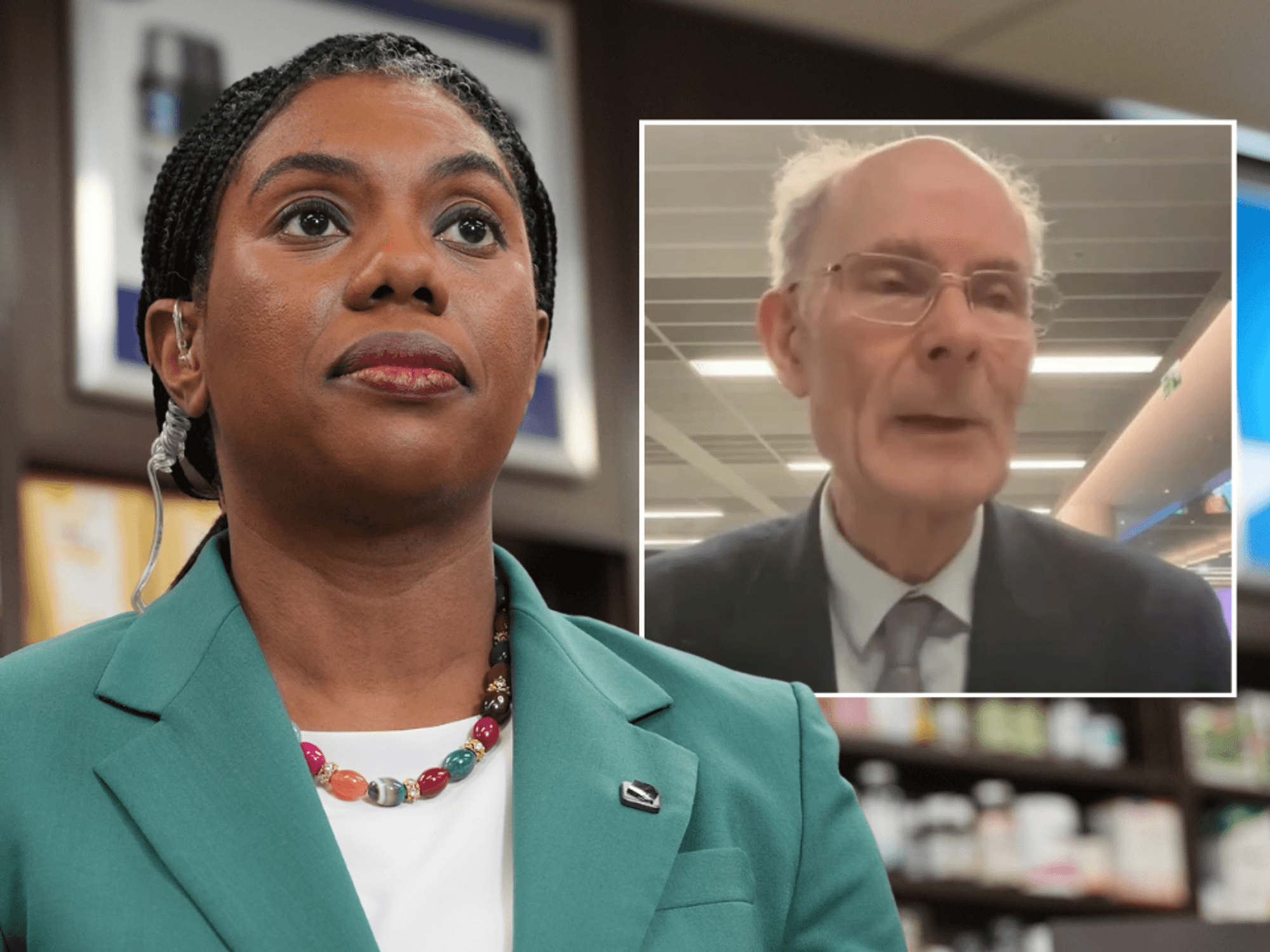

Jeremy Hunt succeeded Kwasi Kwarteng as Chancellor after last autumn’s mini-budget | PA

Jeremy Hunt succeeded Kwasi Kwarteng as Chancellor after last autumn’s mini-budget | PAMakaritis said: “As the UKs cash and banking infrastructure faces significant pressures and consumers deal with the rising cost of living, now is the time for the Government and the FCA to use this Review and recent legislation to help maximise payment choice for businesses and individuals, maintaining the diverse payments landscape we need well into the future.”

Lowman added: “As well as cash still being used for more than half of convenience store transactions, customers use ATMs located at convenience stores to access cash for their daily needs.

"The Treasury has committed to support a full range of payment options, including cash, for the long-term, and we need to see improved ATM interchange fees to make sure this is delivered.”

Booth continued: “Ensuring that rural residents have access to cash is vital particularly for older residents who may not use online banking services and those in more remote isolated communities.

"Lack of broadband and mobile telephone signal can impact on users ability to access digital banking systems, these residents should not be left disadvantaged as technology develops and their right to access cash should be protected.”

You can help GB News in ensuring the Government and businesses Don't Kill Cash by signing our petition.

Have you found yourself impacted by the cashless society? Email in and let us know your stories gbviews@gbnews.com