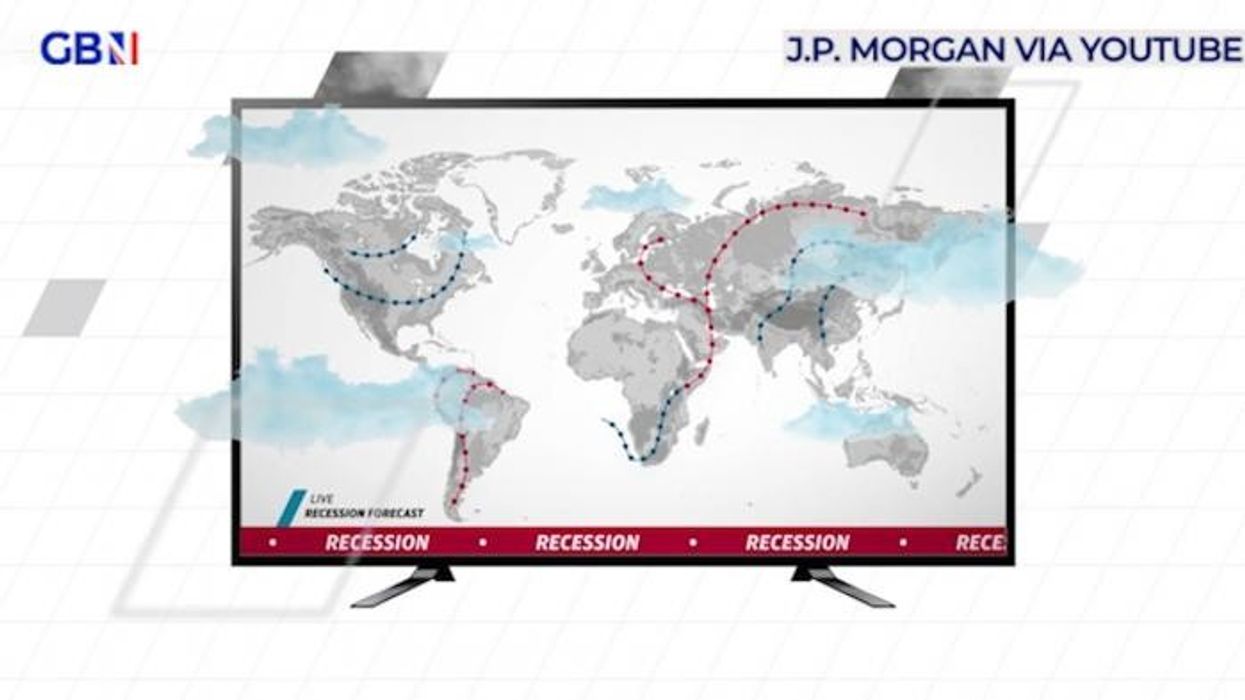

Britain on 'brink of recession' despite GDP rebound in November

What is a Recession?

|GB NEWS

The Office for National Statistic (ONS) reported a rebound in the economy for November but that has not eased anxieties over a 'technical recession'

Don't Miss

Most Read

:The UK is on the “brink of recession” despite the country’s gross domestic product (GDP) rebounding in December, experts claim.

Office for National Statistics (ONS) figures show GDP expanded by 0.3 per cent for November which is slightly higher than the City’s forecasts for the country’s economy. This was bolstered by a better than expected performance by the UK’s services sector which grew by 0.4 per cent.

However, despite this growth for the month, GDP dropped 0.2 per cent in the three months up to November 2023. Services reported no growth over the period, production dropped by 1.5 per cent and construction by 0.6 per cent.

Analysts are warning that interest rates could remain on hold at the Bank of England’s Monetary Policy Meeting (MPC) next month.

Experts are warning about a potential 'technical recession'

|GETTY

A recession is defined as happening when a country experiences two consecutive quarters of negative economic growth.

While the UK did not experience this in 2023, economists are concerned a “technical recession” could be on the cards this year.

Suren Thiru, the economics director at ICAEW, called for interest rates to be cut as soon as possible instead of later in 2024.

He said: “November’s rebound may have been insufficient to prevent a small technical recession at the end of 2023, with the cost-of-living squeeze and high borrowing costs likely to have constrained output in December.

“The UK is facing a notably difficult 2024 with the lagged impact of previous interest rate rises, weaker consumer demand and moderately higher unemployment likely to stifle economic activity, despite a boost from lower inflation.

“This lacklustre GDP outturn means that interest rates will remain on hold next month. With the UK teetering on the brink of recession and inflation slowing, the case for loosening policy sooner rather than later is growing.”

Yael Selfin, the chief economist at KPMG UK, echoed this sentiment and noted that the economy will likely be in “stagnation territory” even if it avoid recession.

As it stands, the central bank has raised the country’s base rate to 5.25 per cent and has remained at this level for the last three months.

Interest rates were raised to mitigate the impact of inflation on the economy, however with the Consumer Price Index (CPI) easing, experts are pushing the Bank to take action sooner rather than later.

LATEST DEVELOPMENTS:

The Bank of England is being urged to cut rates faster

| PADespite these concerns, ONS chief economist Grant Fitzner told BBC Radio 4’s Today Programme than an actual recession is more serious than a “technical recession”.

Fitzner explained: “It’s important to remember that a recession is not simply a very small negative number followed by another very small negative number. It’s a significant and sustained fall in output. We don’t expect to see that.”

He added that the UK may avoid a negative quarter in Q4 if if December’s GDP is flat or positive, and there are no revisions to previous months.

Reacting to the latest figures, even Chancellor Jeremy Hunt admitted that economic growth would be "slower" in the months ahead.

He said: “While growth in November is welcome news, it will be slower as we bring inflation back to its two per cent target.

“But we have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”