Debt alert as UK economy faces worst fiscal 'challenge' since 1950s as interest rates rise

Debt and interest rates have risen substantially in recent years which will impact decisions around Government spending and tax cuts

Don't Miss

Most Read

Latest

Britain faces one of its worst fiscal “challenges” since the 1950s after Second World War due to stagnant growth and rising debt, experts have warned. Tax cuts and more funding for public services could be on the agenda at the next General Election but a leading think tank is reminding politicians of the “trade-offs”.

The Institute of Fiscal Services (IFS) is urging the current, and potential future, Government to be honest about the “trade-offs” of potential tax cuts or increased spending. This follows various hints from Prime Minister Rishi Sunak and Chancellor Jeremy Hunt of potential tax cuts at the upcoming Spring Budget.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

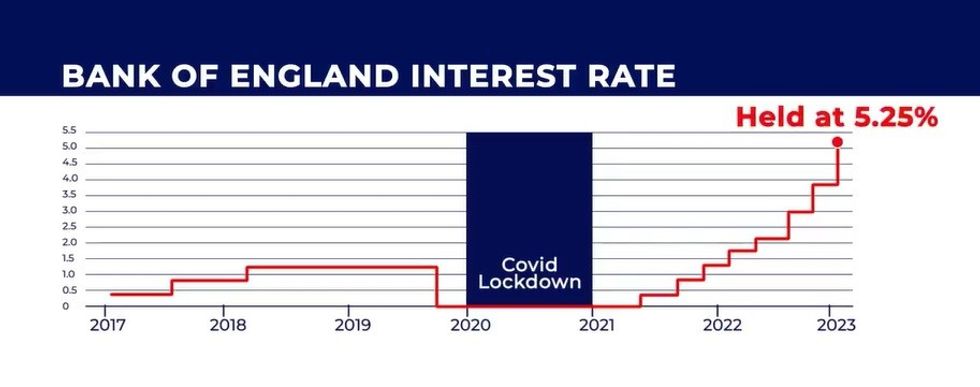

The Bank of England base rate is currently at a 15-year high | GB NEWS

The Bank of England base rate is currently at a 15-year high | GB NEWSLabour and Conservatives have pledged to tackle debt as a fraction of national income but the IFS is highlighting that this will be harder to achieve due lower than expected growth and high interest rates.

During the 1950s, the UK saw a debt-to-GDP of around 200 per cent, which is about double what it is today, due to debt that accrued as a result of the Second World War. In its latest report, the IFS has warned any Government will inherit a country with record high taxes and struggling public services.

However, this has not stopped policymakers from putting forward plans for more public spending and cuts to tax rates.

According to the institute, the country is set for a £20billion reduction in funding for services outside of the NHS, schools, defence, childcare and international aid.

In its report, the IFS said: “These challenges – unlike a conflict, pandemic or financial crisis – are entirely predictable.

None can be meaningfully confronted by a government that wilfully ignores reality and the need to choose between difficult competing options.

“As tempting as it may be to engage in ‘cakeism’ – to seek to have the government’s fiscal cake and eat it – any party serious about governing after the election should resist the urge. The electorate surely deserves better than that.”

Paul Johnson, the director of the IFS, reminded politicians that they must be “honest about these trade-offs” with the British electorate.

LATEST DEVELOPMENTS:

The UK is facing multiple fiscal "challenges" which could impact tax and spending plans

|GETTY

Mubin Haq, head of abrdn Financial Fairness Trust, added: “With the next election imminent, there’s a danger that politicians paint themselves into a corner by failing to confront difficult trade-offs.

“They therefore risk being unable to fund existing public services or invest in new provision to kickstart our ailing economy. Fiscal constraints make these commitments tricky but not impossible.”

A Treasury spokesperson said: “Our decisive action to halve inflation and ensure debt falls as a share of the economy means we are now beginning to turn a corner, which is why we can afford tax cuts for 27 million working people this month.

“The best way to deliver sustainable funding for public services in the future is to grow the economy – the UK has grown faster than France, Germany and Japan since 2010 and the OBR say our action in spring and autumn will deliver the largest boost on record.”

In a statement, Downing Street questioned the IFS assessment of the state of the UK’s economy and debt woes. A spokesperson said: “We think we have created the right conditions to enable us to cut tax, with the tax changes coming into force.”